The Facebook Ad That Ruined Everything

Marcus saw the ad on Facebook. Bold letters: “700+ Credit Score in 30 Days – GUARANTEED!”

He was desperate. His credit score was 520. Therefore, he couldn’t get an apartment. Moreover, car loans were impossible. Furthermore, even job applications were getting rejected because of credit checks.

The ad looked professional. Real testimonials. A money-back guarantee. Additionally, they promised “legal methods” and “insider secrets.”

Marcus paid $1,500 upfront. Then, he waited.

30 days passed. His credit score? Still 520. Actually, it dropped to 515. Meanwhile, the company stopped answering calls. The website disappeared. His money was gone.

Worse yet, his credit report now showed suspicious activity. The “credit repair company” had disputed legitimate accounts. Consequently, creditors flagged his file for fraud. His credit was worse than before.

This is how credit repair scams work. They promise miracles. Instead, they deliver disaster.

The Brutal Truth About Credit Repair

Here’s what credit repair companies don’t want you to know: There are no shortcuts. None. Zero.

The reality:

- Bad credit takes 2-7 years to fix naturally

- No company can remove accurate negative information

- Everything a credit repair company can do, you can do yourself for free

- “Legal loopholes” don’t exist

- “Insider secrets” are lies

The Fair Credit Reporting Act is clear. Accurate negative information stays on your report:

- Late payments: 7 years

- Bankruptcies: 7-10 years

- Foreclosures: 7 years

- Collections: 7 years

- Hard inquiries: 2 years

No company can change these laws. Moreover, no company has special access to credit bureaus. They’re lying.

How Credit Repair Scams Work

Most credit repair scams follow the same pattern. Here’s the playbook:

Phase 1: The Advertisement

- Facebook ads, Instagram posts, YouTube videos

- Promises: “Raise your score 100+ points in 30 days!”

- Fake testimonials with before/after screenshots

- “Limited time offer” to create urgency

- Professional-looking websites

Phase 2: The Sales Pitch

- Free “consultation” (actually a sales call)

- They review your credit report

- They claim they found “errors” (sometimes real, often exaggerated)

- They promise to fix everything quickly

- They pressure you to sign up immediately

Phase 3: The Payment

- Upfront fees: $500-$3,000

- Monthly fees: $50-$150

- “Success fees” for each item removed

- Often, they demand payment before doing anything

Phase 4: The “Work”

- They dispute everything in your report

- Even accurate information

- They flood credit bureaus with frivolous disputes

- They might tell you to stop paying bills

- They might suggest illegal tactics

Phase 5: The Disappearance

- After 30-90 days, they stop responding

- Website goes offline

- Phone numbers disconnect

- Your money is gone

- Your credit is often worse

Meanwhile, you’ve wasted months and money.

Real Victim: Jessica’s $2,800 Mistake

Jessica was 28 and drowning in student loans. Her credit score was 580. Then, she saw an Instagram ad: “We removed $45,000 in debt from Sarah’s credit report! You’re next!”

The company was called “Credit Freedom Solutions.” They seemed legitimate. Professional website. BBB logo (fake). Testimonials everywhere.

Jessica paid $2,800 upfront. They promised her score would hit 700 in 60 days. Instead, here’s what happened:

Week 1-2: They sent dispute letters to credit bureaus. They disputed every negative item. Even legitimate debts.

Week 3-4: Some items temporarily disappeared from her report. Jessica was excited. Her score jumped to 620.

Week 5-6: The credit bureaus investigated. They verified the debts were accurate. Everything came back on her report.

Week 7-8: Her score dropped to 565. Lower than before. Why? Because the company had also disputed her oldest credit card (which was actually helping her score).

Week 9: Jessica tried calling. No answer. Emails bounced. The website was gone.

Total loss: $2,800. Additionally, her credit was damaged worse. Moreover, she wasted two months that she could have used fixing things properly.

The Illegal Tactics They Use

Some credit repair companies cross into criminal territory. Here are tactics that are illegal:

File Segregation: They tell you to apply for an EIN (Employer Identification Number) and use it instead of your Social Security Number. This is fraud. Moreover, it’s a federal crime.

Disputing Accurate Information: Claiming accurate debts are “errors” is lying. Credit bureaus can sue you for frivolous disputes. Additionally, creditors can take legal action.

Creating New Identity: Some scammers suggest getting a new Social Security Number or creating a “CPN” (Credit Privacy Number). This is identity fraud. People go to prison for this.

Advising Non-Payment: Telling you to stop paying bills to “reset” your credit. This destroys your credit further. Moreover, you can get sued.

Deleting Public Records: They claim they can remove bankruptcies or judgments early. Impossible. These are court records, not credit bureau decisions.

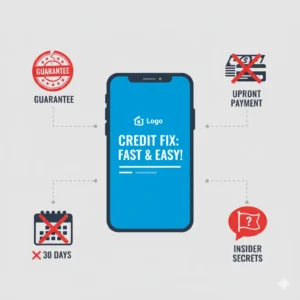

Warning Signs of Credit Repair Scams

Here’s how to spot a scam instantly:

Red Flag 1: Guarantees: Any promise to “guarantee” a specific score or remove accurate information is a lie. Legitimate companies can’t guarantee results.

