The phone rings at 2 PM.

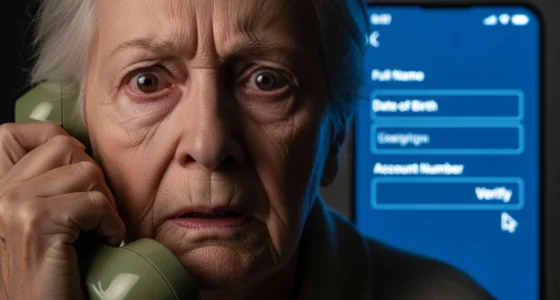

Sarah Martinez, 67, answers. A stern voice identifies himself as Agent Bradley from the IRS. He knows her address. He knows her Social Security number. He says she owes $8,347 in back taxes. Pay immediately, or the police will arrest her within the hour.

Sarah’s hands shake. She’s never been in trouble before. The voice sounds official. Moreover, he has her personal information. How could this be fake?

It isn’t real. But Sarah doesn’t know that yet.

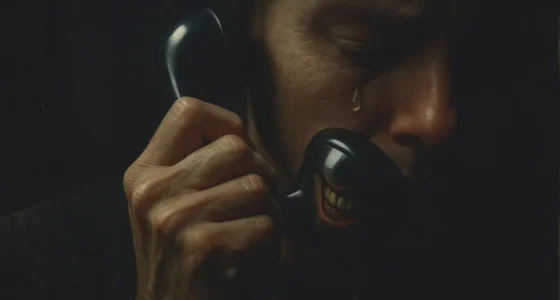

The Predators Wearing Badges

IRS tax scams have become a billion-dollar hunting ground. Criminals pose as federal agents to terrorize innocent people into sending money. In 2023 alone, the Treasury Inspector General documented over 1.4 million fake IRS contacts. These predators know exactly how to manipulate fear.

The scam works because it hijacks your survival instinct. Nobody wants to face federal charges. Nobody wants the IRS knocking on their door. Consequently, victims panic and make decisions they’d never make in calm moments.

These fake agents don’t just call anymore. They text. They email. They show up on your caller ID as “IRS” or “Department of Treasury.” Furthermore, they’ve perfected the art of sounding legitimate.

The Anatomy of Terror

Real IRS tax scams follow a disturbing pattern. First, they create urgency. You must pay NOW. Not tomorrow. Not next week. Right this second.

Then they demand specific payment methods. Gift cards. Wire transfers. Cryptocurrency. Meanwhile, the real IRS never asks for payment this way. Never.

The scammers also threaten consequences that sound terrifyingly real:

- Immediate arrest by local police

- Deportation for immigrants

- License suspension

- Property seizure

- Lawsuit filing within hours

Each threat hammers another nail into the coffin of rational thinking. Fear floods your brain. Logic drowns in panic.

Sarah’s Descent Into Darkness

Sarah stayed on the phone for 47 minutes. “Agent Bradley” transferred her to his “supervisor.” The supervisor confirmed everything. They’d give her one chance to avoid prosecution.

She needed to buy $8,000 in Apple gift cards. Then read the numbers over the phone.

Sarah drove to three different stores. Her hands trembled as she scratched off the silver coating. She read each 16-digit code carefully. The “agents” thanked her for her cooperation.

They hung up. She never heard from them again.

Today, Sarah lives with her daughter. She lost her entire emergency savings. Additionally, she faces crippling shame and depression. The $8,347 represented her safety net for medical emergencies. Now it’s gone forever, dissolved into the digital void where scammers hide.

The Numbers Tell a Horror Story

The Federal Trade Commission reported that Americans lost $458 million to government impersonation scams in 2023. IRS impersonation ranked as the most common type. Indeed, these predators filed over 2,400 victims’ pockets every single day.

The average loss per victim hit $7,000. However, elderly victims lost significantly more. People over 60 reported median losses of $9,800.

Most victims never recover their money. The gift cards get drained within minutes. Wire transfers disappear across international borders. Cryptocurrency vanishes into untraceable wallets. Therefore, prevention remains the only real protection.

How the Real IRS Actually Works

The real IRS follows strict protocols. They mail you first. Always. No exceptions.

They never call to demand immediate payment. They never threaten arrest over the phone. They never ask for gift cards, wire transfers, or cryptocurrency. Furthermore, they never demand payment without giving you the right to question or appeal the amount you owe.

Real IRS agents provide multiple opportunities to verify their identity. They give you callback numbers. They send official correspondence. They follow legal procedures that take weeks or months, not minutes.

But scammers count on you not knowing these facts. They exploit the gap between fear and knowledge.

Marcus’s Midnight Terror

Marcus Chen, 34, received a voicemail at 11 PM. The automated message warned of “legal action” and an “arrest warrant” for tax fraud. It provided a callback number and case number.

Marcus panicked. He’d recently started a small business. Had he filed something wrong? He called back immediately.

