The Friday Withdrawals Stopped

June 10, 2022. Friday morning. Sarah tried to withdraw $85,000 from her Celsius account. She needed the money for her daughter’s medical bills. The withdrawal had always worked before. Takes 24 hours, usually less.

The app froze. Then, an error message appeared: “Withdrawals temporarily paused.”

She tried again. Same error. Moreover, there was no explanation. Furthermore, the Celsius website offered no details. Just a vague notice about “extreme market conditions.”

By Friday afternoon, panic spread across social media. Nobody could withdraw. Moreover, Celsius had frozen all accounts. Additionally, 1.7 million users were locked out of their money.

Sarah’s $85,000 was trapped. Her daughter’s surgery was scheduled for Tuesday. The money she’d entrusted to “a safer alternative to banks” was gone. And Alex Mashinsky, the CEO who’d promised this could never happen, went silent.

This is the Celsius Network bankruptcy. A story of lies, fraud, and 1.7 million people who trusted the wrong company with their life savings. Consequently, it exposed crypto lending as a house of cards. Meanwhile, it revealed how easily “financial innovation” becomes old-fashioned theft.

Let’s investigate how a man in a suit destroyed $25 billion while claiming he was saving people from banks.

The Promise: Banking Reimagined

Alex Mashinsky: The Serial Entrepreneur

Alex Mashinsky arrived in crypto with impressive credentials. He’d founded seven companies. Moreover, he held multiple patents. Furthermore, he claimed to have invented VoIP (Voice over Internet Protocol). The media called him a visionary.

In 2017, he founded Celsius Network. The pitch was revolutionary: A crypto bank that paid you instead of charging fees. Deposit your cryptocurrency. Earn high interest. Withdraw anytime. No tricks. No catches.

The slogan: “Unbank yourself.” Traditional banks were the enemy. They paid 0.1% interest while lending your money at 6%. Celsius would pay you 17%. Moreover, you’d keep control of your assets. Additionally, blockchain made it transparent and safe.

Mashinsky sold the vision relentlessly. He appeared on hundreds of podcasts. He hosted weekly AMAs (Ask Me Anything) on YouTube. Furthermore, he positioned himself as the people’s champion against evil banks.

People believed him. Desperately.

The Yields That Seemed Too Good

Celsius offered interest rates that banks couldn’t match:

Deposit Rates (2020-2021):

- Bitcoin: 6.2% APY

- Ethereum: 5.35% APY

- Stablecoins: 8.88% APY

- CEL token: 17% APY

In comparison, banks offered 0.1-0.5%. Celsius paid 10-170 times more. How was this possible?

Mashinsky explained: “We’re not greedy. We give 80% of profits to depositors. Banks keep 80% for themselves.” It sounded logical. Moreover, it sounded fair. Furthermore, crypto was supposed to democratize finance.

