The Smartest Guys in the Room

October 16, 2001. 8:30 AM conference call. Wall Street analysts are listening. Enron was reporting third-quarter earnings. CEO Jeffrey Skilling and CFO Andrew Fastow were presenting.

The numbers looked good. Revenue up. Profits strong. Stock at $33.

Then Richard Grubman, an analyst, asked a simple question: “You’re the only financial institution that can’t produce a balance sheet or cash flow statement with your earnings.”

Skilling’s response shocked everyone: “Well, thank you very much. We appreciate that, asshole.”

The call went silent. Moreover, analysts were stunned. Additionally, the press coverage was brutal. Why was Enron’s CEO so defensive about basic financial questions?

Three weeks later, Enron announced a $618 million loss. They revealed $1.2 billion reduction in shareholder equity. The SEC launched an investigation.

Six weeks after that call, Enron filed for bankruptcy. It was the largest corporate bankruptcy in U.S. history at the time. Moreover, $74 billion in market value evaporated. Additionally, 20,000 employees lost their jobs and retirement savings.

This is the Enron accounting fraud. A scheme so complex that Harvard Business School taught it. Consequently, it destroyed thousands of lives. Meanwhile, it exposed how accountants can weaponize complexity. And it proved that the “smartest guys in the room” were actually criminals.

Let’s investigate how Enron hid billions in debt and destroyed American capitalism’s credibility.

The Rise: Building America’s Energy Giant

The Beginning (1985)

Enron was formed in 1985 from the merger of Houston Natural Gas and InterNorth. Kenneth Lay became CEO. Initially, Enron was a simple pipeline company. They transported natural gas. They were profitable but boring.

Then deregulation arrived. The energy market opened up. Suddenly, companies could trade energy like commodities. Moreover, new profit opportunities appeared. Lay saw the future.

The Transformation

Under Lay and later Jeffrey Skilling, Enron transformed:

From: Traditional pipeline company

To: Energy trading powerhouse

The New Model:

- Trade energy contracts

- Create energy derivatives

- Build trading platforms

- Innovate financial products

Skilling brought “mark-to-market” accounting to Enron. This lets them book future profits immediately. It made earnings look spectacular. Additionally, it hid reality behind projections.

The Success Story (1990s)

Throughout the 1990s, Enron dominated:

Achievements:

- Revenue grew from $4 billion to $100 billion

- The stock price soared from $10 to $90

- Market cap hit $70 billion

- Fortune ranked them the 7th largest U.S. company

- Named “Most Innovative Company” 6 years straight

The Culture:

- Aggressive and competitive

- “Rank and yank” employee reviews (fire bottom 15% annually)

- Massive compensation for top performers

- Risk-taking rewarded

- Question nothing

Enron became Wall Street’s darling. Moreover, executives became celebrities. Additionally, the company seemed unstoppable.

The Fraud Mechanics

Mark-to-Market Accounting

This was Enron’s first weapon:

How It Worked:

- Enron signs 20-year energy contract

- They estimate total future profits ($100 million)

- They book the entire $100 million profit immediately

- Even though money won’t arrive for 20 years

- If estimates are wrong, nobody checks for years

The Problem: Enron inflated estimates wildly. They booked profits on deals that never materialized. They counted future earnings as current revenue. This made growth look spectacular when it was fictional.

Example: Enron built a power plant in India. Cost: $3 billion. They estimated 20-year profits of $1 billion. Moreover, they booked that $1 billion immediately. Actually, the plant never worked properly. The profit never came. But shareholders believed the earnings were real.

