Jessica Ramirez’s transmission died on a Tuesday morning.

She had $247 in her checking account. Payday wasn’t for another 11 days. The repair shop quoted $680. Without her car, she’d lose her job at the hospital cafeteria.

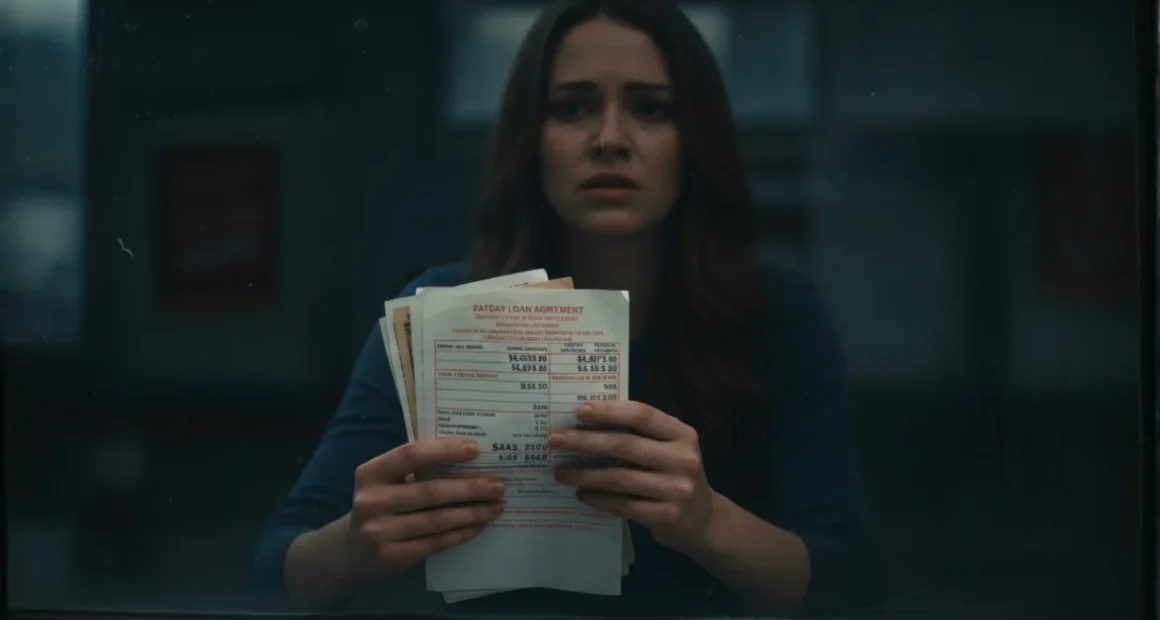

The payday loan store sat three blocks from the mechanic. Bright signs promised “Fast Cash” and “No Credit Check.” Jessica walked through those doors at 10:33 AM.

She walked into payday loan traps that would consume the next two years of her life.

The application took seven minutes. The woman behind the bulletproof glass smiled warmly. Jessica borrowed $500. The fee was just $75 for two weeks. Simple math: $575 total when her paycheck arrived.

Except that payday came with rent, electricity, groceries, and her daughter’s medication. Jessica couldn’t afford the $575. Therefore, she paid the $75 fee and “rolled over” the loan for another two weeks.

Then another. And another.

Eighteen months later, Jessica had paid $4,873 in fees. She still owed the original $500.

The Beast That Feeds on Desperation

Payday loan traps operate with terrifying efficiency. These aren’t accidents. They’re designed to catch you and never let go.

The Consumer Financial Protection Bureau reports that 12 million Americans take payday loans annually. Moreover, 80% of payday loans get rolled over or renewed within 14 days. The average borrower stays trapped for five months. Some never escape.

The math reveals the horror. A typical two-week payday loan charges $15 per $100 borrowed. That sounds reasonable until you calculate the annual percentage rate: 391%.

Credit cards charge 20-30% APR. Car loans run 5-10%. Mortgages hover around 7%. Payday loans charge 400%.