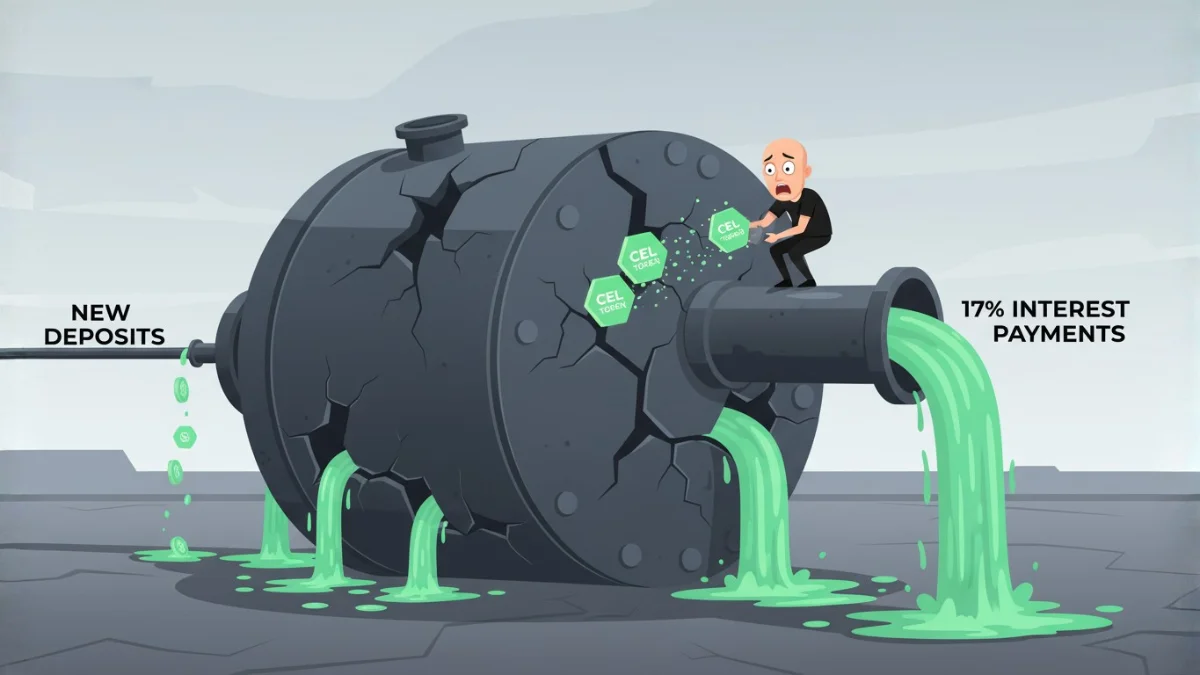

What he didn’t say: The yields were unsustainable. The business model was broken. Moreover, they were using new deposits to pay old customers. Classic Ponzi mechanics.

The Growth Explosion

Deposits flooded in:

2018: $100 million in assets

2019: $500 million

2020: $3 billion

2021: $25 billion (peak)

By mid-2021, Celsius managed more assets than many regional banks. Moreover, it had 1.7 million users globally. Additionally, it had raised $750 million from VCs at a $3 billion valuation.

The company seemed unstoppable. Mashinsky appeared on CNBC bragging about growth. He bought a billboard in Times Square. Furthermore, he sponsored Formula 1 teams. The message: Celsius was the future of finance.

Behind the success, the company was hemorrhaging money and taking catastrophic risks.

The Hidden Ponzi

Where the Money Really Went

Celsius claimed to generate returns through safe lending. Borrow your crypto, lend it to institutions, earn spread. Simple, low-risk.

The truth was different. Internal documents later revealed where the deposits went:

DeFi Gambling (40%): Celsius put billions into risky DeFi protocols. These were unregulated, experimental platforms. Many failed. Moreover, some were outright scams. When protocols collapsed, Celsius lost billions.

Leveraged Trading (25%): Celsius used customer funds for leveraged crypto trading. They bet on price movements with 10-20x leverage. When trades went wrong, losses multiplied catastrophically.

Illiquid Investments (20%): They invested in crypto startups and tokens that couldn’t be sold quickly. When customers wanted withdrawals, this money was locked up.

Operating Expenses (10%): Marketing, salaries, and Mashinsky’s compensation. They spent customer deposits on operations.

Actual Safe Lending (5%): Only a tiny fraction went to the safe, institutional lending they advertised.

This allocation was suicide. One major loss would trigger collapse. And major losses were coming.

The CEL Token Scam

Celsius created its own token: CEL. Holders got higher interest rates. Moreover, they got promotional benefits. Additionally, Celsius claimed CEL would increase in value.

But here’s the scam: Celsius bought its own CEL tokens to pump the price. They used customer deposits to create artificial demand. When the CEL price rose, they used it as collateral for more borrowing. The entire ecosystem depended on CEL maintaining value.

Additionally, Mashinsky and executives held massive CEL positions. They’d get rich if the price rose. Consequently, they had an incentive to manipulate the market. And manipulate they did.