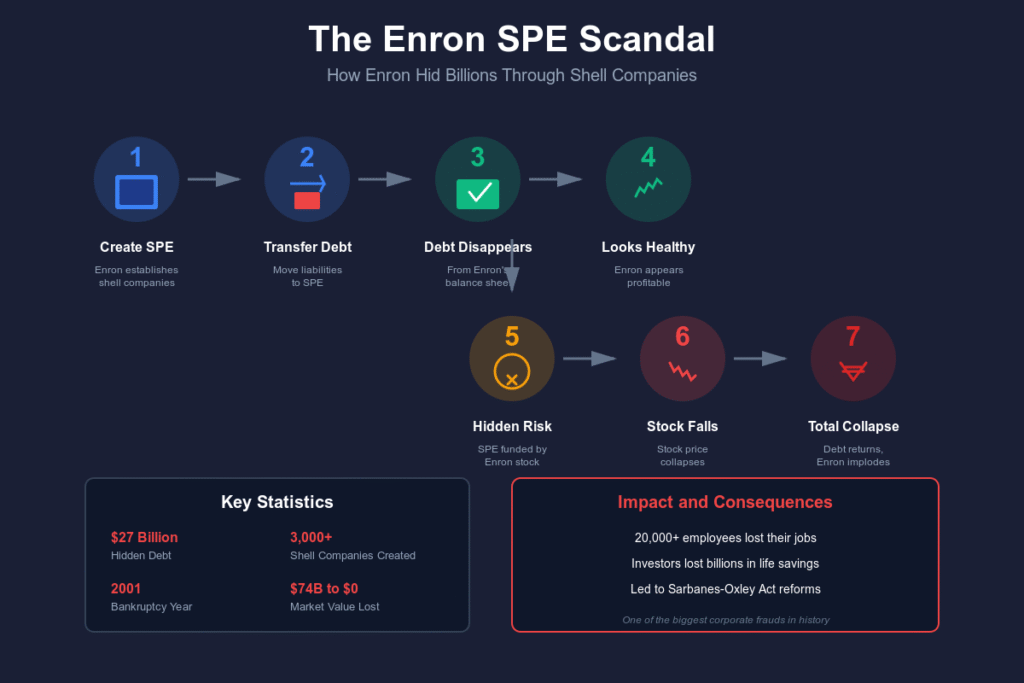

Special Purpose Entities (SPEs)

This was Enron’s main fraud tool:

What They Were: Shell companies created by Enron. Technically independent. Actually controlled by Enron executives.

How They Worked:

- Enron creates SPE (shell company)

- Enron transfers debt to SPE

- Debt disappears from Enron’s balance sheet

- Enron looks financially healthy

- SPE is actually funded by Enron stock

- When the stock falls, SPE collapses

- Debt comes back to Enron

The Scale: Enron created 3,000+ SPEs. They hid billions in debt. They generated fake profits. CFO Andrew Fastow personally ran many SPEs and profited $30+ million from them.

LJM Partnerships

Andrew Fastow created LJM1 and LJM2—SPEs that he personally managed while serving as Enron’s CFO. This was a massive conflict of interest.

The Scheme:

- Enron sells assets to LJM at inflated prices

- LJM books the purchase (funded by Enron stock)

- Enron books a profit on the “sale”

- Fastow personally profits from both sides

- Assets are worthless but appear valuable

- Debt is hidden off the balance sheet

The Audacity: Fastow was essentially trading with himself. He profited personally while hiding Enron’s debts. The board approved it. Furthermore, Arthur Andersen (auditors) called it acceptable.

The Raptor Entities

These were particularly complex SPEs designed to hide losses:

The Structure:

- Enron funds Raptors with its own stock

- Raptors act as “independent” hedge counterparties

- When Enron investments lose money, Raptors pay Enron

- This makes losses disappear on paper

- Actually, Enron is hedging with itself

- When Enron stock falls, Raptors collapse

- Losses reappear

This was financial engineering as fraud. It was intentionally complex. Additionally, complexity hid the scam.

The Warning Signs

Bethany McLean’s Article

In March 2001, Fortune reporter Bethany McLean published “Is Enron Overpriced?” The article asked simple questions:

- How exactly does Enron make money?

- Why can’t analysts understand the business?

- Why is the company so opaque?

- Does the valuation make sense?

Enron’s executives attacked McLean viciously. They called her unethical. Skilling personally berated her. The overreaction was suspicious.

