The phone rang at 9:47 AM on a Tuesday.

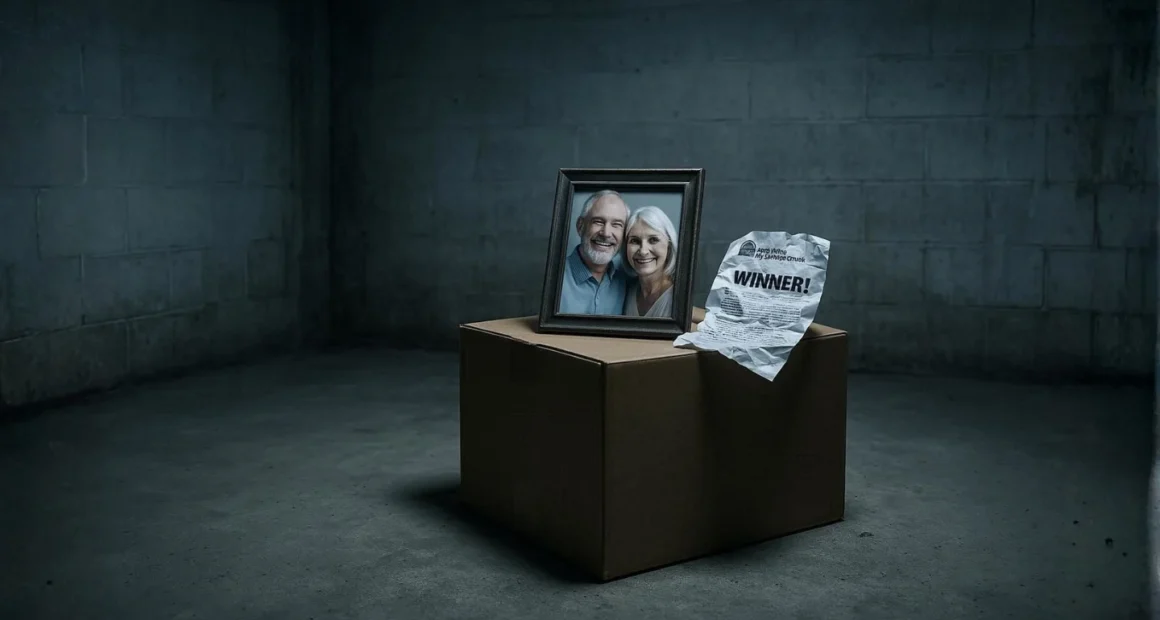

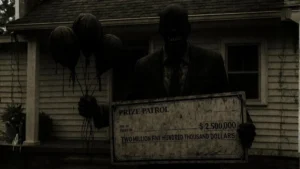

Dorothy Williams, 73, heard the news she’d waited decades to hear. She won the Publishers Clearing House sweepstakes. $2.5 million. A brand new Mercedes. The Prize Patrol was coming to her door.

The voice sounded official, professional even. He knew her full name. Her address. Details about entries she’d submitted years ago. Everything checked out.

Then came the fee. Just $4,500 to cover taxes and processing. A small price for millions, he explained. She needed to act fast. Moreover, she couldn’t tell anyone yet. Winners who talked early forfeited their prizes.

Dorothy wired the money that afternoon. Then another $3,200 the next day for “insurance bonds.” Within two weeks, she sent $23,847 to secure her prize.

The Prize Patrol never arrived. Instead, prize scam imposters had just destroyed her retirement.

The Wolves Wearing Familiar Masks

Publishers Clearing House has built trust over 70 years. Consequently, scammers wear their name like stolen skin.

The Federal Trade Commission reports Americans lost over $255 million to prize and lottery scams in 2023. However, experts estimate actual losses exceed $400 million. Shame keeps most victims silent. Fear prevents them from reporting.

These predators don’t strike randomly. They hunt methodically.

Prize scam imposters target seniors with surgical precision. People over 60 represent 78% of all victims. They remember when Publishers Clearing House first became famous. They trust the brand completely. That trust becomes their downfall.