But desperate people don’t calculate APR. They see the immediate solution to an immediate crisis. The predators understand this perfectly.

How the Jaws Snap Shut

Payday loan traps follow a brutal pattern. First, they target vulnerable communities. Payday lenders cluster in low-income neighborhoods like vultures circling dying prey.

The Federal Deposit Insurance Corporation found that payday loan stores outnumber McDonald’s and Starbucks combined in certain zip codes. They position themselves near check-cashing stores, discount retailers, and bus stops. Anywhere people struggle financially.

The application process is deliberately simple:

- Proof of income (pay stub or bank statement)

- Valid ID

- Checking account

- Post-dated check or ACH authorization

No credit check required. No employment verification. No assessment of your ability to repay. Indeed, they prefer borrowers who can’t repay. Those customers generate the most profit.

Next comes the trap mechanism. You borrow $500. Two weeks later, you owe $575. However, if you can’t pay the full amount, they offer a solution: pay just the $75 fee and extend the loan.

This sounds helpful. It’s actually poison.

Each rollover generates another $75 fee. The principal never decreases. You’re paying rent on your own money. Moreover, the fees compound faster than you can earn income to cover them.

The Center for Responsible Lending reports that 76% of payday loan volume comes from borrowers trapped in more than 10 loans per year. These aren’t customers. They’re captives.

When One Trap Leads to Another

Marcus Thompson, 42, took his first payday loan to cover a $400 medical bill. His credit cards were maxed. His family couldn’t help. The loan felt like a lifeline.

Two weeks later, he couldn’t repay it. Therefore, he took out a second payday loan from a different lender to pay off the first. Then a third loan to cover the second. Within four months, Marcus owed six different payday lenders simultaneously.

The fees crushed him. His paycheck of $2,100 every two weeks got divided immediately: $780 to payday loans, $850 to rent, $220 to car payment. That left $250 for food, gas, utilities, and everything else.

Marcus stopped eating lunch. He skipped his blood pressure medication. His electricity got shut off twice. Eventually, his landlord evicted him.

The payday lenders got paid first. Always.

Marcus declared bankruptcy at 43. His credit score dropped to 487. He lost his apartment and moved into his sister’s garage. The $400 medical bill that started everything? He paid over $6,200 in payday loan fees trying to cover it.

The lenders lost nothing. Bankruptcy doesn’t erase payday loans easily. Moreover, they have already collected 15 times their original investment from their fees.

The Predator’s Playbook

Payday loan traps use sophisticated psychological techniques. First, they normalize the debt cycle. Employees call rollover customers “returning friends.” They remember your name. Ask about your family.

This builds false intimacy. You’re not being exploited. You’re being helped by people who care. The friendly service masks the financial violence happening in your life.

Second, they create dependency. Once you’re trapped, escaping requires coming up with the full principal plus fees. However, if you could access that much money, you wouldn’t need payday loans. The trap becomes self-reinforcing.

Third, they exploit shame. Customers hide payday loan debt from family and friends. Consequently, they can’t ask loved ones for help. Isolation keeps victims trapped longer.

The Consumer Financial Protection Bureau found that payday borrowers average eight loans per year, spending roughly $520 in fees to repeatedly borrow $375. They pay more in fees than they ever received in actual loan money.

The Legal Monsters Among Us

Here’s the truly terrifying part. Payday loan traps are perfectly legal in 37 states.

Regulators know the devastation these loans cause. Studies prove the damage. Victims testify about destroyed lives. Nevertheless, the industry continues operating because it generates massive profits.

Payday lenders earned $9 billion in fees in 2023. That money came directly from people who could least afford to lose it. Working families. Single parents. Elderly citizens on fixed incomes.

The industry lobbies aggressively to prevent regulation. They fund political campaigns. They challenge every attempt at reform. Moreover, when states ban traditional payday loans, lenders simply rebrand as “installment loans” or “title loans” with similar predatory terms.

