The Day Wall Street’s Trust Died

December 11, 2008. Thursday morning. Bernie Madoff called his sons into his Manhattan apartment. His voice was shaking. His hands trembled. Additionally, he looked exhausted.

“I have something to tell you,” he said. “The investment advisory business is a fraud. It’s basically a giant Ponzi scheme. There’s nothing left.”

His sons, Mark and Andrew, both worked at his firm. They stared in disbelief. Their father—chairman of NASDAQ, pillar of Wall Street, trusted advisor to billionaires—was confessing to the biggest financial fraud in history.

“How big?” they asked.

“About $50 billion,” Bernie replied. Actually, it was $65 billion.

The next day, FBI agents arrested Bernard Madoff at his apartment. Moreover, he didn’t resist. Additionally, he confessed immediately. Furthermore, he seemed almost relieved.

The arrest sent shockwaves globally. Banks collapsed, charities closed, and retirees lost everything. Furthermore, celebrities discovered they were penniless. And an entire industry questioned how they’d missed the biggest Ponzi scheme ever.

This is the Bernie Madoff Ponzi—a 30-year fraud that fooled everyone from Nobel laureates to movie stars. Consequently, it destroyed thousands of lives. Meanwhile, it exposed how easily trust destroys wealth. And it proved that on Wall Street, even legends can be liars.

Let’s investigate how Bernie Madoff stole $65 billion while everyone thought he was a genius.

The Builder of Trust (1960-1990)

The Early Years

Bernard Lawrence Madoff was born in 1938 in Queens, New York. His parents were working-class, and he attended Hofstra University. Additionally, he worked as a lifeguard and sprinkler installer to pay tuition.

In 1960, at age 22, Bernie started his own investment firm with $5,000. Initially, he traded penny stocks. Moreover, he worked from a small office. His father-in-law helped find clients. The business was modest but legitimate.

Building the Technology Edge

Bernie saw technology’s potential early. In the 1970s, he pioneered electronic trading. Moreover, he helped create the NASDAQ stock market. He pushed for automated systems. Furthermore, he championed market reforms.

His firm, Bernard L. Madoff Investment Securities LLC, became successful legitimately:

- Market making for major stocks

- Trading technology innovations

- NASDAQ leadership roles

- Respected industry voice

By the 1980s, Bernie was wealthy and respected. Moreover, he was NASDAQ chairman. Additionally, he sat on SEC advisory committees. Furthermore, major firms used his services. He’d built genuine credibility over 30 years.

This credibility would become the weapon for his fraud.

The Split Business Model

Bernie’s firm had two sides:

Legitimate Side (19th Floor):

- Market-making operations

- Proprietary trading

- NASDAQ market operations

- Where his sons worked

Fraudulent Side (17th Floor):

- Investment advisory business

- “Secret” wealth management

- Where the Ponzi operated

- Completely separated from legitimate business

His sons genuinely didn’t know about the fraud. Moreover, most employees had no idea. Additionally, the separation was complete. This compartmentalization let the fraud to grow hidden for decades.

The Exclusive Image

Bernie cultivated mystique around his investment advisory business:

The Strategy:

- Invitation-only client acceptance

- Rejected most applicants

- Required referrals from existing clients

- Created scarcity and exclusivity

Additionally, he claimed to use a “split-strike conversion” strategy—a complex options trading technique. Moreover, he said this generated consistent 10-12% returns. Furthermore, he never fully explained how it worked. The complexity and exclusivity made people want more.

The Steady Returns

What attracted investors? The consistency:

Bernie’s Returns:

- 10-12% annually

- Every single year

- Even in market crashes

- Never a down year

- Completely steady

In comparison:

- S&P 500 was volatile

- Other funds had bad years

- Market timing was impossible

- Nobody else achieved this consistency

But Bernie did. Year after year. Decade after decade. The returns weren’t spectacular—just impossibly consistent. And that should have been the biggest red flag.

How the Fraud Worked

The Simple Ponzi Mechanics

Bernie’s scheme was classic Ponzi:

The Process:

- Client invests $1 million

- Bernie promises 10% annual return

- Bernie doesn’t actually invest the money

- Instead, he deposits it in a bank account

- When the client wants “profits,” Bernie sends $100,000 from the bank account

- Money comes from new investors, not profits

- Monthly statements show fake trades and fake gains

That’s it. No complex financial instruments. Moreover, no sophisticated fraud techniques. Additionally, no innovative scam mechanics. Just lies, fake statements, and new money paying old investors.