The “agent” painted a nightmare scenario. Marcus owed $12,500 in payroll taxes. He’d allegedly committed fraud by misclassifying employees. Jail time was imminent unless he settled immediately.

Marcus negotiated a “settlement” of $6,200. He sent it via wire transfer at 1 AM from a 24-hour service. The agent promised to email confirmation.

No email ever came.

Marcus later discovered the real IRS had no record of his call. No investigation existed. No debt existed. The entire scenario was theatrical fiction designed to empty his bank account.

He reported the crime, but the money trail ended in Southeast Asia. Six months later, Marcus still wakes up at night, replaying his stupidity on an endless loop.

The Warning Signs That Save Lives

IRS tax scams share common red flags. Learn them. Memorize them. Share them with everyone you love.

The IRS will NEVER:

- Call to demand immediate payment

- Threaten arrest or deportation

- Require a specific payment method

- Ask for credit or debit card numbers over the phone

- Demand payment without sending a bill first

- Threatened to bring local police or immigration officers

- Suspend your Social Security number or driver’s license

Additionally, be suspicious of:

- Calls asking you to confirm Social Security numbers

- Emails with links to “verify” tax information

- Text messages about refunds or payments

- Robocalls threatening legal action

- Caller ID showing “IRS” or government agencies

Real tax issues develop slowly. They arrive in your mailbox first. They provide appeal rights. They follow legal procedures.

Scam threats arrive fast and loud. They demand instant action. They bypass all legal protocols.

If You Get the Call

Stay calm. The fear is their weapon. Don’t let them load it.

Hang up immediately. Don’t engage. Don’t argue. Don’t try to outsmart them. Just disconnect.

Then verify independently. Call the IRS directly at 1-800-829-1040. Use the number from their official website, never from caller ID or voicemail. Ask if they’ve tried to contact you.

Report the scam to the Treasury Inspector General at 1-800-366-4484. Also, file a complaint with the FTC at ReportFraud.ftc.gov. Your report helps authorities track these predators.

If you already sent money, act fast. Contact your bank immediately. Report the fraud to local police. Time matters. However, honestly, recovery remains unlikely.

The Expanding Nightmare

IRS tax scams evolve constantly. Criminals adapt faster than law enforcement can respond. Recently, they’ve added new tactics:

Text messages claiming you’re eligible for tax refunds. Links lead to fake IRS websites that steal login credentials. The sites look perfect. Every logo, every color, every form appears legitimate.

Email phishing has grown more sophisticated. Messages reference real tax laws and recent changes. They create urgency around deadlines. Furthermore, they include official-looking PDF attachments infected with malware.

Social media scams promise quick refunds or “secret” tax strategies. They collect personal information under the guise of “qualifying” you for benefits. Your data then feeds into identity theft operations.

The IRS itself reported receiving over 6,500 reports of phone scams in a single peak tax season week. That’s one report every 90 seconds. The actual number of attempts likely reaches millions.

The Aftermath Nobody Discusses

Victims of IRS tax scams lose more than money. They lose trust. They lose confidence. They lose their sense of security in a world that suddenly feels full of predators.

Many victims withdraw from normal life. They stop answering their phones completely. They suspect every official communication. Some develop anxiety disorders or depression.

Families fracture under the strain. Spouses blame each other. Adult children lose respect for elderly parents who “should have known better.” The psychological damage ripples outward like cracks in ice.

Financial recovery can take years. But emotional recovery? That might never come.

Your Shield Against the Darkness

Knowledge is the only defense that works. Spread it like your life depends on it. Because someone’s life does.

Tell your parents. Tell your grandparents. Tell anyone who might answer the phone when fear comes calling.

The real IRS is a bureaucracy. They move slowly. They follow rules. They send letters. They provide options. They never operate like the predators who impersonate them.

When someone demands immediate payment by gift card, you’re not talking to the government. You’re talking to a criminal who studied your fear and learned how to weaponize it.

Remember Sarah. Remember Marcus. Remember the 1.4 million victims who heard that voice on the phone and believed the nightmare was real.

The call might come tomorrow. The text might arrive tonight. The email might be waiting in your inbox right now.

But now you know the truth.

The IRS doesn’t call like that. They never have. They never will.

When the voice demands payment, when your heart starts racing, when panic floods your mind—hang up. Just hang up.

The real nightmare isn’t owing taxes. It’s the predator on the other end of the line, waiting in the shadows for the next person who doesn’t know what you know now.

Don’t be their next victim. And don’t let anyone you love become one either.

The darkness is real. But now you can see it coming.

Resources

[2] Federal Trade Commission. “Consumer Sentinel Network Data Book 2023.” February 2024.

[3] Federal Trade Commission. “Protecting Older Consumers.”

[5] Internal Revenue Service. “IRS Warns of Pervasive Phone Scam.” March 2024.

Related reading(suggested)

The Government Voice That Wants to Destroy You: Inside Social Security Scam Scripts

Romance Scam Psychology: The Love Hunters Who Weaponize Your Loneliness