Some lenders moved online to evade state regulations. They operate from Native American reservations or foreign countries. These online payday loan traps charge even higher rates, sometimes exceeding 700% APR.

Your state might ban payday loans. The internet delivers them anyway.

The Scars That Never Fade

Jessica Ramirez finally escaped her payday loan after her brother gave her $1,200 as a gift. She paid off the principal and closed her account.

But the damage lingers. Her credit score sits at 512. Banks won’t approve her for normal loans. She can’t refinance her car at a reasonable rate. Consequently, she still pays 24% interest on her auto loan because payday lenders destroyed her creditworthiness.

Moreover, she lives in constant fear of unexpected expenses. Every strange noise from her car triggers panic attacks. She keeps $2,000 in cash hidden in her apartment, terrified of ever needing emergency money again.

The payday loan stole more than $4,873. It stole her sense of security. Her financial stability. Her peace of mind.

Marcus Thompson’s bankruptcy will haunt him for seven years. He can’t rent an apartment without a co-signer. Potential employers run credit checks and reject him. His medical conditions worsened from stress and skipped medications.

The $400 medical bill cost him his home, his health, and his dignity.

Escaping the Monster’s Grip

If you’re trapped in payday loan traps, escape routes exist. Nevertheless, they require courage and action.

Contact nonprofit credit counseling services. They negotiate with payday lenders and create repayment plans. Many offer these services free or for minimal fees.

Check if your employer offers paycheck advances. Some companies provide emergency loans at 0% interest. This breaks the payday loan cycle immediately.

Ask family or friends for help. Swallow your pride. The shame keeps you trapped longer. A $500 loan from someone who cares carries no fees and infinite patience.

Explore community assistance programs. Churches, charities, and social services offer emergency funds. These resources exist specifically for people in your situation.

Consider credit union payday alternative loans. Federal credit unions offer small loans with 28% APR caps. Still high, but not predatory.

File complaints with the Consumer Financial Protection Bureau if lenders violate regulations. Document everything. Report illegal practices to your state attorney general.

The Monster That Hunts Forever

Right now, someone is walking into their first payday loan store. The transmission just died. The medical bill arrived. The rent is due.

They’re desperate. Scared. Out of options.

The friendly employee behind the glass is smiling. The paperwork is simple. The money arrives in minutes. Everything seems fine.

But payday loan traps are already closing around them. The fees will start compounding. The rollover cycle will begin. The financial destruction will follow inevitably.

Jessica needed $500 for car repairs. She paid $4,873 and spent 18 months trapped. Marcus needed $400 for medical bills. He lost his home and declared bankruptcy.

These aren’t extreme cases. They’re normal. Typical even. Millions of Americans right now are trapped in the same cycle. Paying hundreds in fees to borrow pennies. Drowning slowly in legal, regulated, government-approved financial quicksand.

The predators are legal. The traps are everywhere. The system protects them, not you.

Next time you see those bright signs promising fast cash, remember Jessica counting out her 24th fee payment. Think about Marcus sleeping in his sister’s garage.

Payday loan traps don’t just take your money. They devour your future, one two-week cycle at a time.

The monster is waiting. It’s patient. It’s hungry. And it’s perfectly legal.

Don’t feed it.

Resources

[1] Consumer Financial Protection Bureau. “Payday Loans and Deposit Advance Products.” April 2024.

[2] Pew Charitable Trusts. “Payday Lending in America: Who Borrows, Where They Borrow, and Why.”

[3] Consumer Financial Protection Bureau. “CFPB Data Point: Payday Lending.”

Related reading(suggested)

[1]Bank Impersonation Scams: Fake Chase/Bank of America Calls

[2]Debt Consolidation Fraud: Companies That Made Debt Worse

[3]Business Loan Scams: Fake Lenders Who Steal Application Fees

[4]Student Loan Forgiveness Scams: Government Imposters Exposed

[5]Credit Repair Scams: Why ‘Fix Your Credit in 30 Days’ Is Always Fake