Robert Chen worked for 37 years without missing a single day.

He drove the same Honda for 18 years. He packed lunch every morning. His wife clipped coupons religiously. They saved 15% of every paycheck, watching their retirement account grow slowly, steadily.

By age 64, they had $847,300 saved. One more year until retirement. Finally, the golden years they’d sacrificed everything to reach.

Then Marcus called.

The voice sounded friendly, knowledgeable even. He represented an “exclusive retirement protection program” for people over 60. Moreover, he knew Robert’s exact age. His approximate account balance. Details only a legitimate financial professional would know.

Marcus explained how retirement fraud schemes were destroying people’s savings. Market crashes loomed. Inflation would devour fixed incomes. However, his company offered protection. Guaranteed returns of 12% annually. Full insurance against all losses.

Robert transferred $290,000 as a “starter position.” Then another $315,000 three weeks later. Within two months, he moved his entire life savings into Marcus’s “protected accounts”.

Marcus vanished completely. The company never existed.

Robert turns 67 next month. He still works full-time at the hardware store. Retirement died with that phone call.

The Hunters Who Wear Suits

Retirement fraud schemes operate with terrifying sophistication. These aren’t street criminals. They’re financial predators in expensive clothes.

The FBI reports Americans over 60 lost $3.4 billion to investment and retirement fraud in 2023. However, experts believe actual losses exceed $6 billion. Shame keeps victims silent. Fear prevents them from reporting.

These predators hunt systematically. They don’t strike randomly.

First, they obtain data from breaches, leaks, and purchases. Your name, age, and approximate savings become weapons. Then they research your background. LinkedIn shows your career. Facebook reveals your interests. Public records expose your vulnerabilities.

They know exactly who you are before the first call.

Next comes the approach. Phone calls sound professional. Emails look legitimate. Websites mimic real investment firms perfectly. Some scammers even rent office space and hire receptionists.

Every detail reinforces the lie.

The Poison They Serve

Retirement fraud schemes come in countless variations. All share one goal: separate you from your savings forever.

Common traps include:

- “Guaranteed” high-yield investments promising 8-15% annual returns

- Promissory notes from companies that exist only on paper

- Real estate investment pools with fabricated properties

- Precious metals dealers are charging triple the actual market price

- Cryptocurrency retirement funds that vanish overnight

- Pension advance schemes that drain monthly checks for years

- Annuity switching scams are generating massive hidden fees

- Living trusts that actually transfer your assets to criminals

The Securities and Exchange Commission warns that seniors face targeted attacks unlike any other demographic. Scammers know retirees can’t recover lost savings. One successful strike destroys an entire lifetime.

That makes seniors the perfect prey.

When Trust Becomes Fatal

Margaret Sullivan, 71, met her “financial advisor” at church. He attended services for six months before approaching her. Everyone trusted him. The pastor even endorsed his services.

David presented himself as a retirement specialist. He had an office downtown. Business cards listed legitimate credentials. His website showcased testimonials from satisfied clients. Everything checked out perfectly.

Margaret’s husband died two years earlier. She inherited his pension and life insurance. Her total retirement savings reached $623,000. David promised to grow it safely while generating monthly income.

She signed the papers at his office. A notary witnessed everything. David provided official-looking account statements every month. Her balance grew steadily, exactly as promised.

For three years, everything seemed perfect. Then Margaret needed $50,000 for emergency surgery. David stopped returning calls. His office stood empty. The phone number went dead.

Investigators eventually discovered the truth. David operated retirement fraud schemes across four states. He stole from 27 victims. Total losses exceeded $8.3 million. Margaret’s entire $623,000 had vanished into his accounts.

The monthly statements were fiction. The growth was a fantasy. Every number was a lie.

Margaret now lives with her daughter. Medicaid covers her medical care. She’ll never be independent again. Moreover, she blames herself daily for trusting someone from the church.

The predator served seven years in prison. He’ll be released next month with good behavior.

The Clockwork of Destruction

Retirement fraud schemes follow predictable patterns. Understanding these patterns might save your future.

The setup phase builds credibility. Scammers invest weeks or months establishing trust. They attend community events. Join clubs. Volunteer at churches. Some even pay for advertising in senior publications.

They look legitimate because they work hard at deception.

The hook phase exploits fear and greed. Scammers warn about market crashes, inflation disasters, and government failures. Then they offer solutions that sound too good to refuse. Guaranteed returns. Protected principal. Tax advantages.

Every promise targets your deepest financial anxieties.

The extraction phase moves your money quickly. They create urgency through limited-time offers. Pressure you with claims that spots are filling fast. Some even use fake countdown timers showing opportunities expiring.

Once your money transfers, the relationship changes. Communication slows. Excuses multiply. Eventually, they disappear completely.

The National Institute on Aging reports that 90% of retirement fraud victims never recover their losses[5]. Banks can’t reverse wire transfers. Investment accounts that never existed can’t be traced. Criminals operating from other countries remain untouchable.

Your savings vanish like smoke.

The Scars That Never Heal

Robert Chen’s wife developed severe depression. She attempted suicide twice. Their marriage barely survived the financial devastation. His adult children stopped speaking to him for two years.

He lost more than money. Consequently, he lost his identity as a provider. His self-respect crumbled. Every day reminds him of the catastrophic mistake.

Margaret Sullivan’s daughter resents the burden. The relationship fractures more daily. Margaret hears the frustration in every conversation. She knows she’s become an unwanted obligation.

Retirement fraud schemes destroy more than bank accounts. They obliterate dignity, independence, and family bonds. Victims describe feeling worthless, stupid, and broken beyond repair.

Many never tell anyone. The shame cuts too deep. They suffer silently while predators hunt their next victim.