Internal messages showed executives coordinating CEL purchases. They discussed timing buys to “support the price.” This was market manipulation using customer money.

The Missing Collateral

Celsius advertised itself as “over-collateralized.” Every loan was supposedly backed 200%. If borrowers defaulted, collateral protected depositors.

Lies. Complete lies.

Bankruptcy filings revealed Celsius was severely under-collateralized. Many loans had no collateral. Moreover, some collateral was CEL token—worthless once confidence broke. Furthermore, they’d made loans to shell companies controlled by executives.

When auditors finally examined the books, they found chaos:

- No tracking of collateral

- No risk management systems

- No separation of customer funds

- No internal controls

It was a cryptocurrency slush fund masquerading as a bank.

The Cascade of Failures

May 2022: Terra/Luna Collapse

When Terra/Luna crashed in May 2022, Celsius held significant exposure. They lost hundreds of millions instantly. Moreover, the broader crypto market crashed. Additionally, DeFi protocols began failing.

Celsius faced massive unrealized losses. Their assets had dropped 40% in value. Meanwhile, customer deposits remained constant. The math no longer worked. They were insolvent.

Mashinsky appeared on YouTube as usual. “We’re fine,” he claimed. “Celsius is strong.” He showed fake balance sheets. He lied about exposure. Furthermore, he encouraged people to deposit more.

Behind the scenes, panic. Executives knew they were doomed. Nevertheless, they kept accepting deposits. This was criminal fraud—knowingly taking money while insolvent.

June 2022: The Squeeze Begins

As June began, withdrawal requests increased. Customers grew nervous about market conditions. Additionally, rumors circulated about Celsius’s health. Consequently, people wanted their money out.

Celsius faced a liquidity crisis. They couldn’t meet withdrawals without selling assets. However, selling would realize losses and reveal insolvency. Therefore, they stalled.

They slowed withdrawal processing. Moreover, they claimed “technical issues.” Furthermore, they blamed high volume. But the real reason: They were desperately trying to raise emergency funds.

Multiple firms rejected Celsius’s pleas for bailouts. The losses were too severe. Moreover, the accounting was too messy. Additionally, everyone knew the company was finished.

June 12, 2022: Withdrawals Frozen

Sunday night, Celsius announced: All withdrawals, swaps, and transfers frozen. The reason: “Extreme market conditions.” They promised to “restore services soon.”

This was the point of no return. Freezing withdrawals meant only one thing: Insolvency. They didn’t have the assets to cover deposits. Moreover, they were buying time to figure out bankruptcy.

Mashinsky claimed it was “temporary.” He said customers would get their money. These were lies. He knew bankruptcy was inevitable.

1.7 million users woke up Monday morning to frozen accounts. Life savings trapped. Retirement funds inaccessible. Medical emergency funds locked. And nobody could do anything about it.

July 13, 2022: Bankruptcy Filed

One month after freezing withdrawals, Celsius filed for Chapter 11 bankruptcy. The filing revealed shocking numbers:

Assets: $4.3 billion

Liabilities: $5.5 billion

Hole: $1.2 billion (later revised to $2.8 billion)

But the real horror was in the details:

- 1.7 million creditors (customers)

- Assets included worthless CEL tokens

- Mashinsky had withdrawn millions before the freeze

- Executives had cashed out while customers were trapped

The bankruptcy filing made it official: Customers would lose most of their deposits. Recovery projections: 10-30 cents on the dollar.

The Fraud Revealed

Mashinsky’s Secret Withdrawals

Records showed Alex Mashinsky withdrew $10 million from Celsius in May 2022. This was weeks before the freeze. Moreover, other executives withdrew millions too. They knew the collapse was coming. Consequently, they got out first.

Meanwhile, Mashinsky was publicly telling customers to “HODL” (hold their crypto). He was tweeting about Celsius’s strength. Furthermore, he was appearing on podcasts claiming safety.

He saved himself while his customers drowned. This was securities fraud. Wire fraud. Potentially criminal conspiracy.

