The call came at 2:47 AM.

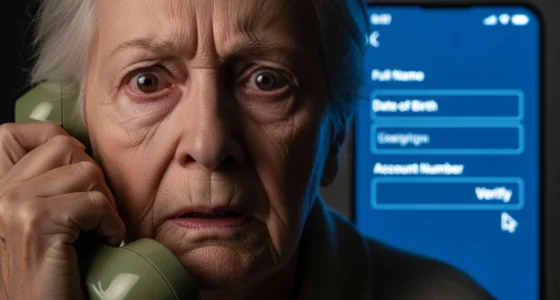

Dorothy Williams, 73, grabbed the phone with shaking hands. Nobody calls at that hour with good news. A young man’s voice, trembling and desperate, spoke through tears.

“Grandma? It’s Jake. I’m so sorry. I’m in so much trouble.”

Dorothy’s grandson Jake was 19, away at college. This sounded like him. Frightened. Ashamed. Begging for help.

But it wasn’t Jake. Grandparent scams had found another victim in the darkness.

The Predators Who Know Your Family

Grandparent scams have evolved into a precision weapon. Criminals mine social media for family connections. They find your grandchildren’s names. They study their voices from videos. They learn where they go to school.

Then they wait for the perfect moment to strike.

The scam works because it hijacks the deepest human instinct. Grandparents protect their grandchildren. No questions asked. No hesitation allowed. Consequently, rational thinking evaporates when fear takes control.

The FBI reported that people over 60 lost over $3.4 billion to all fraud types in 2023. Grandparent scams represented a significant portion. Moreover, these numbers only reflect reported cases. Shame keeps thousands of victims silent.

The Anatomy of Emotional Manipulation

The scammers follow a terrifyingly effective script. First, they call in the middle of the night. Sleep deprivation makes you vulnerable. Your defenses are down.

Then they create an immediate crisis. Your grandchild is in jail. They had a car accident. Someone is hurt. They need bail money NOW. Furthermore, they beg you not to tell their parents.

That last part is crucial. The secrecy isolates you from anyone who might recognize the scam. You’re alone with your fear and their lies.

The “grandchild” usually hands the phone to a “lawyer” or “bail bondsman.” This second voice sounds professional and official. They provide case numbers. They cite laws. They make everything feel legitimate.

Finally, they demand specific payment methods:

- Wire transfers to “the courthouse”

- Gift cards for “processing fees”

- Cryptocurrency for “bail bonds”

- Cash given to a “courier” who’ll come to your house

Real bail systems never work this way. Never.

Dorothy’s Descent Into Hell

Jake’s voice cracked as he explained. He’d been in a car accident after leaving a party. The other driver was injured. Police arrested him for DUI. He needed $8,500 for bail immediately.

Dorothy’s hands trembled. Her grandson needed her. She couldn’t let him sit in jail. Additionally, he begged her not to call his parents. They’d be so disappointed.

The “lawyer” got on the phone. Mr. Rodriguez. He sounded calm and professional. He explained the charges. He provided a case number. He said Dorothy could wire the money to the court administrator’s office.

She drove to Walmart at 4 AM. She sent $8,500 via Western Union to an address in another state. Mr. Rodriguez confirmed receipt and promised Jake would be released within hours.

Dorothy went home to wait. She called Jake’s cell phone at noon. He answered cheerfully from his dorm room. He’d been asleep. He hadn’t been arrested. He didn’t know what she was talking about.

The nightmare was real, but Jake’s emergency wasn’t.

Today, Dorothy lives with crippling guilt and depression. She lost her emergency medical fund. That $8,500 represented years of careful savings. Furthermore, she can’t forgive herself for not calling Jake’s parents first.

The money vanished into accounts that closed within 24 hours. Police traced the wire to a network spanning three countries. Nobody has been arrested. Nobody will be.

The Numbers Paint a Horrifying Picture

The FBI’s Internet Crime Complaint Center received over 5,400 complaints about grandparent scams in 2023. Victims over 60 reported median losses of $9,000 per incident. However, many victims lose significantly more.

The Federal Trade Commission documented that impostor scams targeting seniors resulted in $41 million in losses during 2023. This number increased 78% from the previous year. The trend accelerates as scammers refine their techniques.

Most devastating? Only 10% of victims ever recover any money. The wire transfers disappear. The gift cards get drained instantly. The cryptocurrency becomes untraceable. Therefore, prevention remains the only real protection.

Robert’s Midnight Terror

Robert Chang, 68, got the call at 11:30 PM. His granddaughter Emma was crying. She’d been arrested in Mexico during spring break. Drug possession. She needed $12,000 for a lawyer immediately.

The voice sounded like Emma. Young. Female. Terrified. Robert’s protective instincts took over instantly.

A man identifying himself as “Attorney Garcia” explained the situation. Mexican jails were dangerous for American girls. Emma needed legal representation immediately. They had to act fast before the court closed for a three-day holiday.

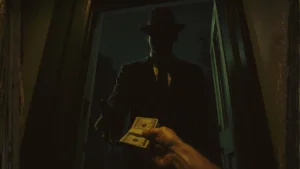

Robert couldn’t wire money to Mexico that late. Instead, “Attorney Garcia” said a courier would come to collect cash. Robert went to three ATMs, maxing out his withdrawal limits. He pulled $6,000 from his safe at home.

A man in a suit arrived at 1 AM. He provided business cards. He gave Robert a receipt. He promised Emma would call within hours.

Robert’s wife woke up during the commotion. She immediately called Emma’s cell phone. Emma answered from her apartment. She’d been home all night studying. She’d never been to Mexico.

