It started at midnight. The crypto-app notification blinked: “Your balance +25%.” A factory worker in Manila rubbed his eyes. He had wagered months of savings into a promising “yield farming” DeFi project. The dashboard looked like real coins, growing charts, and glowing logos. He leaned back, heart racing. A few hours later, the screen froze. The website disappeared. His money was gone. This was no accident. It was a rug pull scams and a brutal lesson in how DeFi projects can turn your hope into a digital nightmare.

Anatomy of a Digital Haunting

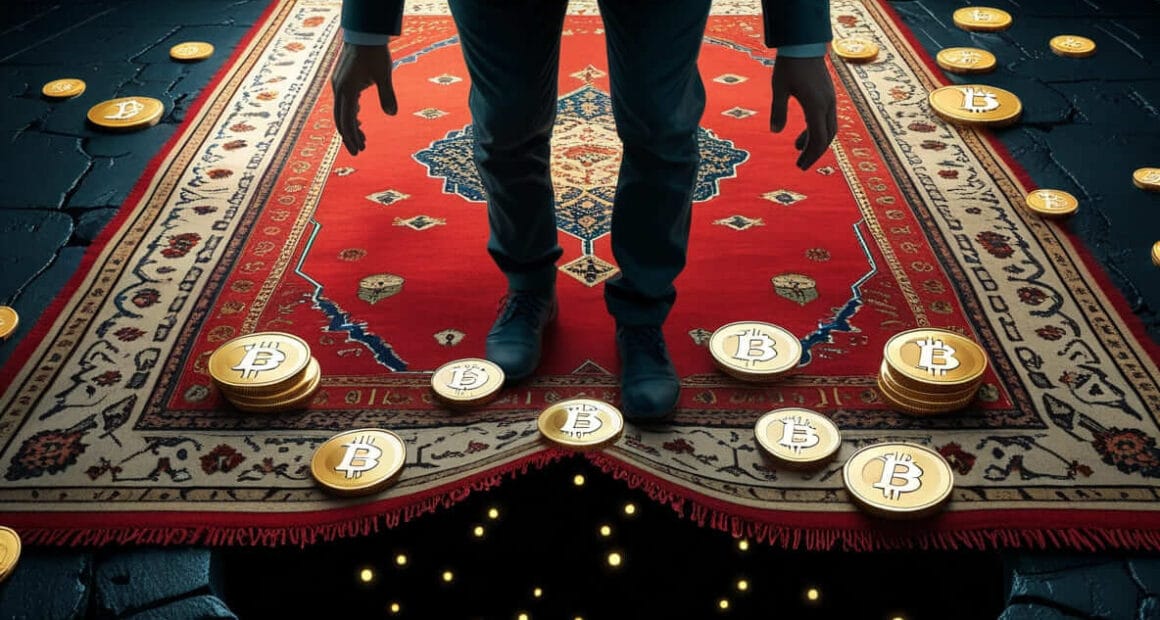

In the world of DeFi projects, rug pulls are the dark art of disguised exit scams. Developers spin up a new token, deploy liquidity, and pump hype via social channels. They advertise “high APY, locked liquidity, decentralized governance.” But behind the scenes, the control lies in a backdoor. At the right moment, the devs drain the liquidity pool (a shared pot of funds that enables users to trade tokens), converting all user funds to other tokens or moving them off-chain. Investors are left holding worthless tokens that can’t be sold.

Here’s where it gets worse: the front-end continues to pretend everything is normal. Prices flicker, balance updates happen, and emails arrive “confirming your stake.” The illusion holds long enough to trap more money. When the exit begins, they trigger “verification issues,” “withdrawal delays,” or sudden contract calls that disable transfers. Then—silence. The site is deleted, the devs vanish, millions vanish. That is the precise rug pull mechanism inside many DeFi projects today.

In 2021 alone, rug pulls accounted for 37% of all crypto-scam revenues, stealing over $2.8 billion from victims [1]. DeFi’s permissionless nature and minimal audit requirements make it a fertile ground for these schemes [2].