Short Sellers Noticed

Investors betting against Enron (short sellers) saw problems:

Red Flags:

- Footnotes in financial statements were incomprehensible

- Off-balance-sheet entities numbered in thousands

- Cash flow didn’t match reported earnings

- Debt kept growing despite “profits”

- Related-party transactions were massive

Jim Chanos, a famous short seller, started betting against Enron in 2000. He told everyone who’d listen that Enron was fraudulent. Most ignored him.

Sherron Watkins: The Whistleblower

Sherron Watkins was an Enron vice president. In August 2001, she wrote an anonymous letter to Ken Lay:

The Warning: “I am incredibly nervous that we will implode in a wave of accounting scandals. Skilling is resigning for ‘personal reasons’ but I think he wasn’t having fun, looked down the road and knew this stuff was unfixable.”

She detailed the accounting fraud. She explained the SPE schemes. Additionally, she predicted a collapse. Lay thanked her. Then did nothing.

The Collapse (2001)

August: Skilling Resigns

August 14, 2001. Jeffrey Skilling suddenly resigned as CEO after only six months. Reason given: “Personal reasons.”

This shocked everyone. Moreover, 42-year-old CEOs don’t quit successful companies for vague reasons. Additionally, his departure suggested problems. Stock began falling.

Ken Lay became CEO again. He tried to reassure markets. He told employees to buy stock. He claimed everything was fine. It wasn’t.

October 16: The Loss

Enron announced Q3 2001 results:

- $618 million loss

- $1.2 billion reduction in shareholder equity

- Admission of accounting “errors”

- Need to restate years of earnings

The stock crashed from $33 to $15. Moreover, credit rating agencies downgraded Enron. Additionally, SEC opened an investigation. The end was beginning.

October 22: SEC Investigation

SEC launched a formal investigation. They focused on:

- Related-party transactions

- Off-balance-sheet entities

- Andrew Fastow’s conflicts of interest

- Mark-to-market accounting abuse

Fastow was fired. He became the scapegoat. Other executives panicked. Furthermore, they started deleting evidence.

November: The Death Spiral

November 8: Enron restates five years of earnings. Actually, they’d overstated profits by $586 million. Moreover, they’d hidden $2.6 billion in debt. The fraud was undeniable.

November 9: Dynegy (competitor) offers to buy Enron for $9 billion. This would save the company. However, due diligence reveals worse problems.

November 28: Dynegy walks away from deal. Credit rating agencies downgrade Enron to junk status. Stock falls to $1. Bankruptcy is inevitable.

December 2, 2001: Bankruptcy

Enron filed for Chapter 11 bankruptcy. The numbers were staggering:

The Destruction:

- $63.4 billion in assets (the largest bankruptcy ever at the time)

- $31.2 billion in debt

- 20,000 employees are losing jobs

- $2 billion in employee pension losses

- $74 billion in market cap evaporated

- Investors lost everything

The Victims

The Employees

The 401(k) Tragedy:

Enron employees’ retirement accounts were invested heavily in Enron stock. The company matched contributions with Enron shares. Moreover, employees couldn’t sell until age 50. Additionally, during the collapse, 401(k) accounts were “frozen” for administrative changes.

The Timeline:

- October 2001: Enron announces losses, stock starts falling

- October 17-November 13: Employee 401(k)s frozen “for administrative changes”

- During the freeze, employees can’t sell Enron stock

- Executives can sell (and did)

- Stock falls from $33 to $8 during the freeze period

- Employees watch retirement evaporate, can’t do anything[16]

Charles Prestwood, 63: Retired Enron employee. His 401(k) had $1.3 million in Enron stock in 2000. By 2002: $3,000. “I worked for Enron for 33 years. I believed in the company. They stole my retirement.”

Janice Farmer, 56: Worked at Enron for 20 years. Lost $700,000 in retirement savings. “I can’t retire now. I’ll work until I die. Ken Lay told us to buy more stock while he was selling his.”