The Fake Balance Sheets

Celsius had shown fabricated financial statements to investors and lenders. These statements inflated assets. Moreover, they hid losses. Additionally, they misrepresented risk exposure.

For example:

- Claimed $25 billion in assets (real: $19 billion)

- Showed profitability (real: massive losses)

- Listed CEL tokens at inflated values

- Hid related-party transactions

These fake statements induced people to deposit more money. Therefore, they constituted fraud. Multiple criminal statutes were violated.

The Ponzi Payments

Analysis revealed Celsius used new deposits to pay interest to existing customers. This is the definition of a Ponzi scheme. No legitimate investment generated those returns. Instead, new money funded old withdrawals.

This worked during growth. However, when deposits slowed, the model collapsed. By June 2022, outflows exceeded inflows. The Ponzi couldn’t sustain itself. Consequently, everything froze.

The Missing $2 Billion

Even today, $2 billion is unaccounted for. Bankruptcy trustees can’t locate it. Possible explanations:

- Lost in DeFi protocol collapses

- Stolen by executives

- Hidden in offshore accounts

- Gambled away in bad trades

- Locked in illiquid investments

Nobody knows. The accounting was so poor that tracking money was impossible. This level of mismanagement borders on intentional theft.

The Victims’ Stories

Retirement Funds Destroyed

David Chen, 62: Deposited $450,000 (his entire retirement) for 6% Bitcoin yield. “I was six months from retiring. Now I’m working until I die. Celsius destroyed my future.”

Margaret Williams, 58: Lost $280,000. “I believed Mashinsky when he said ‘safer than banks.’ I was an idiot. That money was supposed to last 30 years. Now I have nothing.”

Medical Emergencies

Sarah Martinez, 41: Her story from the opening. $85,000 trapped, daughter needed surgery. “I had to borrow money at 18% interest for medical bills. Meanwhile, my money sits frozen in Celsius, earning nothing.”

Young Families Destroyed

James Rodriguez, 29: Lost $120,000 saved for a house down payment. “I was supposed to close in July. Instead, I lost everything. My wife and I are back to renting. We may never own a home.”

Emily Park, 31: Lost $95,000 designated for IVF treatment. “We spent five years saving. One day, it was gone. Now we can’t afford to have the family we dreamed of.”

The Institutional Victims

Even sophisticated investors got burned:

Tether: Lost $1 billion lent to Celsius

Caisse de dépôt et placement du Québec: Lost $150 million

WestCap Group: Lost $125 million investment

Institutions assumed Celsius was legitimate. The VC backing, the marketing, the CEO’s confidence—all convinced them. They were wrong.

The Criminal Investigation

July 2022: Investigations Begin

Within weeks of bankruptcy, federal prosecutors opened investigations:

U.S. Attorney SDNY: Securities fraud investigation

FBI: Wire fraud and conspiracy probe

SEC: Civil fraud charges preparation

CFTC: Commodities fraud investigation

Additionally, state regulators filed charges. Texas, New Jersey, Alabama, and Vermont accused Celsius of operating unregistered securities.

The case against Mashinsky was building rapidly.

January 2023: Federal Indictment

Federal prosecutors indicted Alex Mashinsky on seven counts:

- Securities fraud

- Commodities fraud

- Wire fraud (three counts)

- Conspiracy to commit fraud

- Market manipulation

Maximum sentence: 115 years in prison. The indictment detailed years of fraud. Moreover, it included internal communications proving knowledge. Furthermore, it showed Mashinsky’s personal withdrawals.

July 2023: Arrest

FBI agents arrested Mashinsky at his Manhattan apartment. Subsequently, he was released on $40 million bail. Conditions included:

- House arrest

- Surrender of passport

- No contact with co-conspirators

- GPS monitoring

Unlike Do Kwon who fled, Mashinsky stayed in the U.S. However, prosecutors had him trapped. The evidence was overwhelming.

