It began with a grainy webinar. Lights dimmed. A voice promised fortunes. “Turn $5,000 into $50,000 in six months”, the instructor declared, calm but intense. That was when Maria pressed “Enroll Now.”

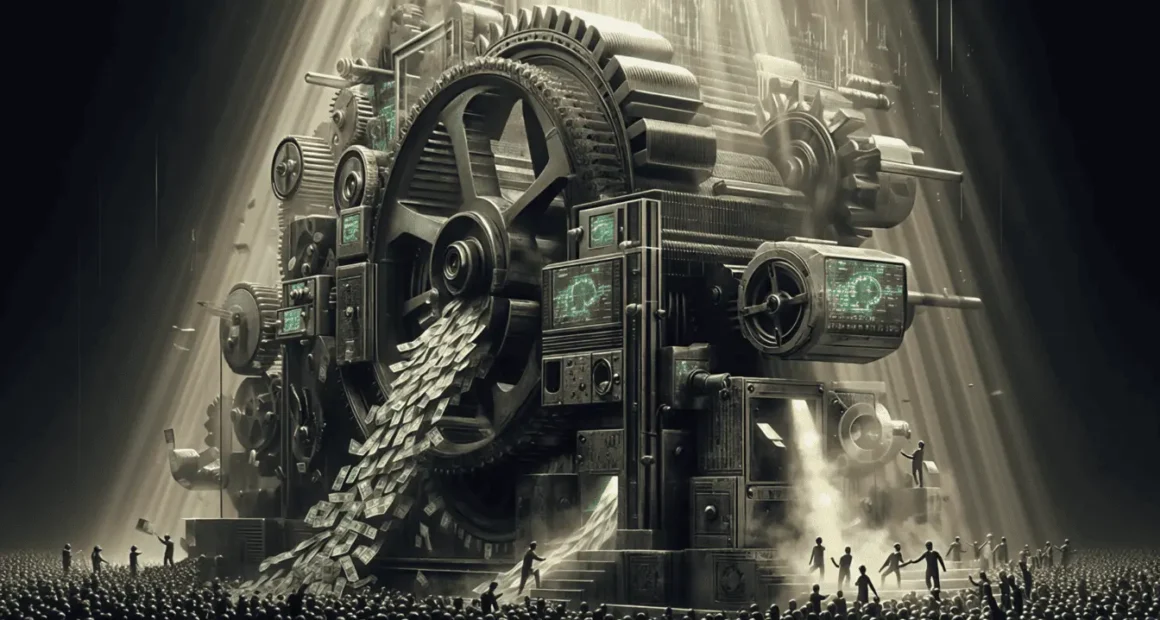

What she didn’t know yet was: she had just walked into a monstrous machine—Forex Trading Scams—one built by fraudsters who counted on hope, not logic.

By the time her savings evaporated, the machinery had consumed more than money. It swallowed her confidence. It stripped her of belief in anything that sounds too good to be true.

The Machinery Behind the Horror

The fraudsters behind so many “forex courses” build a horror show in layers. First: a dazzling lure. They offer “exclusive strategies,” “proprietary systems,” and “guaranteed returns.” That’s the recruitment script—part hypnosis, part high-pressure sales pitch.

Once a victim like Maria signs up, the nightmare accelerates. The course never teaches trading fundamentals. Instead, they push “advanced modules”—only unlocked for big payments. If you try to back out, the sales team leans on emotional pressure: you’ll never catch up without continuing.

Many of these courses are simply shopfronts to funnel money into fake trading platforms. Those platforms show fake “profits” on dashboards. But when you try to withdraw, you’re blocked. Or you’re told there’s a “withdrawal fee” you haven’t paid. Or the support line goes silent. Victims discover too late: the system was rigged from Day One.

“95% Are Fraudulent” — Is That Real?

I called it a “horror statistic” because it stings. The figure isn’t from folklore—it echoes what many consumer protection agencies warn.

The CFTC, in its “Foreign Currency Fraud” advisory, warns that many retail forex schemes misrepresent risk, promise impossible profits, and misdirect or steal funds.

In fact, the CFTC says the number of complaints about forex scams has spiked sharply in recent years.

Look at a recent case: the FTC alleges that IM Mastery Academy / IYOVIA defrauded consumers—many of them vulnerable young adults—out of more than $1.2 billion through deceptive “trading education” schemes in forex, crypto, and stocks.

In that complaint, the agency claims most customers lost more money than they invested in the course itself.