The Ghosts in the Machine: A Human Cost

One victim was a pensioner in Spain who believed in a “low risk yield farming” DeFi token. She transferred her lifetime savings—only to see her balance collapse to zero overnight. A Brazilian student watched in horror as his entire scholarship deposit turned worthless. A small business owner in Nigeria poured capital into the project, believing in endorsements; he was left unable to pay his suppliers.

In court testimonies, victims describe the shock in real time: “I watched the chart go flat. The balance read zero. I felt I’d lost my future.” The randomness of targeting makes it worse: the scam picks everyday people. While victims suffer ruin, the villains move in private jets, buy pricey real estate, or dump their stolen crypto through mixers (services that obscure the trail of transactions to make them untraceable). The contrast is brutal: one side, shattered lives; the other, obscene luxury built from betrayal.

Architects of Ruin and the Fallout

Who executes these schemes? Often anonymous devs, sometimes groups spanning continents. They code “rug-pull functions” into smart contracts—allowing them to mint tokens, freeze sales, or sweep liquidity. Some use complex layering: they auto-convert stolen assets across chains—a technique known as “chain-hopping”—to obfuscate the trail [3].

In 2022, U.S. prosecutors charged operators behind the Baller Ape rug pull—a project promising NFT staking returns. They allegedly withdrew investor funds, deleted the website, and laundered the $2.6 million in proceeds across multiple blockchains to hide their tracks [3]. One lead defendant faced up to 40 years in prison.

Some rug pull scams cases merge into larger frauds. For instance, in a global crypto Ponzi scheme, operators collected $100 million and funneled funds through offshore exchanges and laundering networks. The greed was enormous. The suffering is greater.

Justice Delivered, But Damage Done

Some cases reach court. Judges issue sentences. Assets sometimes get seized. But recovery is rare. The emotional damage lasts much longer than money. In the Baller Ape case, the Department of Justice publicly announced charges and asset freezes [3].

Still, for every guilty verdict, there are dozens of victims with no justice. The blockchain trail can be cut. Cold wallets go dormant. Victims lament: “They stole my trust, not just my money.” Prosecutors often acknowledge that the legal system moves too slowly to save most.

Educational Horror — How to Avoid the Next Scam

Here are red flags to watch in DeFi projects (Rug Pull Analysis style):

- Guaranteed returns / too good to be true — “Get 10% daily.”

- No code audit or unverifiable audit

- Liquidity is not locked (or the lock is fake)

- Anonymous or unverifiable developers

- Pressure to invest quickly (“1 hour left”)

- Referral-based rewards / MLM structure

- No real use case or token utility

- Fake endorsements or celebrity claims

- No clear ownership or corporate entity

- Withdrawal or trading is disabled after investment

- Complex contract code with obscure functions

- Lack of proof of reserves or proof-of-stake backing

- Honeypot tokens (you can buy but not sell)

- Contracts that can freeze or blacklist wallets

Whenever possible, stick to established DeFi projects with open-source contracts, verifiable audits, transparency, and reputable teams. Do a “small test deposit” first.

Horror Epilogue — The Aftermath

Even after the collapse, the damage ripples outward. Stolen funds move silently through mixers, shapeshift into other assets, and vanish in the shadows. Some victims never speak. Many never recover. Trust in DeFi weakens. Every new rug pull becomes another scar in the blockchain.

Yet the cycle continues. Every new token launch is a potential trap. But knowledge is power. Because the next DeFi project might be real—and your caution might save you more than your money. Stay alert. Don’t hand over trust to code you don’t understand. In the world of decentralized finance, even the most promising project can become a ghost overnight.

References

[1] Chainalysis. (2022, January 6). The 2022 Crypto Crime Report.

[2] WeSecureApp. (n.d.). Security and Safety of Decentralized Finance (DeFi) Platforms.

Related Posts

Fake Crypto Exchanges: 20 Red Flags of an Empty Vault