The sophistication was in the execution and longevity, not the method.

The Fake Statements

Bernie sent clients monthly statements showing:

- Trades that never happened

- Profits that didn’t exist

- Account values that were fiction

- Realistic-looking transaction details

Moreover, the statements were perfect. They included:

- Stock symbols and prices

- Trade dates and amounts

- Options positions

- Cash balances

- Historical performance

Everything looked legitimate. The numbers matched market conditions generally. Furthermore, the complexity seemed authentic. But it was all fabricated in Microsoft Excel.

The Feeder Funds

Bernie didn’t market directly to most investors. Instead, he used “feeder funds”—intermediaries that collected money and invested it with Bernie. These funds included:

Major Feeder Funds:

- Fairfield Greenwich Group: $7.5 billion

- Tremont Group Holdings: $3.3 billion

- Banco Santander: $2.87 billion

- Bank Medici: $2.1 billion

- Kingate Management: $2.8 billion

These funds were collected fees for directing money to Bernie. Moreover, they conducted minimal due diligence. Additionally, they trusted Bernie’s reputation. Furthermore, they didn’t verify the trades.

The feeder fund structure amplified the fraud. Instead of thousands of individual investors, Bernie had dozens of institutional channels bringing billions.

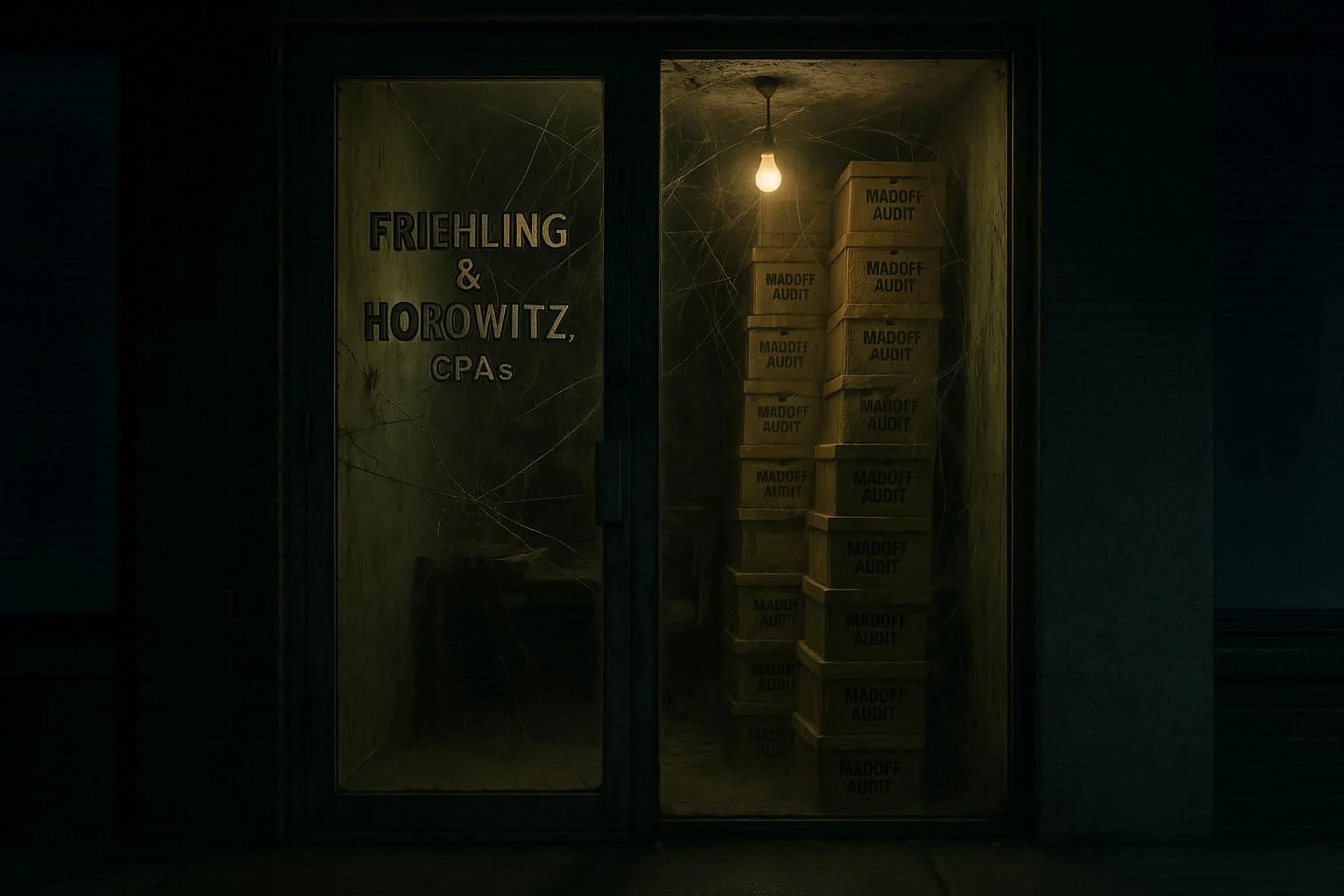

The Auditor Scam

Bernie’s firm used a tiny accounting firm: Friehling & Horowitz. This “firm” was basically one person—David Friehling—operating from a small office in suburban New York.

How could a one-person firm audit a multi-billion-dollar operation? They couldn’t. And they didn’t. Instead, Friehling rubber-stamped everything without verification. Moreover, he was paid well to do nothing. Additionally, he claimed the audits were thorough.

Any sophisticated investor should have questioned this. A major investment firm using a no-name auditor? That’s an instant red flag. Yet nobody investigated.

The SEC Failures

The Securities and Exchange Commission received multiple warnings about Bernie:

Harry Markopolos (2000-2008): Financial analyst who repeatedly told SEC Bernie was running a Ponzi. He provided:

- Mathematical proofs Bernie’s returns were impossible

- Evidence trades weren’t actually happening

- Analysis showing the fraud mechanics

- Detailed reports explaining the scheme