The scammers study their prey carefully. They know exactly which buttons to push.

How the Trap Snaps Shut

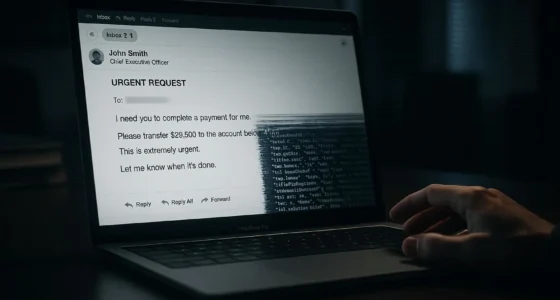

The attack begins with a phone call. Sometimes an email arrives first. Occasionally, a letter appears in the mailbox on official-looking letterhead.

The message always promises something incredible:

- Multi-million dollar cash prizes

- Luxury vehicles delivered to your door

- Lifetime monthly payments of $5,000 or more

- Vacation packages worth six figures

- Recognition in national television commercials

The details sound legitimate. Furthermore, the scammers provide “confirmation numbers” and “claim codes.” They reference specific sweepstakes you might have actually entered. Some even send fake checks as “advance payments.”

Then comes the poison.

You must pay fees before collecting your prize. Taxes, they claim. Processing charges. Insurance bonds. Customs clearance for international prizes. Courier delivery costs. Security deposits.

The real Publishers Clearing House never asks winners for money. Never. Not one penny. Not ever.

But prize scam imposters demand payment immediately. Wire transfers work best. Gift cards from major retailers also work perfectly. Cryptocurrency transfers leave no trace.

Each payment method shares one quality. None can be reversed or traced easily.

The Feeding Frenzy Begins

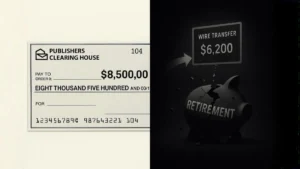

Michael Torres, 68, received his winning notification via certified letter. The letterhead looked flawless. Official stamps covered the envelope. A check for $8,500 arrived inside as “partial payment.”

His bank accepted the check. The funds appeared in his account. Therefore, everything seemed legitimate.

The caller instructed Michael to wire $6,200 for tax processing. He complied immediately. After all, he had $8,500 in his account already. The math made sense.

Three days later, his bank reversed the deposit. The check was counterfeit. Meanwhile, his wire transfer vanished forever. Scammers had stolen $6,200 and left him owing the bank another $8,500.

Michael worked as a grocery store manager for 43 years. He saved carefully. His retirement fund held $127,000. Within six weeks, the scammers convinced him to send it all.

“One more payment,” they promised. “Just this final fee.”

The payments never stopped. Moreover, each excuse sounded reasonable. Each delay made logical sense. Michael paid $4,800 for “diplomatic immunity waivers.” Another $7,300 for “IRS documentation.” Then $9,100 for “Federal Reserve clearance.”

His wife discovered the truth when their mortgage payment bounced. By then, Michael had sent $134,628 chasing his prize.

He never recovered a single dollar.

The Many Faces of Deception

Prize scam imposters adapt constantly. Their tactics evolve faster than law enforcement can track.

Current variations include:

- Phone calls from spoofed numbers matching Publishers Clearing House’s real customer service lines

- Emails with domains nearly identical to legitimate sweepstakes companies

- Social media messages claiming you won contests you never entered

- Text messages with links to fake prize claim websites

- Voice messages demanding immediate callback to “secure your winnings”

- Video calls showing fake Prize Patrol members with balloons and oversized checks

- Mailed letters with authentic-looking holographic seals and watermarks

The technology improves daily. Scammers now use artificial intelligence to clone voices. They create deepfake videos of Prize Patrol deliveries. Some even hire actors to show up at victims’ homes pretending to represent Publishers Clearing House.

The Federal Bureau of Investigation warns these schemes grow more sophisticated every month[3]. Yesterday’s obvious fraud becomes today’s perfect impersonation.