The Cooperating Witnesses

Several Celsius executives flipped:

Roni Cohen-Pavon (CSO): Pleaded guilty, agreed to testify. He’d helped create fake financial statements.

Hanoch Goldstein (CFO): Cooperating with prosecutors. Provided documents showing Mashinsky’s knowledge of fraud.

Internal emails were devastating:

- “We’re insolvent but can’t tell customers.”

- “Keep accepting deposits, we need the liquidity.”

- “Make the balance sheet look better.”

- “Alex wants to withdraw his position.”

These messages proved intentional fraud, not mere mismanagement.

The Trial and Aftermath

Celsius Reorganization (2023-2024)

Bankruptcy court approved a reorganization plan:

Customer Recovery:

Crypto holdings: 67-85% recovery (in crypto)

Fiat holdings: 10-30% recovery (in dollars)

Timeline: 12-24 months for distribution

Better than expected but still devastating. Moreover, recovery is in crypto—which has fluctuated wildly. Additionally, tax implications hurt many victims.

CEL Token: Essentially worthless. Trading at $0.02 (was $8 at peak).

Celsius Company: Relaunching as “Celsius Network LLC”, focused on mining. Most customers are excluded from any future upside.

Mashinsky’s Upcoming Trial (2024)

Trial scheduled for late 2024. The prosecution’s case:

Evidence:

- Internal emails proving knowledge of fraud

- Fake balance sheets sent to investors

- Personal withdrawal records

- Witness testimony from executives

- Customer victim impact statements

Defense Strategy: Mashinsky claims:

- Mistakes, not crimes

- He believed the company would recover

- Market crash caused problems, not fraud

- He’s a victim too

The defense is weak. Moreover, the evidence is overwhelming. Furthermore, cooperating witnesses will testify he knew everything. Conviction appears likely.

Potential Sentence

If convicted on all counts, Mashinsky faces:

- 40-60 years in prison (realistically)

- $10+ billion in restitution ordered

- Lifetime ban from the securities industry

- Disgorgement of all assets

At 57 years old, this would be a life sentence. He’d die in prison.

The Broader Impact

Crypto Lending Industry Collapsed

Celsius wasn’t alone. The entire crypto lending sector imploded:

June-August 2022 Failures:

- Celsius (1.7M users, $25B)

- Voyager Digital (3.5M users, $5B)

- BlockFi (600K users, $10B)

- Genesis Trading ($3B in withdrawals frozen)

Total destroyed: $40+ billion across 6+ million users. The crypto lending model was exposed as fundamentally broken.

Regulatory Crackdown

Regulators responded aggressively:

SEC Actions:

- Sued multiple crypto lenders

- Declared most crypto lending products are securities

- Demanded registration or shutdown

State Regulators:

- New York suspended crypto lending

- Texas banned unregistered platforms

- California proposed strict licensing

Federal Legislation: Congress introduced bills requiring:

- Full reserve backing

- Regular audits

- Insurance requirements

- Disclosure standards

The Wild West era of crypto lending ended.

Investor Confidence Destroyed

The Celsius bankruptcy, combined with FTX and others, destroyed mainstream confidence in crypto:

Survey Data (Late 2022):

73% of Americans distrust crypto companies.

81% believe crypto is “too risky.”

65% think crypto is “mostly scams.”

Institutional allocation to crypto dropped 80%.

Recovery took years. Moreover, some trust may never return.

Lessons from Celsius

Red Flags Everyone Missed

Warning signs were everywhere:

Yields Too High: 17% returns don’t exist without massive risk. Traditional finance can’t compete with unsustainable rates.

Cult of Personality: Mashinsky’s weekly AMAs created parasocial relationships. Customers trusted him personally, not the business model.

“Unbank Yourself” Propaganda: Positioning banks as evil and Celsius as savior. Classic manipulation—create an enemy, offer a solution.

No Transparency: Despite blockchain marketing, Celsius never showed proof of reserves. No audits. No verification.