SEC investigated Bernie FIVE times. They found nothing suspicious. They closed all investigations. Furthermore, they never verified if trades actually occurred.

Why did the SEC fail? Multiple reasons:

- Bernie’s reputation and connections

- SEC examiners intimidated by his status

- Insufficient technical understanding

- Regulatory capture

- Bureaucratic incompetence

The failure was catastrophic. Moreover, it enabled 8 more years of fraud after the first warning.

The Victims: A Complete Analysis

The Scale of Destruction

When Bernie’s Ponzi collapsed, the numbers were staggering:

Total Claims Filed: $64.8 billion

Actual Money Invested: $17.5 billion (the rest was fake gains)

Money Recovered: $14.5 billion (as of 2024)

Net Loss: $3 billion in principal

Number of Victims: ~37,000 accounts

However, these numbers don’t capture the full devastation. Because “victims” included individuals, charities, pension funds, universities, and banks.

Individual Investors

The Retirees: Thousands of elderly people lost life savings. They’d trusted Bernie for decades. They thought their money was safe. Additionally, they relied on “returns” for living expenses.

Norman Braman, 78: Lost $100 million. Former NFL team owner. “I trusted Bernie personally. We golfed together. He seemed like the safest choice. I was wrong.”

The Wilpons (Mets Owners): Lost $500 million. Nearly forced to sell the baseball team. Family fortune was devastated. Had to sell ownership shares to cover losses.

Charities and Nonprofits

The charitable sector was devastated:

Elie Wiesel Foundation: $15.2 million—entire endowment gone. Holocaust survivor and Nobel laureate Elie Wiesel lost his foundation. “We gave Bernie our trust and money. He stole both.”

Hadassah Women’s Organization: $90 million lost. Jewish charity serving hospitals and schools. Had to cut programs. Moreover, they faced lawsuits for not detecting fraud earlier.

JEHT Foundation: $29 million—entire assets gone. Focused on justice reform. Had to close completely. Programs helping formerly incarcerated people ended.

Victims:

- 162 charities lost money

- Total charitable losses: $2.1 billion

- Many closed permanently

- Thousands of beneficiaries lost services

Celebrity Victims

Bernie attracted famous clients:

Steven Spielberg: Lost millions through the Wunderkinder Foundation. Charity work disrupted. Additionally, personal investments were affected.

Kevin Bacon & Kyra Sedgwick: Lost most of their wealth. Had to work more to rebuild. “We trusted the wrong person.”