The Scars They Leave Behind

Dorothy Williams lost more than money. Her daughter stopped speaking to her. The shame felt unbearable. Friends avoided her at church.

She sold her home to cover the losses. Now she lives with her son in his basement. Depression consumed her completely. Moreover, she blames herself daily for falling victim.

The psychological damage cuts deeper than financial ruin. Victims describe feeling stupid, worthless, and broken. Many contemplate suicide. Some succeed.

The Better Business Bureau reports that prize scam imposters destroy an average of 73,000 victims annually. Each victim represents a family torn apart. Retirements vaporized. Trust was shattered permanently.

Real sweepstakes companies suffer too. Publishers Clearing House spends millions fighting imposters. Their legitimate winners face skepticism. People assume all prize notifications are scams now.

The predators poison everything they touch.

Recognizing the Monster’s Footprints

Prize scam imposters leave tracks. You simply need to know where to look.

Warning signs appear consistently:

- Any request for payment to claim prizes

- Pressure to act immediately without time to verify

- Instructions to keep winnings secret from family or friends

- Demands for payment via wire transfer, gift cards, or cryptocurrency

- Claims you won contests you never entered

- Requests for bank account information or Social Security numbers

- Threats that prizes expire within hours

- Refusal to send written documentation via standard mail

- Caller ID showing government agency numbers or legitimate company names

Publishers Clearing House provides a fraud hotline. Call them directly at their verified number. They confirm real winners instantly. Fake winners get exposed immediately.

Check the official Publishers Clearing House website. They list all current legitimate sweepstakes. Moreover, they maintain a fraud alert page identifying known scams.

Trust verification over excitement. Real prizes wait for you. Fake prizes disappear like smoke.

Fighting Back Against the Pack

You can protect yourself from prize scam imposters. Nevertheless, you must stay alert constantly.

Never pay money to claim prizes. Legitimate sweepstakes are free to enter and free to win. Any fee request signals fraud immediately.

Verify everything independently. Search online for the sweepstakes name plus “scam.” Check the Federal Trade Commission’s scam database. Contact the real company using phone numbers from their official website.

Hang up on suspicious calls. Delete questionable emails. Throw away dubious letters. Block numbers that pressure you.

If someone claims you won, take time to verify. Real prizes don’t expire in hours. Scammers create false urgency to prevent verification.

Report suspected fraud immediately. Contact the FTC, your state attorney general, and the FBI’s Internet Crime Complaint Center. Your report might save someone else.

The Shadow That Hunts Forever

Right now, somewhere in the world, a scammer is dialing another number. They’re crafting another email. Printing another fake letter.

They’re searching for their next Dorothy. Their next Michael.

Prize scam imposters never sleep. They work around the clock hunting victims. Phone banks operate 24 hours daily. Thousands of criminals share one goal: steal everything you have.

They’ve refined their craft to perfection. Each word calculated. Every detail researched. They know your hopes, your dreams, your desperation for financial security.

Dorothy Williams thought she’d won freedom from money worries. Instead, she lost everything that made her feel safe.

Michael Torres believed his golden years would finally arrive. Now he works part-time at 71 because retirement became impossible.

These stories repeat daily. Hourly even. The predators feast endlessly.

Next time your phone rings with incredible news, remember Dorothy’s voice shaking as she wired her life savings away. Think about Michael explaining to his grandchildren why he can’t afford their birthday presents anymore.

The monsters are calling. They’re emailing. They’re texting.

They already know your name. They might even know which sweepstakes you entered last month.

But now you know their tricks. You’ve learned their patterns. You understand how they hunt.

Don’t let them add your name to their victim list. And don’t let them steal from someone you love.

Because the real prize in these scams goes to the predators. They win your money. Your dignity. Your peace of mind.

They win everything. You lose forever.

Resources

[1]FTC Issues Annual Report to Congress on Agency’s Actions to Protect Older Adults

[2] Federal Trade Commission. “Consumer Sentinel Network Data Book 2024

[5] Federal Trade Commission. “Fake Prize, Sweepstakes, and Lottery Scams”