Then there’s PGI Global: it claimed to be a forex + crypto trading company, offering “membership packages” with guaranteed returns. The SEC says PGI raised about $198 million, misappropriating $57 million of it.

Those aren’t fringe stories. They are the rule. Suppose 20 or more high-profile operations get shut down each year, and hundreds of smaller ones slip by. In that case, it’s not unreasonable to believe that most forex courses are, at a minimum, dangerously misleading—or criminal. The “95%” is a shock, but reality often surpasses fiction.

Victim Impact: Real People, Real Loss

Maria isn’t alone.

In the FTC case against the Online Trading Academy, victims testified to losing tens of thousands of dollars after paying $22,000 or $50,000 for courses that never delivered true results. Many said the “education counselors” pressured them relentlessly during the courses.

One person wrote:

“I gave it everything I had … lost 75% of my savings … now I wish I had never even started.”

In the IM Mastery / IYOVIA case, the complaint states a staggering fact: 80% of “salespeople” (i.e., course buyers turned recruiters) earned under $500 per year. Meanwhile, the founders reportedly pulled in tens of millions.

OmegaPro? The U.S. Justice Department says its founders defrauded investors of more than $650 million with a blend of forex and crypto promises disguised behind “investment education.”

The horror is not just the money. It’s lives derailed. Retirement plans shattered. Trust broken. Families left scrambling.

Mechanics of the Scam: How They Build the Trap

Warning signs from real cases:

- Guaranteed returns or “no-risk trading” promises. (CFTC warns such promises are a red flag.)

- Pressure tactics: limited time offers, “spots left,” “enroll now or never.”

- Fake dashboards showing fabricated wins.

- Withdrawal obstacles: fees, hidden terms, refusals.

- Pay to advance: You must pay more to unlock “pro levels.”

- Referral incentives / MLM structure: You’re rewarded to bring in others. PGI Global used this.

- Identity theft or faux vetting: scammers collect your passport, ID, and credit data for later misuse.

- Unregistered firms or fake regulators: Many bogus course sellers pretend to be regulated or claim fake licensing. The SEC’s PAUSE list flags dozens of “unregistered soliciting entities.”

If you see three or more of these signs—walk away.

How to Avoid Becoming the Next Victim

Here’s your defense plan (simple, actionable):

- Check registration

Use the CFTC or SEC / Investor.gov to search for company and individual registration. If they don’t show up, red flag. - Ask for an audited performance

Legit trading enterprises can provide verifiable records. If they can’t—or refuse—you probably deal with illusion. - Never pay up front in full

Reject sky-high upfront fees. A trustworthy course might take lower fees in installments, with refund guarantees. - Avoid “join and recruit” structures

If the course revenue depends on recruiting other buyers, that’s a hallmark of a pyramid or Ponzi scheme. - Test withdrawal first

Before committing big capital, deposit small, trade, and try withdrawing. If that fails, you’ve found the trap. - Get everything in writing

Contracts, promises, refund policies—insist on documentation. Don’t rely on verbal guarantees. - Watch for fake endorsements/fraud signals

Be skeptical of celebrity photos, screenshots of bank accounts, or claims of “secret strategies.” - Talk to ex-students

If you can’t find verifiable testimonials outside their marketing funnel, it’s a warning sign.

Horror Epilogue: Lasting Consequences

Even when authorities intervene, they can only do so much.

In the Online Trading Academy case, many victims still haven’t been fully refunded, because companies imposed non-disparagement clauses and complex refund terms.

The founders of OmegaPro face criminal charges. But many victims abroad will never see compensation.

PGI Global’s founder was sued by the SEC. But the damage remains: thousands who believed their future was secure now wrestle with lost trust, debt, and emotional trauma.

Many tell of sleepless nights, guilt, and depression. The money was just the start.

CONCLUSION

This was never just education. This was a trap. With Forex Trading Scams everywhere, the “95% fraudulent” figure is more than an alarm—it’s a warning sign for your wallet and your sanity.

You don’t have to be a statistic. If you see the red flags, pause. Investigate. Think again.

The machinery doesn’t rest. But now you know it’s there.

Stay safe. Stay skeptical. And never let a pitch outshine your reason.

—

resources:

- CFTC / NASAA Investor Alert: Foreign Exchange Currency Fraud [CFTC/NASAA, Forex Fraud]

- [CFTC, Forex Fraud Advisory]

- FTC case vs Online Trading Academy [FTC]

- [FTC, May 2025 complaint]

- SEC PGI Global case [SEC]

- [SEC, binary options fraud]

- [SEC, PAUSE list]

- [Justice Department press release, July 2025]

Related reading (suggested):