The courier vanished. The business cards listed a law office that didn’t exist. The receipt was worthless paper. Robert had handed $6,000 to a criminal who walked right into his home.

He reported the crime, but the investigation went nowhere. The courier’s description matched thousands of men. The money funded criminal networks that operate with virtual immunity.

Robert now suffers from anxiety and sleeps with a baseball bat beside his bed. The financial loss hurt. But the violation of his home? That wound may never heal.

The Technology That Powers the Nightmare

Modern grandparent scams use sophisticated tools. Voice cloning software can replicate anyone’s voice from just a few seconds of audio. Scammers pull clips from social media videos. Then they use AI to make the fake grandchild say anything.

Caller ID spoofing makes calls appear to come from local numbers or even family members’ phones. You glance at your screen and see a familiar area code. Your guard drops.

Social media provides a complete blueprint of your family. Names. Relationships. Schools. Hobbies. Travel plans. Criminals harvest this data and weaponize it against you. Furthermore, they can see when your grandchildren post about parties, trips, or risky activities.

The scammers work in organized networks. One person makes the call. Another poses as a lawyer. A third collects the money. They communicate through encrypted apps. They launder funds through multiple accounts. Law enforcement struggles to keep pace.

The Warning Signs That Save Lives

Grandparent scams share common red flags. Learn them. Memorize them. Share them with every grandparent you know.

Be suspicious if:

The call comes at an unusual hour (late night or early morning)

The caller begs you not to tell anyone, especially parents

They demand immediate payment before you can think

They want wire transfers, gift cards, or cryptocurrency

The situation requires secrecy for “legal reasons”

You can’t call your grandchild directly to verify

A “lawyer” or “official” takes over the conversation

They pressure you to act before banks close or courts open

Real emergencies allow time for verification. Real lawyers don’t demand gift cards. Real bail bondsmen don’t send couriers to collect cash at midnight.

If You Get the Call

Stop. Breathe. Your grandchild needs you to think clearly.

Hang up immediately. Don’t engage with the caller. Don’t try to get more information. Just disconnect.

Then verify independently. Call your grandchild’s cell phone. Call their parents. Call their roommate. Use numbers you already have, never numbers the caller provides.

If you can’t reach your grandchild right away, that’s okay. Real emergencies don’t resolve in minutes. Take time to confirm before sending money.

Already sent money? Act fast. Contact your bank immediately. Report the fraud to the police. File a complaint with the FBI’s IC3 at ic3.gov. Time matters, but honestly, recovery remains unlikely.

The Expanding Nightmare

Grandparent scams now include terrifying variations. Some scammers claim your grandchild caused a car accident that injured a pregnant woman. Others say they’re calling from a hospital after an overdose. A few even impersonate kidnap victims.

Each version targets different emotional pressure points. Fear. Guilt. Shame. Love. The scammers study human psychology and exploit our deepest vulnerabilities.

Text message versions have emerged recently. A message from “your grandchild’s new number” describes an emergency. Links lead to fake payment portals that steal bank credentials. The messages feel urgent and authentic.

The AARP Fraud Watch Network documented that grandparent scam attempts increased 130% between 2022 and 2023. The trend shows no signs of slowing. Indeed, as technology improves, the scams become more convincing.

The Aftermath Nobody Discusses

Victims of grandparent scams suffer wounds that money can’t measure. They lose trust in phone calls. They question their judgment. They withdraw from family members out of shame.

Many victims develop depression or anxiety disorders. Some refuse to answer phones anymore. Others compulsively check on grandchildren, damaging those relationships with constant worry.

Families fracture under the strain. Adult children blame their parents for “being foolish.” Victims blame themselves for not being smarter. The shame becomes a prison built from love twisted into a weapon.

Financial recovery takes years if it happens at all. But emotional recovery? That might never come. The scammers steal more than money. They steal the joy of hearing your grandchild’s voice.

Your Shield Against the Darkness

Knowledge is power, but only if you use it. Talk to your family about grandparent scams before the call comes. Create a family code word. Establish verification protocols.

Tell your grandchildren about these scams. Ask them to understand if you need to verify emergencies. Make it okay to hang up and call back. Remove the shame from protecting yourself.

Remember Dorothy. Remember Robert. Remember the thousands of grandparents who answered the phone when fear came calling and believed the voice on the other end was someone they loved.

The call might come tonight. The text might arrive tomorrow. The voice will sound exactly like your grandchild because they’ve studied how to break your heart.

But now you know the truth.

Your grandchild won’t beg you to keep secrets from their parents. They won’t need gift cards for bail. They won’t ask you to give cash to strangers at midnight.

When that voice cracks with tears, when your heart starts racing, when love makes you reach for your wallet—stop. Hang up. Verify.

The real nightmare isn’t your grandchild in trouble. It’s the predator who knows you’d do anything to protect them. They’re counting on your love to blind you.

Don’t let them win. And don’t let anyone you love become the next victim.

The darkness is real. The predators are hunting. But now you can see them coming.

Your grandchildren need you alive and financially stable more than they need you to respond to fake emergencies in the middle of the night.

Trust your instincts. Verify everything. Protect yourself.

Because the voice that sounds like love might be the most dangerous call you’ll ever answer.

Resources

[1] Federal Bureau of Investigation. ” Elder Fraud Report.”

[2]FCC: ‘Grandparent’ Scams Get More Sophisticated’

[4] IC3: Internet Crime Complaint Center.

Related reading(suggested)

[1]IRS Tax Scams: Inside the Fake Agent Terror Campaign

[2]The Government Voice That Wants to Destroy You: Inside Social Security Scam Scripts