John Malkovich: Lost millions. Delayed retirement plans. Nearly lost his theater company.

Larry King: Lost $700,000. At 75, had to continue working longer than planned.

Zsa Zsa Gabor: Lost $10 million. Elderly actress financially destroyed.

Sandy Koufax: Lost $5 million. Baseball Hall of Famer’s retirement was damaged.

The celebrity victims highlighted how universal the trust in Bernie was. If sophisticated Hollywood figures were fooled, anyone could be.

Institutional Investors

Major banks and funds were destroyed:

Fairfield Greenwich Group: Lost $7.5 billion in client money. Faced massive lawsuits. The firm essentially collapsed. Founders’ reputations destroyed.

Banco Santander: Lost $2.87 billion. A major Spanish bank had to write off huge amounts. Additionally, face regulatory penalties.

HSBC: Lost $1 billion. Multiple European operations were affected.

BNP Paribas: Lost $434 million. French bank customers are devastated.

Nomura Holdings: Lost $303 million. Japanese bank’s U.S. operations damaged.

Pension Funds

Retirement systems were gutted:

Teamsters Local 445: Lost $850,000—8% of fund assets. Union members’ pensions have been reduced. Additionally, benefits are cut.

Multiple Union Pensions: Dozens of pension funds had Bernie exposure. Consequently, retirees received reduced benefits. Moreover, some faced total loss of pensions.

Universities

Educational endowments suffered:

Yeshiva University: Lost $110 million. Nearly 8% of the endowment. Consequently, scholarship funding was cut. Moreover, programs were eliminated.

Bard College: Lost $3 million endowment. Small school devastated by loss.

Multiple Schools: Universities, prep schools, and colleges lost combined $1+ billion.

The Collapse (December 2008)

The Financial Crisis Trigger

The 2008 financial crisis caused Bernie’s downfall. Here’s why:

The Problem:

- Market crashed

- Investors needed cash

- Redemption requests flooded in

- Bernie had to return $7 billion in weeks

- But the money wasn’t there

In a normal market, new deposits covered withdrawals. However, during the crisis:

- New investments stopped

- Everyone wanted money out

- No new money coming in

- Ponzi mathematics collapsed instantly

Bernie tried to raise emergency funds. He called wealthy investors. He sought loans. Additionally, he stalled withdrawals. But it was hopeless. The end had come.

The Confession

December 10, 2008. Bernie knew it was over. Therefore, he called his sons Mark and Andrew. Additionally, he invited them to his apartment. Furthermore, he confessed to everything.

The sons were devastated. Moreover, they immediately consulted lawyers. Additionally, they contacted FBI. They had no choice. Furthermore, family loyalty couldn’t cover this crime.

December 11, 2008. FBI agents arrived at Bernie’s apartment. He didn’t deny anything. Instead, he said: “There is no innocent explanation.”

The arrest made global headlines. Moreover, markets panicked. Additionally, investors worldwide checked Bernie’s exposure. The financial crisis had found its perfect villain.

The Guilty Plea

Bernie didn’t fight the charges. On March 12, 2009, he pleaded guilty to 11 felonies:

- Securities fraud

- Investment adviser fraud

- Mail fraud

- Wire fraud

- Money laundering

- False statements

- Perjury

- False filings with SEC

- Theft from an employee benefit plan

He admitted everything and took full responsibility. He claimed nobody else knew. However, prosecutors didn’t believe him.

The Sentencing

June 29, 2009. Bernie appeared for sentencing. Victims packed the courtroom. Moreover, many gave impact statements. They demanded maximum punishment.

Judge Denny Chin sentenced Bernie to 150 years in prison, effectively life. The judge said: “The breach of trust was massive. The scale of fraud was unprecedented.”

Bernie was 71 years old. He would die in prison. Moreover, he knew it. Additionally, he showed no emotion during sentencing.

The Family Tragedy

The Sons’ Fate

Mark and Andrew Madoff genuinely didn’t know about the fraud. They worked on the legitimate side of the business. Moreover, they immediately reported their father. They cooperated with investigators.

But the world didn’t believe them. They faced lawsuits. Their reputations were destroyed. Furthermore, the shame was unbearable.

Mark Madoff (1964-2010): On December 11, 2010—exactly two years after his father’s arrest—Mark hanged himself in his Manhattan apartment. He was 46 years old. Moreover, he left behind a wife and children. Additionally, his suicide note expressed despair over the scandal.

