The danger behind the promise

You run a small business. You need cash — yesterday. Then a glossy inbox pops up: “Fast business loan approved! Just pay $199 to start.”

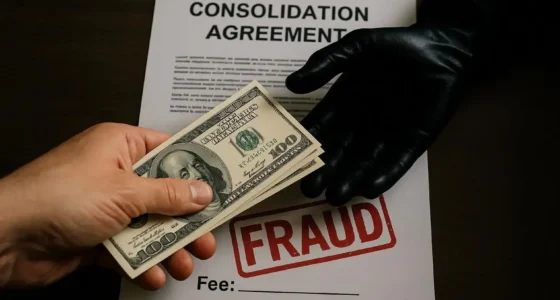

That’s how business loan scams often begin. Scammers pretend to be lenders. They whisper hope, demand payment, then disappear.

They know your stress. They exploit your urgency.

How the trap is set

First, they present a loan offer that seems real. They use slick websites, copied logos, and fake trust seals.

Then, once you submit your application, they say, “Pay $300 for processing.” Or “Pay $450 for paperwork fees.”

You pay. They stall. They vanish. The promised funds never arrive.

These are called advance-fee loan scams. Scammers promise funds but require payment before delivering.

Legitimate lenders never ask for large upfront fees. They deduct fees from the loan when it’s processed.

Victim story — Cafe owner

Madison, 38, runs a small café in Ohio. She wanted to expand. She applied with what she thought was a real lend-tech platform.

They told her, “Pay $499 for application processing.” Eager, she wired it.

Weeks later, she saw nothing. The emails stopped. The website went dark.

Madison lost $499 — money she saved for a new espresso machine. She now feels betrayed and trapped.

Victim story — Landscaping startup

Carlos, 26, just launched a landscaping business. He responded to an ad: “Guaranteed funding for new businesses.”

They asked for $1,200 for “credit verification.” He paid via gift card.

When he asked for his funds, they ghosted him. He found other victims in online forums.

He says he still replays that decision every night — the moment he wired that money feels like it stole his confidence too.

Real enforcement and warnings

In 2020, the FTC charged Ponte Investments, LLC for pretending to be affiliated with the SBA. They used the name “SBA Loan Program” to trick businesses into paying bogus fees. The company was forbidden from misrepresenting its ties to the SBA. [0search15]

State agencies also warn: asking for advance fees is illegal in many jurisdictions. [0search12]

The SBA Office of Inspector General advises caution: if someone claims to contact from SBA but not using an @sba.gov address, suspect fraud.

Why this horror persists

Because small businesses often feel ignored by banks.

Because the promise of fast funding seduces.

Because desperate people don’t always pause to verify.

Because these fake lenders vanish across jurisdictions.

Many victims never report — they feel shame. The predator moves in silence.

Warning signs — red flags

• They demand payment before approval

• They guarantee approval regardless of credit history

• They pressure you to act now

• They ask for wiring, gift cards, or crypto

• They use names like “Loan Program,” “Funding Agency,” “SBA Loans” without proof

• They don’t show a verifiable physical address or registration

If you see two or more, treat it as a trap.

What you can do

• Research the lender. Check with state regulators.

• Ask for licensing and registration proofs.

• Request the fee to be deducted from the loan, not paid upfront.

• Use secure payment paths — no gift cards or wires to strange accounts.

• Report the fraud: FTC, state Attorney General, local law enforcement.

Final warning — don’t let hope betray you

When someone promises you “sure thing funding,” smell the trap.

This isn’t just fraud. It’s emotional violence. It steals your trust, your money, and sometimes your future.

Stay cautious. Demand proof. Don’t rush. Otherwise, the phantom lender will vanish — and so will your dreams.

Resources

[1] Federal Trade Commission. “What To Know About Advance-Fee Loans.” March 2022.

[2] New York Department of Financial Services. “Predatory Loans and Loan Scams.” 2024.

[3] U.S. Small Business Administration. “Protect Yourself from Scams and Fraud.” June 3, 2025.

[5] Federal Trade Commission. “Scams | Consumer Advice.” 2025.

Related reading(suggested)

Credit Repair Scams: Why ‘Fix Your Credit in 30 Days’ Is Always Fake