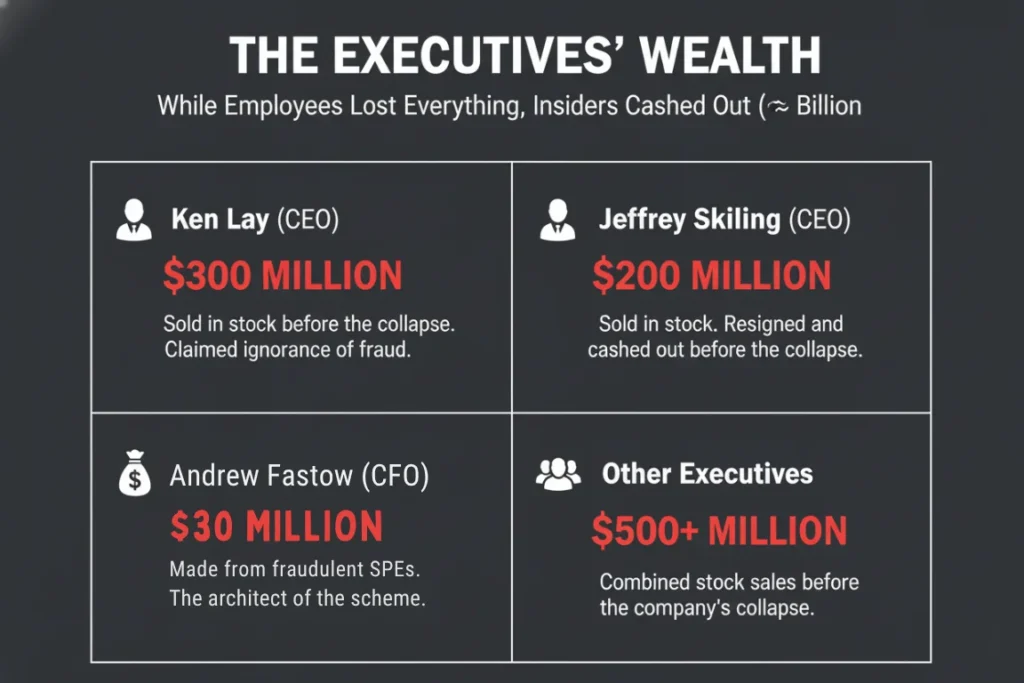

The Executives’ Wealth

While employees lost everything, executives sold $1 billion in stock:

Ken Lay (CEO): Sold $300 million in stock before the collapse. He maintained innocence. He claimed ignorance of fraud.

Jeffrey Skilling (CEO): Sold $200 million in stock. He resigned at his peak. He cashed out before the collapse.

Andrew Fastow (CFO): Made $30 million from SPEs. He orchestrated the fraud. He was the architect of the scheme.

Other Executives: Combined sales of $500+ million before collapse.

Arthur Andersen

Enron’s auditor, Arthur Andersen, was one of the “Big Five” accounting firms. They approved Enron’s fraudulent accounting. They destroyed evidence.

October 2001: When SEC investigation started, Arthur Andersen began shredding Enron documents. They deleted thousands of emails. Additionally, they destroyed evidence systematically.

This obstruction of justice destroyed the firm. By 2002, Arthur Andersen collapsed. Moreover, 85,000 employees worldwide lost jobs. One fraud destroyed two major corporations.

The Criminal Trials

Andrew Fastow (CFO)

Fastow was indicted on 78 counts of fraud, money laundering, and conspiracy. He initially pleaded not guilty. However, prosecutors offered a deal.

The Plea Deal: Plead guilty to 2 counts. Moreover, serve 6 years in prison. Additionally, forfeit $23.8 million. Furthermore, testify against Skilling and Lay.

Fastow accepted. He testified extensively. His testimony convicted his bosses. He was released in 2011 after serving 6 years.

Jeffrey Skilling (CEO)

Charges: 35 counts, including fraud, insider trading, and conspiracy.

Defense: Claimed he didn’t know about fraud. He said Enron was healthy when he left. He blamed Fastow.

Evidence Against Him:

- Emails showing knowledge of fraud

- Testimony from subordinates

- Stock sales before the collapse

- Lies to investors and employees

Verdict (2006): Guilty on 19 counts.

Original Sentence: 24 years in prison.

Actual Time Served: Released in 2019 after 12 years (sentence reduced in exchange for dropping appeals and agreeing to forfeit $40 million).