His death devastated the family further. Moreover, it highlighted the fraud’s psychological toll. Additionally, it showed how victims included the fraudster’s family.

Andrew Madoff (1966-2014): Battled cancer for years. The stress from the scandal likely worsened his condition. Moreover, he died at age 48. Additionally, he’d never recovered from his father’s betrayal and brother’s suicide.

Before dying, Andrew said, “I’ll never forgive my father for what he did.”

Ruth Madoff

Bernie’s wife, Ruth, claimed ignorance of the fraud. She said Bernie kept her completely separate from business. Moreover, she insisted she had no knowledge of the Ponzi.

Investigators were skeptical. However, they never charged her criminally. Instead, she agreed to forfeit $80 million in assets, while keeping $2.5 million for living expenses.

Ruth’s life was destroyed:

With her husband in prison, she lost her home, her wealth, and both sons (one to suicide, one to cancer), faced social exile, and was left living in near-poverty in Connecticut.

She became one of the most hated women in America. Moreover, friends abandoned her. She faced public scorn everywhere. The wife of the most famous fraudster bore her own punishment.

The Enablers Convicted

While Bernie claimed to work alone, prosecutors disagreed. They convicted several employees:

Frank DiPascali (Chief Financial Officer): Pleaded guilty to helping fabricate statements. Admitted to knowing about fraud for 20+ years. Died before sentencing from lung cancer.

Five Operations Employees:

- Annette Bongiorno (40 years)

- Joann Crupi (6 years)

- Daniel Bonventre (10 years)

- Jerome O’Hara (30 months)

- George Perez (30 months)

All were convicted of helping fabricate records and process fake trades.

Peter Madoff (Bernie’s Brother): Pleaded guilty to conspiracy and falsifying records. Sentenced to 10 years. Claimed he didn’t know about the Ponzi but admitted he should have known.

The Recovery Effort

Irving Picard: The Trustee

The court appointed Irving Picard as trustee to recover assets for the victims. His mission: Find money anywhere it went and return it to the victims.

Picard filed thousands of lawsuits:

The clawback controversy centered on aggressive lawsuits targeting investors who withdrew more than they deposited, feeder funds for failing to detect the fraud, banks for enabling Bernie, and even family members who benefited—essentially, anyone who had touched Madoff’s money.

Picard’s most controversial action: Suing “net winners”—investors who withdrew more than they invested. Even if they thought profits were legitimate, they had to return “fake profits.”

Example:

- Investor deposits $1 million

- Over 20 years, withdrew $3 million

- Madoff collapses

- The investor thinks they made $2 million profit

- Picard sues for $2 million back

- Why? That $2 million was the other victims’ money

Thousands of innocent investors faced clawback lawsuits. Moreover, many had spent the money. Additionally, they thought profits were real. The lawsuits created secondary victims.

Recovery Results (As of 2024)

The recovery has been remarkably successful:

Total Recovered: $14.5 billion

Total Claims (Principal Only): $17.5 billion

Recovery Rate: 83% of principal investment

This is unprecedented for a Ponzi scheme. Moreover, it came from:

- $10 billion from clawback lawsuits

- $2.6 billion from Bernie’s assets

- $1.9 billion from settlement with Picard estate

However, victims only get back principal—not the fake gains they thought they had. Moreover, distribution takes years. Additionally, many victims died before receiving anything.

Bernie Madoff in Prison

Life Behind Bars

Bernie served his sentence at FCI Butner Medium, a federal prison in North Carolina. The facility housed white-collar criminals and sex offenders.

His life:

- Inmate #61727-054

- Shared cell with drug dealers

- Prison job in commissary (paid $40/month)

- Basic prison meals

- Limited visits from family

From penthouses to prison cells. Moreover, from billionaire to inmate. Additionally, from Wall Street chairman to prisoner #61727.

No Remorse

In prison interviews, Bernie showed limited remorse. He focused on:

- Defending his sons’ innocence

- Claiming he acted alone

- Blaming SEC for not catching him sooner

- Minimizing victim impact

He told one interviewer, “I carried out the biggest Ponzi scheme ever. I am responsible for a great deal of suffering and pain. But I made a lot of people wealthy first.”

