The Trap Opens

It began with a promise.

“Invest $500,” the ad said, “and watch your Bitcoin multiply.”

In 2023, Aaron Liu, a 29-year-old software engineer from California, joined what looked like a legitimate mining pool. The website showed live mining stats, constant payouts, and photos of humming mining rigs. It felt real.

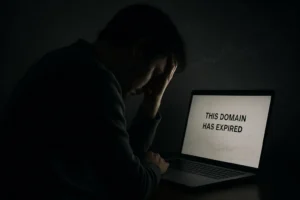

Within three months, he deposited $14,200. Then, one morning, he logged in—and everything was gone.

The site vanished overnight. The chat group dissolved. The Telegram admin blocked him.

That’s when Aaron realized he’d been trapped in one of the fastest-growing crypto nightmares: mining pool scams.

The Rise of the Phantom Mines

Mining pool scams prey on one thing—greed disguised as innovation.

They mimic legitimate crypto mining operations, promising daily returns from “shared hashing power.”

However, behind the polished dashboards, there are no servers, no rigs, and no rewards. Just predators hiding behind anonymous domains.

The Federal Trade Commission (FTC) reported that cryptocurrency investment scams stole over $3.8 billion in 2023, a 54% increase from the year before.

Moreover, a growing share of those losses came from fake mining pool platforms, according to the Federal Bureau of Investigation (FBI).

These operations use glossy marketing, deepfake videos, and fake testimonials. They look like real companies, but they exist only to bleed investors dry.

Victim Story: Priya’s Fall Into the Mine

Priya Nair, 42, a nurse from Texas, joined a Telegram group called “HashNest Pro Mining” in late 2022.

The group claimed to offer “low-cost mining plans with guaranteed returns.”

She started with $1,000, then reinvested her “profits.”

By February, her account balance showed $38,000 in gains. But when she tried to withdraw, the site demanded a “tax deposit” of $6,800 before releasing funds.

She paid. Then the website locked her out.

The chat went silent. The admin’s profile vanished.

In total, she lost $15,300—her life savings.

Priya reported it to the Consumer Financial Protection Bureau (CFPB), which confirmed she’d fallen victim to an unregistered crypto investment scheme.

“I thought I was mining Bitcoin,” she said. “Turns out, I was digging my own grave.”

How Mining Pool Scams Work

Mining pool scams follow a chillingly precise playbook.

Step 1: Bait.

Scammers advertise on social media using influencers, bots, and ads promising 3% to 5% daily returns.

Step 2: Illusion.

They show fake dashboards that simulate mining activity—hash rates, uptime stats, and payout charts.

Step 3: Hook.

Victims receive small “payouts” at first. This builds trust and encourages larger deposits.

Step 4: Vanish.

Once enough funds accumulate, the site shuts down or rebrands under a new name.

According to the Securities and Exchange Commission (SEC), these schemes often move across borders, using “mixers” to hide stolen crypto funds.

The result is digital silence. No refunds. No accountability. Just an empty wallet and regret.

The Scale of the Deception

The horror runs deeper than anyone expected.

In 2024 alone, the Department of Justice (DOJ) prosecuted over 117 cases.

Many of these scams originate from overseas “mining farms” that don’t exist. They use stolen photos of data centers, fake addresses, and AI-generated staff bios.

Furthermore, the FBI’s Internet Crime Complaint Center (IC3) received over 48,000 reports of crypto-related investment scams in 2023—more than double the 2021 levels.

Mining pool scams have become the new Ponzi, masked by tech jargon and digital dust.

The Anatomy of a Lie

The danger lies in the illusion of transparency.

You see “mining rewards” tick up every hour. You see “hash rate updates.” You even get notifications like “Mining round complete.”

But every number, every graph, every transaction log—it’s all **fabricated**.

The scammer controls the code.

Therefore, no blockchain verification exists. No real wallets back the data. The dashboard becomes a digital theater, designed to hypnotize victims into believing their crypto is working.

Once the curtain drops, the actors disappear—and your money burns with them.

Red Flags of Mining Pool Scams

🚩 Red Flag 1: Unrealistic Returns**

Anything above 1% daily is a lie. Real mining profits fluctuate—and rarely exceed 0.2% per day.

🚩 Red Flag 2: Tax or Withdrawal Fees

Legitimate platforms never demand “extra deposits” to release your funds.

🚩 Red Flag 3: Anonymous Teams

If you can’t verify the founders through SEC filings or LinkedIn, walk away.

🚩 Red Flag 4: Telegram-Only Communication

Serious mining operations use verifiable business channels—not encrypted chatrooms.

🚩 Red Flag 5: No Blockchain Proof

If the site can’t show a verifiable transaction ID, it’s fake.

🚩 Red Flag 6: Copycat Websites

Scammers clone real mining sites with slightly different URLs. Always check domain registration data.

🚩 Red Flag 7: Urgent Investment Promises

Pressure tactics mean desperation. Real miners never beg for deposits.

How to Protect Yourself

• Verify Licenses: Check the SEC’s EDGAR database before investing in any mining operation.

• Research Ownership: Use the FTC’s business registry and WHOIS tools to confirm legitimacy.

• Use Cold Storage: Keep your crypto in personal wallets, not on unverified platforms.

• Report Suspicious Activity: File complaints at reportfraud.ftc.gov or ic3.gov immediately.

• Stay Private: Never share wallet keys or screenshots of balances online.

According to the CFPB, early reporting increases the chance of fund recovery by 27%.

The Horror Beneath the Hash Rate

The sound of digital miners humming once meant progress. Now, it hides screams.

Each fake mining pool leaves behind thousands of empty accounts and broken lives.

Aaron stopped checking his email months ago—too many messages from others just like him. Priya deleted every trace of crypto apps from her phone.

Both live with the same echoing thought: How could something so modern feel so medieval?

Because the monster has evolved.

It no longer knocks on your door.

It just asks for your wallet address.

Have you encountered this scam?** Help others by sharing your experience in the comments below.

—

Resources

[[1] Federal Bureau of Investigation. “IC3 Annual Report: Crypto Investment Scams Surge.” [2]Two Estonian fraud defendants sentenced for $577 million fraud scheme [3] Federal Bureau of Investigation. “Internet Crime Complaint Center: [4] Federal Bureau of Investigation (FBI) IC3 Annual Report: The link for the annual report is updated each year. The correct and official landing page for the 2023 IC3 report. [5] Consumer Financial Protection Bureau (CFPB) Fraud Data: The CFPB’s primary data source is the “Consumer Complaint Database,” where they track and report on all types of fraud, including those reported early.

Related Articles

Rug Pull Scams:How DeFi Projects Steal Millions Overnight

Fake Crypto Exchanges: 20 Red Flags of an Empty Vault