Red Flag 2: Upfront Payment: Federal law prohibits credit repair companies from charging before completing services. If they want money up front, it’s illegal.

Red Flag 3: 30-Day Promises: Credit repair takes months or years, not days. Anyone promising quick fixes is lying.

Red Flag 4: No Contract or Agreement: Legitimate companies must provide a written contract explaining your rights. Scammers avoid paperwork.

Red Flag 5: Pressure Tactics: “Sign up now or lose this offer!” Real companies don’t pressure. Scammers create false urgency.

Red Flag 6: Telling You Not to Contact Credit Bureaus: They want to control information. This is suspicious. You have the right to contact bureaus anytime.

Red Flag 7: Advising You to Lie: Any suggestion to dispute accurate information or hide your identity is illegal. Run away immediately.

Red Flag 8: No Physical Address: Legitimate businesses have real locations. Scammers hide behind PO boxes or fake addresses.

What Actually Works (For Free)

Here’s the truth: Everything credit repair companies do legally, you can do yourself. For free. Here’s how:

Step 1: Get Your Credit Reports

Visit AnnualCreditReport.com (the only official free site). Get reports from all three bureaus: Equifax, Experian, and TransUnion. This is truly free.

Step 2: Check for Actual Errors

Look for:

Accounts that aren’t yours

Wrong payment history

Incorrect balances

Duplicate entries

Outdated information (older than 7 years)

Step 3: Dispute Real Errors

If you find actual mistakes, dispute them directly with the credit bureaus. It’s free. You can do it online. They must investigate within 30 days.

Step 4: Pay Your Bills On Time

This is 35% of your credit score. Nothing else matters more. Set up automatic payments if necessary.

Step 5: Reduce Credit Utilization

Keep credit card balances below 30% of limits. Ideally, below 10%. This is 30% of your score.

Step 6: Keep Old Accounts Open

Length of credit history matters. Don’t close old cards even if you don’t use them.

Step 7: Limit New Credit Applications

Each application creates a hard inquiry. Too many hurt your score. Space out applications.

Step 8: Be Patient

Good credit takes time. There’s no shortcut. Accept this reality now.

Legitimate Credit Counseling vs. Scams

Not all credit help is a scam. Legitimate non-profit credit counseling exists. Here’s the difference:

Legitimate Counselors:

- Non-profit status (check IRS records)

- Free or low-cost services ($50 or less)

- Educate you about credit management

- Help create debt payment plans

- Never promise quick fixes

- Accredited by NFCC or FCAA

- Transparent about what they can and can’t do

Scams:

- For-profit companies

- High upfront fees

- Promise miracles

- Pressure tactics

- Vague about methods

- No accreditation

- Disappear after payment

If you need help, use only non-profit credit counselors. They’re free or very cheap. Moreover, they actually help.

The FTC’s Action Against Credit Repair Scams

The Federal Trade Commission regularly shuts down credit repair scams. However, new ones appear constantly. Recent actions include:

2022: FTC banned “Credit Assistance Network” from the credit repair business. They had charged $1.2 million in illegal upfront fees.

2023: Multiple companies shut down for false advertising and illegal fee structures.

Despite enforcement, scams proliferate. Why? Because desperate people keep paying. The profit margin is too tempting for criminals.

What To Do If You’ve Been Scammed

If you paid a credit repair scam:

Step 1: Stop Payment Immediately: Contact your bank or credit card company. Dispute the charges. Sometimes you can get money back.

Step 2: Report the Scam:

FTC: ReportFraud.ftc.gov

State Attorney General

Consumer Financial Protection Bureau

Better Business Bureau

Step 3: Check Your Credit Reports: See what damage was done. Identify any fraudulent disputes filed in your name.

Step 4: Contact Credit Bureaus: Explain the situation. Ask them to remove any fraudulent disputes. Provide documentation.

Step 5: Document Everything: Save all communications, contracts, and receipts. You might need them for legal action or criminal complaints.

Step 6: Warn Others: Post reviews. Share your story. You might save someone else.

The Bottom Line

Credit repair scams exploit desperation. They promise miracles to people in financial pain. Then, they disappear with the money.

The truth is harsh but simple: Time and responsible behavior fix credit. Nothing else works. No shortcuts exist. No secrets are hidden. The process is boring, slow, and free.

Anyone promising otherwise is lying. “Fix your credit in 30 days” is always, without exception, a scam. So is “remove bankruptcies legally.” So is “boost your score 200 points guaranteed.”

These promises sound good because you want them to be true. But wanting something doesn’t make it real. And paying someone doesn’t make it happen faster.

Your credit is damaged because of past financial decisions. It will heal with better decisions over time. That’s the only path forward.

Save your money. Do it yourself. Be patient. In two years, your credit will improve naturally if you pay bills on time and reduce debt.

Or, pay a scammer $2,000 for nothing but disappointment.

Your choice is that simple.

Resources

[2] Federal Trade Commission. “Credit Repair Organizations Act.” 15 U.S.C. § 1679 et seq.

[4] Federal Trade Commission. “Credit Repair Organizations Act – 16 CFR Part 310.” Regulations.

[5] National Foundation for Credit Counseling. “Find a Certified Credit Counselor.” NFCC Directory.