The Federal Trade Commission reports that financial abuse accelerates cognitive decline in seniors. Stress triggers heart problems. Depression becomes clinical. Some victims die within months of discovering the fraud.

The predators kill slowly. But they still kill.

Spotting the Predator’s Marks

Retirement fraud schemes leave tracks. You just need to know where to look.

Warning signs appear consistently:

- Promises of returns exceeding 8% annually with “guaranteed” safety

- Pressure to act immediately before opportunities vanish

- Requests to transfer money from legitimate accounts to new ones

- Resistance to providing verifiable credentials or registrations

- Claims that investments are “exclusive” or “secret”

- Recommendations to keep investments hidden from family

- Demands for payment via wire transfer, cryptocurrency, or cash

- Unregistered advisors claiming special licenses or certifications

- Social connections used to bypass normal skepticism

Check every financial professional’s credentials. The SEC maintains a free database of registered advisors. FINRA offers background checks on brokers. State securities regulators track complaints and enforcement actions.

Real professionals welcome scrutiny. Fake ones evaporate under investigation.

Protecting Your Future Now

You can defend yourself against retirement fraud schemes. Nevertheless, you must act with absolute vigilance.

Never make investment decisions under pressure. Real opportunities don’t expire in hours. Scammers create false urgency to prevent verification. Take time. Do research. Consult family members or trusted advisors.

Verify everything independently. Search online for the company name plus “scam” or “fraud.” Check the SEC, FINRA, and state regulator databases. Call the phone number listed on official websites, not numbers provided by the advisor.

Be suspicious of guaranteed returns. No legitimate investment offers high returns with zero risk. Anyone making such promises is lying. Period.

Keep family involved in financial decisions. Scammers isolate victims intentionally. They know family members ask hard questions. Transparency protects you.

Report suspected fraud immediately. Contact the SEC, FBI, and your state securities regulator. Your report might save others from the same predator.

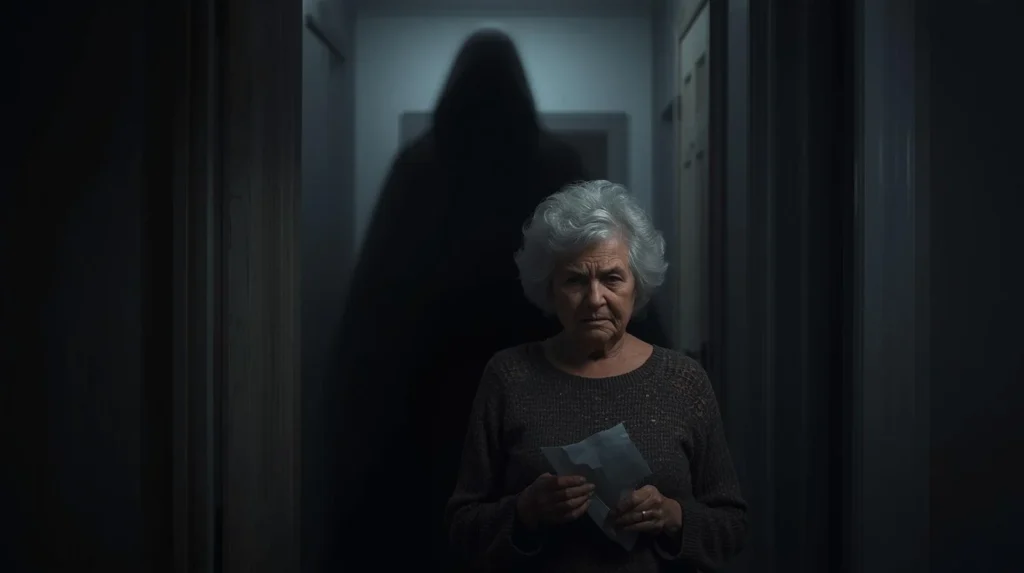

The Shadow That Stalks Forever

Right now, somewhere close to you, a predator is preparing. They’re buying data. Researching targets. Crafting their next identity.

They’re looking for their next Robert. Their next Margaret.

Retirement fraud schemes operate constantly. The predators never rest. They work around the clock hunting vulnerable seniors. Every day brings fresh victims. Every week destroys more families.

They’ve studied you. They know your generation trusts professionals. Respects authority. Avoids confrontation. Those qualities made you successful. Now they make you prey.

Robert Chen thought he was protecting his future. Instead, he handed it to a monster. Margaret Sullivan believed she found a trustworthy advisor. She found a thief instead.

These stories repeat daily. Hourly even. The predators feast endlessly on broken dreams.

You spent decades building your retirement. Every sacrifice. Every skipped vacation. Every denied pleasure. All those choices led to this moment.

One phone call can erase it all.

The monsters are calling. They’re emailing. They’re sitting in church pews beside you, smiling warmly while planning your destruction.

But now you know their patterns. You’ve learned their tricks. You understand how they hunt.

Don’t let them add your name to the victim list. And don’t let them destroy someone you love.

Because the retirement they promise doesn’t exist. It never did.

What exists is a predator. And your life savings. And the terrible moment when you discover which one survives.

Resources

[2] Federal Bureau of Investigation. “2023 Elder Fraud Report.” March 2024.

[3] Securities and Exchange Commission. “A Guide for Seniors.

[4] Financial Industry Regulatory Authority. “Affinity Fraud: How to Avoid Investment Scams.” January 2024.

[5] CFPB: Protecting older adults from fraud and financial exploitation

Related reading(suggested)

[1]The Lottery Curse: Winners Who Lost Everything

[2]Grandparent Scams: ‘Grandma, I Need Bail Money’ Frauds

[3]The Government Voice That Wants to Destroy You: Inside Social Security Scam Scripts