Kenneth Lay (Chairman/CEO)

Charges: 11 counts of fraud and conspiracy.

Defense: Claimed he was deceived by Fastow and Skilling. He said he trusted his CFO. He portrayed himself as a victim.

Verdict (2006): Guilty on all counts.

Sentence: He died of a heart attack on July 5, 2006, before sentencing. Because he died before sentencing was finalized, his conviction was vacated. Therefore, legally, he died “innocent”.

His death denied justice to many victims. It prevented asset seizure. Additionally, his family kept much of his wealth.

The Regulatory Response

Sarbanes-Oxley Act (2002)

The Enron scandal prompted sweeping reforms:

Key Provisions:

- CEOs must personally certify financial statements

- Criminal penalties for false certification

- Auditor independence requirements

- Whistleblower protections

- Enhanced financial disclosure

- Internal control requirements

The Impact: Compliance costs billions. It changed corporate governance. Additionally, it made fraud harder (but not impossible). Sarbanes-Oxley (SOX) became the most significant securities legislation since the 1930s.

Accounting Reform

Changes Made:

- Banned most consulting work by auditors

- Required auditor rotation

- Established Public Company Accounting Oversight Board

- Enhanced scrutiny of complex transactions

- Restricted off-balance-sheet entities

These changes addressed Enron’s specific frauds. However, creative accounting continues.

Securities Law Changes

Enhanced Requirements:

- Real-time disclosure of material events

- Prohibition of loans to executives

- Faster reporting of insider trades

- Stricter definitions of independence

- Enhanced penalties for fraud

The Lessons

How It Happened

The Perfect Storm:

- Aggressive executives are incentivized to show growth

- Complex accounting that few understood

- Auditors compromised by consulting fees

- The board that didn’t ask hard questions

- Analysts who believed the hype

- Regulators who moved too slowly

- Employees who trusted too much

The Warning Signs

Complexity as Camouflage: If you can’t understand how a company makes money, don’t invest. If explanations require advanced degrees, something’s wrong. Complexity often hides fraud.

Off-Balance-Sheet Entities: Thousands of SPEs? That’s not business strategy. Instead, it’s hiding debt. Additionally, it’s avoiding transparency.

Related-Party Transactions: CFO profiting from deals with his own company? Clear conflict of interest. Board approval doesn’t make it right.

Insider Selling: Executives selling while telling employees to buy? They know something you don’t. Their actions contradict their words.

Aggressive Accounting: Mark-to-market can be legitimate. However, booking 20-year profits immediately? That’s aggressive, bordering on fraudulent.

Auditor Conflicts: When auditors earn more from consulting than auditing, independence is compromised. They become enablers, not watchdogs.

Defensive Executives: Skilling calling an analyst an “asshole” for basic questions? That’s not confidence. Instead, it’s desperation. Additionally, it’s a massive red flag.

Protection Strategies

1. Understand the Business Model: If you can’t explain how a company makes money to a child, don’t invest. Moreover, sustainable businesses have clear revenue sources.

2. Check Cash Flow: Earnings can be manipulated. However, cash flow is harder to fake. If earnings grow but cash flow doesn’t, investigate why.

3. Read the Footnotes: Boring but critical. Moreover, fraud details hide in footnotes. Additionally, complexity in footnotes suggests problems.

4. Watch Insider Activity: If executives are selling heavily, ask why. Insider buying is generally positive. Additionally, insider selling during problems is very negative.

5. Question Aggressive Accounting: Mark-to-market, off-balance-sheet entities, related-party transactions—all can be legitimate. However, when combined, they’re suspicious.

6. Verify Auditor Independence: How much does the auditor earn from consulting vs. auditing? Has the auditor been with the company for decades? Long relationships breed complacency.

The Legacy

Changed Corporate America

Enron’s collapse fundamentally changed business:

Before Enron:

- Self-regulation mostly worked

- Auditors largely trusted

- Complex accounting accepted

- Executive compensation has minimal oversight

- Whistleblowers rarely protected

After Enron:

- Heavy regulation (SOX) implemented

- Auditor independence required

- Transparency demanded

- Executive certification mandatory

- Whistleblowers legally protected

The Human Cost

Numbers can’t capture the devastation:

20,000 Employees: Lost jobs, retirement savings, and faith in corporations. Many never financially recovered. Some were in their 50s-60s when it collapsed. Additionally, they had no time to rebuild.