This showed his narcissism remained intact. Moreover, he still didn’t grasp the full devastation. Additionally, he seemed more concerned about his legacy than his victims.

The Death (April 14, 2021)

Bernie died in prison at age 82 from kidney disease. He’d served 12 years of his 150-year sentence. Moreover, he’d developed end-stage renal disease. Additionally, his health had declined rapidly.

Ruth didn’t attend a funeral service. Moreover, the burial was private. Additionally, few mourned his passing. For most victims, his death brought no closure. The money was still gone. Moreover, the pain remained.

The Legacy

Regulatory Changes

Bernie’s fraud prompted sweeping reforms:

Dodd-Frank Act (2010):

- Enhanced SEC powers

- Whistleblower protections

- Mandatory disclosure requirements

- Stronger auditing standards

SEC Reforms:

- Custody rule changes

- Surprise audits required

- Enhanced examinations

- Better examiner training

Industry Standards:

- Independent custodians required

- Third-party verification mandatory

- Due diligence standards enhanced

- “Too good to be true” flags standardized

The Trust Deficit

Bernie destroyed fundamental trust:

Impact on Industry:

- Investors more suspicious

- “Show me” culture developed

- Transparency demands increased

- Verification became mandatory

Personal Impact:

- Friends turned suspicious

- Family investments questioned

- Charity donations scrutinized

- All promises doubted

Bernie proved that anyone—even the most trusted—could be lying. Moreover, credentials meant nothing. Additionally, reputation was no guarantee. Furthermore, verification was everything.

The Cautionary Tale

Bernie Madoff became the face of financial fraud. His name became synonymous with Ponzi schemes. Moreover, his story is taught in every business school. His fraud is the reference point for all investment scams.

The lessons:

- Trust but verify

- Consistent returns are impossible

- Exclusivity often hides fraud

- Complexity can be obfuscation

- Credentials don’t guarantee honesty

The Final Truth

Bernie Madoff ran a $65 billion Ponzi scheme for 30 years, fooling billionaires, banks, regulators, and charities. This massive Bernie Madoff Ponzi wasn’t complex; it was the simplest scam in finance, and it succeeded because people wanted to believe.

The fraud wasn’t sophisticated. Instead, it was audacious. Moreover, it relied on trust, not complexity. Additionally, it exploited human nature: greed, status-seeking, and the desire to believe we’ve found the secret.

Bernie’s victims weren’t stupid. They included:

- Nobel Prize winners

- CEOs of Fortune 500 companies

- Sophisticated investment banks

- Ivy League university endowments

If they couldn’t detect the fraud, anyone could be fooled.

But here’s the darkest truth: Bernie could have stopped anytime. For decades, he could have confessed. Moreover, he could have limited the damage. Additionally, he could have saved people.

He didn’t. Instead, he kept recruiting. He expanded the fraud. Additionally, he brought in charities knowing they’d be destroyed. He chose daily to continue the lie.

And when asked why he did it, Bernie gave the most chilling answer: “I had to keep the Ponzi going.”

Not greed. Not need. Just momentum. The lie had become his life. Moreover, stopping would mean admitting three decades of fraud. Additionally, confession meant destroying his reputation.

So he kept going. Year after year. Victim after victim. Until the math finally caught up.

150 years in prison. Two sons are dead. Wife in exile. Reputation destroyed. Victims ruined.

That’s the cost of the lie Bernie couldn’t stop telling.

His fraud proved that trust is the most valuable currency. Moreover, once lost, it never fully returns. Additionally, betrayal by the trusted creates wounds that never heal.

Bernie Madoff died in prison. But his victims—those still living—serve their own life sentences. Sentences of financial ruin, broken families, and shattered faith in humanity.

That’s his true legacy.

Not $65 billion.

But the trust that can never be repaired.

Resources

[1]United States V. Bernard L. Madoff And Related Cases

[3] U.S. Attorney’s Office SDNY. “United States v. Bernard L. Madoff.” Criminal Case Documents.

Related reading(suggested)

Thodex Scam: How 400,000 Users Lost $2 Billion Overnight

QuadrigaCX Mystery: Did Gerald Cotten Take the Keys to the Grave?

Mt. Gox Hack: The First Great Crypto Exchange Collapse

Bitconnect Ponzi: Complete Timeline of $2.4 Billion Scam

Celsius Network bankruptcy: Why 1.7 Million Users Lost Everything