The dream vs. the disclosure

You see photos of people holding large checks. They say: “You too can be a Diamond.” But the Amway income disclosure hides the real story.

This dream starts with recruiting. You buy inventory. You enroll friends. You hope you climb ranks. But often you fall.

Reading between the lines

In Amway’s 2022 U.S. disclosure, they report average incomes before expenses. The average IBO at Founders Platinum level and below earned just $852.

In 2021, 33% of all U.S. IBOs had no reported sales, no recruits, and earned nothing.

Even top 1% earners? In 2021, they made $87,901 average before expenses, but that number hides massive costs.

In Canada, many IBOs earned under CA$1,000 before expenses, and the top 10% averaged CA$14,447.The FTC reports that in MLMs generally, most people make $1,000 or less per year—before deducting expenses.

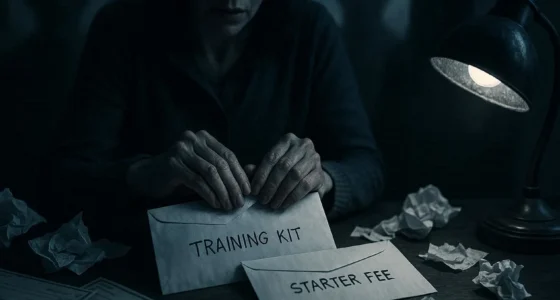

The cost of “success”

You must buy products. You travel. You attend seminars. You pay for marketing materials.

Those expenses slash your “earnings.” Someone who brings in $14,000 might spend $12,000 or more just staying active.

So when you see that $87,901 number, it’s not profit. It’s gross volume.

Victim story — The working mom

Lisa, 35, was a nurse and hopeful entrepreneur. She joined Amway after a friend showed her “Diamond potential.”

She spent $3,500 on starter inventory and training in her first year. Her reported “earnings” looked like $9,000 that year.

After expenses—travel, packaging, lost time—she says she walked away with $450.

Now she works more nursing shifts. She says the dream “cost me sanity.”

Victim story — The college student

Ravi, 22, joined in college to make side income. He invested $800 in a product bundle.

He recruited two people. He sold little to external customers. His “commission” looked like $2,200. But after expenses and time, his net was –$350.

He dropped out of promoting. He still carries guilt.

Why this is horror

Because the math is hidden in plain sight. The bad parts are buried: before expenses, average, top 1%.

Because they sell hope, not reality.

Because you might buy inventory you can’t move.

Because only a tiny fraction succeed—and their success doesn’t fix the damage done below.

The system thrives while most drown.

What to watch — red flags

• They highlight the 1% earnings, not the majority

• They omit or downplay costs, logistics, time

• They focus more on recruitment than product sales

• The “income disclosure” shows gross amounts, not net

• They encourage you to buy more than you can sell

If you see shiny checks used as lure—that’s not transparency.

What the law has done

In 1979, the FTC accused Amway of misrepresenting potential earnings. Amway was ordered to stop. [turn0search6]

FTC’s latest report shows that in 70 evaluated MLMs, most participants earned $1,000 or less, and many got nothing.

The FTC also notes that many income disclosures skip expenses, emphasize few high-earners, and bury the fact that most make little.

So yes—they keep the illusion alive, even with official documents.

Reality check — the real math

Let’s say you see “Diamond” members making $100,000 in commission volume.

Pretend they spent $30,000 on inventory, $10,000 on travel and training, $5,000 on marketing.

Their net? $55,000 — if everything went perfectly.

Now consider you, starting at zero. You face huge costs and low sales. Your odds are not 1 in 10. They’re 1 in 1,000—or lower.

Final warning — don’t let glitter fool you

Those videos, flash checks, and promise of a “life changed” are performance.

The Amway income disclosure is the backstage view—mostly dark, revealing losses.

If you’re drawn by money stories, ask: After all costs, what do people actually keep?

If they dodge that, you’re walking into a trap.

Because in this story, the only sure winner is the system itself.

Resources

[1] Amway. “2022 U.S. Income Disclosure.” 2022.

[2] Amway. “2021 U.S. Income Disclosure.” 2021.

[3] Consumer Financial Protection Bureau / FTC. “FTC staff report analyzes 70 MLM income disclosure statements.” September 4, 2024.

[4] FTC. “What Are Multi-Level Marketing (MLM) Disclosure Statements Really Telling You.” 2024.

[5] FTC. “In the Matter of Amway Corporation.” 1979.

Related reading(suggested)

The Shocking $4 Billion OneCoin Scam: Where is the Vanishing Cryptoqueen