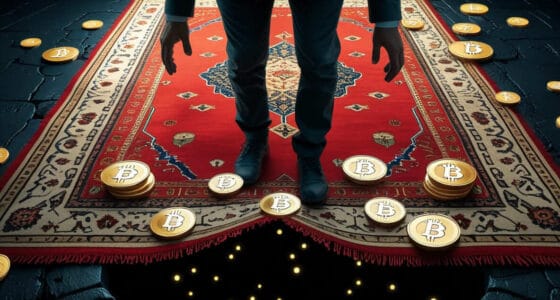

The Illusion of Trust

It always begins the same way with a promise.

A sleek website. A friendly logo. A trading dashboard that looks just like Binance or Coinbase. Only, it isn’t. For millions of investors, fake crypto exchanges were the perfect trap: believable, fast, and designed to look legitimate.

Every button clicked deeper into the nightmare. Every deposit fed the machine. They didn’t know this: the trades were fake, the charts were illusions, and the profits were lies.

The Machinery of the Scam

Fake crypto exchanges operate like digital ghost towns. The front end looks real, price charts flicker, wallets update, balances rise. But behind the curtain, there’s no blockchain activity at all. Victims never actually owned their crypto. Every “trade” happened on a server controlled by scammers.

When users tried to withdraw, the system stalled. “Verification pending.” “Technical issue.” “24-hour delay.”

And then silence. The website vanished, taking millions with it.

The FTC estimated that in 2022 alone, crypto investment scams drained over $1.4 billion from users. Many of these came from fake exchanges promising “guaranteed daily profits” or “AI trading bots” that never existed.

Accelerating Dread: The Global Spread

Moreover, this pattern wasn’t limited to one country.

In South Korea, authorities seized 11 fake exchanges in a single year. In Turkey, a 2021 indictment revealed a platform that vanished overnight with nearly $2 billion in user deposits. Meanwhile, in Canada, bankruptcy records show fake “liquidity platforms” mimicking real trading firms.

The scammers grew bolder, cloning real exchange websites pixel for pixel. Even domain names differed by just a single letter. A user thought they were on Binance. In reality, it was “Binnance.co.”

By the time they noticed the difference, their crypto was gone.

Human Cost: The Victims Left Behind

Court documents reveal the human wreckage.

A software engineer in Seoul lost his entire retirement fund. A university student in Turkey borrowed money to invest. A Canadian nurse testified she “watched her life savings disappear from the dashboard in real time”.

Each story carries the same heartbreak the belief that they were early adopters in a new financial era. Instead, they became data points in one of the largest waves of digital theft in modern history.

Villain’s Excess: Greed Without Borders

The operators lived like kings.

Investigations found fake exchange administrators buying supercars, luxury condos, and yachts with stolen assets. In one DOJ indictment, the ringleader of a “crypto trading platform” used victim funds to purchase a private island.

Each platform was the same story: a slick brand, a fake trading interface, a torrent of deposits, and then disappearance. They didn’t need guns or masks. Just a website and your trust.

Justice Delivered — But Never Enough

Authorities worldwide have begun to strike back.

In 2023, the U.S. Department of Justice charged several operators of fake exchanges under wire fraud and money laundering statutes. In China, courts ordered restitution for thousands of investors defrauded by imitation trading apps. And in South Korea, courts issued long prison sentences for running unlicensed exchanges.

But the truth is grim — most victims never recover their funds. Crypto moves fast. Justice moves slowly.

Educational Horror: 20 Red Flags Before You Deposit

Therefore, here’s where you stop the next nightmare before it begins. If you ever use or sign up for a crypto exchange, check these 20 red flags first:

- Guaranteed returns (“Earn 10% daily”).

- Unlicensed platform (No registration number or legal entity).

- Fake customer support that pushes you to “reinvest”.

- Withdrawal delays with vague excuses.

- No verifiable company address.

- Copied interfaces mimicking real sites.

- Social media hype using bots and fake influencers.

- Unclear ownership — no team or LinkedIn profiles.

- No physical headquarters or only a P.O. box.

- Referral bonuses or MLM-style recruitment.

- Pressure tactics (“Offer expires in 24 hours!”).

- Fake trading volume — charts that never match blockchain data.

- No third-party audits of reserves or liquidity.

- Missing SSL certificate or HTTP-only site.

- Anonymous domain registration.

- “Too new” platform with no long-term reputation.

- Fake endorsements by celebrities or TV shows.

- No legal terms or vague refund policies.

- No social media verification (blue check).

- You can’t find them in any regulator database.

If even two or three of these appear, walk away. Because the moment you deposit, it’s already too late.

Epilogue: The Digital Graveyard

Fake exchanges don’t just steal money. They steal hope — the dream that crypto could free people from broken systems. Billions lost. Lives altered. Trust shattered.

Every fake exchange leaves a scar on the blockchain — a silent monument to misplaced faith. And somewhere, another domain is registering, waiting for the next deposit.

Remember: Real exchanges don’t need to beg for your trust. The fake ones demand it.

Sources

- FTC Report, 2022 — Reports show scammers cashing in on crypto craze

- The Guardian, 2025 — Crypto mogul Do Kwon pleads guilty to fraud for $40bn market collapse

- Al Jazeera, 2021 — Turkey crypto exchange probe: 62 arrested, CEO on the run

- Norton Rose Fulbright, 2019 — Quadriga bankruptcy: C$190 million may have turned into digital dust

- FBI Press Release, 2024 — FBI Publishes 2023 Cryptocurrency Fraud Report

- U.S. DOJ Press Release, 2022 — CEO Of Security Company Pleads Guilty To International Boiler Room Fraud Scheme

- ResearchGate, 2022 — Ban of Cryptocurrencies in China and Judicial Practice of Chinese Courts

Related reading(suggested)

- Before You Invest: Learn from the 10 Biggest Crypto Scams

- PlusToken Fraud: The Multi-Billion Dollar Ponzi from Asia

- The Shocking $4 Billion OneCoin Scam: Where is the Vanishing Cryptoqueen

- NFT Scams: Celebrity Endorsement Frauds That Cost Fans Millions