Locked-Up Capital: Once deposited, withdrawal took days. Real banks have immediate access. This delay enabled freezes.

Token Conflicts: Creating the CEL token gave Celsius an incentive to manipulate markets. Clear conflict of interest.

Regulatory Avoidance: Not registered as a bank. Not registered securities. Operating in a regulatory gray area.

Protection Rules

How to avoid the next Celsius:

1. If Yields Seem Impossible, They Are- 17% returns require taking 17% risks. Probably more. Sustainable yields match risk-free rates (3-5%).

2. Verify Reserves- Demand proof of reserves. Audited, third-party verified. If the company won’t show, don’t deposit.

3. Banks Have Regulations for Reasons- FDIC insurance. Reserve requirements. Regular audits. Capital ratios. These exist because unregulated banking fails.

4. Self-Custody Is Safety- “Not your keys, not your coins” proved true. Holding crypto in your own wallet is the only true ownership.

5. Diversify Platforms- Never keep all funds in one place. Spread risk across multiple providers and custody methods.

6. Question Charisma- Charismatic founders distract from business fundamentals. Focus on math, not personality.

7. Understand What You Own- If you can’t explain how a platform generates yields, don’t use it. Complexity often hides fraud.

Where They Are Now

Alex Mashinsky: Under house arrest, awaiting trial. Reputation destroyed. Facing life in prison. Assets frozen.

Celsius Network: Reorganized. Most customers received 10-70% of their deposits back. The company relaunched as a mining operation.

Victims: 1.7 million people lost an average of $14,000 each. Some lost millions. Many will never financially recover.

Crypto Lending: Mostly dead. Few platforms remain. Those that survive have stricter regulations and lower yields.

Industry Reputation: Permanently damaged. “Yield farming” and “DeFi lending” became associated with scams.

Regulators: Achieved what they wanted—forced crypto under traditional financial regulations.

The Final Truth

Alex Mashinsky promised to “unbank” people. He promised 17% returns. He promised safety better than traditional banks. Moreover, he promised transparency through blockchain. Furthermore, he promised that customers would control their money.

Every promise was a lie.

Celsius was never a bank. Instead, it was a poorly managed hedge fund using customer deposits for risky bets. Moreover, when bets fail, customers bear all losses. Additionally, when the end came, Mashinsky and the executives withdrew their money first.

The marketing was brilliant. The execution was criminal. And 1.7 million people paid the price.

Here’s the darkest truth: Mashinsky actually believed his own lies. Internal communications show genuine delusion. He thought he was revolutionizing finance. Instead, he was running a Ponzi scheme toward inevitable collapse.

He wasn’t a criminal genius. Rather, he was an arrogant fool who gambled with other people’s money. And when the gambling failed, he blamed “market conditions” instead of taking responsibility.

The Celsius bankruptcy destroyed more than money. It destroyed trust. Faith in innovation. Belief that blockchain would democratize finance. Hope that “this time is different.”

It wasn’t different. It was the same old scam with new technology. Promises of high returns. Lack of oversight. Risky bets. Inevitable collapse. And victims left holding nothing.

Some lessons never change. Greed defeats caution. Complexity hides fraud. Charisma distorts judgment. And when someone promises something too good to be true while attacking traditional safeguards, they’re usually running a scam.

Alex Mashinsky said, “unbank yourself.” What he meant: “Trust me with your money so I can gamble it away.”

1.7 million people trusted him. They shouldn’t have.

Don’t make the same mistake with the next charismatic founder promising impossible returns.

Because there’s always a next one.

And they’re always “different this time.”

Until they’re not.

Resources

[1]Celsius Network Limited and Alexander “Alex” Mashinsky (Release No. LR-25779; Jul. 14, 2023)

Related reading(suggested)

Luna Collapse: How Terra Destroyed $60 Billion in 3 Days

FTX Bankruptcy: Sam Bankman-Fried’s $8 Billion Fraud Breakdown

Nikola Motors Fraud: The $34 Billion Fake Hydrogen Truck Company