Investors: Lost $74 billion. Pension funds are devastated. Universities’ endowments were damaged. Individual investors were ruined.

Arthur Andersen Employees: 85,000 lost jobs globally. Careers are destroyed by association. They were victims of their leadership’s fraud.

The Cautionary Tale

Enron became synonymous with corporate fraud. Moreover, business schools teach it as a case study. Additionally, “Enron” became shorthand for accounting manipulation.

The documentary “Enron: The Smartest Guys in the Room” (2005) permanently cemented the story in American culture.

Where They Are Now

Jeffrey Skilling: Released from prison in 2019. Now 70 years old. Attempted to start new ventures. Generally shunned by the business community.

Andrew Fastow: Released in 2011. Became a public speaker on corporate ethics (ironically). Discusses his crimes as warnings. Lives in Houston.

Kenneth Lay: Died July 2006. Conviction vacated due to death before sentencing. The family kept much of his wealth. The grave is unmarked to prevent vandalism.

Enron Employees: Many never recovered financially. Some committed suicide. Others rebuilt careers elsewhere. The 401(k) losses were never fully recovered—average recovery was 20 cents on the dollar.

Arthur Andersen: Firm dissolved. Conviction overturned on appeal in 2005, but too late—the firm was already dead. Partners scattered to other firms.

Sherron Watkins: Became corporate whistleblower advocate. Speaker and author. Named one of Time’s “Persons of the Year” 2002 (The Whistleblowers).

The Final Truth

Enron wasn’t destroyed by bad luck or market forces. Instead, it was destroyed by intentional fraud. Moreover, executives prioritized personal wealth over employee welfare. Additionally, they lied systematically for years.

The saddest part? It was preventable. Sherron Watkins warned Ken Lay. Short sellers identified the fraud. Additionally, analysts asked hard questions. But executives chose greed over honesty.

20,000 employees paid the price. They worked hard. They believed in management. They invested their retirement in company stock. Then they watched it become worthless while executives sold billions.

The cruelty was the 401(k) freeze. Employees couldn’t sell while executives could. They were told to keep buying while insiders sold. It was betrayal in its purest form.

Enron proved that smart doesn’t mean honest. It showed that prestigious boards don’t guarantee oversight. Additionally, it demonstrated that auditors can be compromised. Furthermore, it exposed how complexity hides fraud easily.

Jeffrey Skilling called that analyst an “asshole” for asking how Enron made money. He knew the truth: They didn’t. Instead, they were hiding debt and booking fake profits. Moreover, they were running out of time. The question exposed that.

Three months later, the “smartest guys in the room” were exposed as criminals. Their “most innovative company” was revealed as accounting fraud. Moreover, their billions in profits were lies.

And 20,000 employees learned the hardest lesson: Never trust your retirement to your employer’s stock. Especially when executives are selling while telling you to buy.

That’s Enron’s legacy. Not innovation. Not an energy trading revolution.

Just betrayal.

And 20,000 destroyed retirements.

Resources

[1]The Enron Trial: Indictment of Lay, Skilling, and Causey

[2]The Enron (Ken Lay and Jeff Skilling) Trial: An Account

[5] GOV info “The Role of the Board of Directors in Enron’s Collapse.”

[8] ENRON AND THE SPECIAL PURPOSE ENTITY – Use or Abuse? – The Real Problem – the Real Focus

Related reading(suggested)

[1]WeWork Collapse: Adam Neumann’s $47 Billion Valuation Scam

[2]The $9 Billion Theranos Fraud: How Elizabeth Holmes Fooled Everyone

[3]The $65 Billion Bernie Madoff Ponzi: A Complete Victim Analysis

[4]Thodex Scam: How 400,000 Users Lost $2 Billion Overnight

[5]QuadrigaCX Mystery: Did Gerald Cotten Take the Keys to the Grave?