The Arena of Believers

Picture Wembley Arena. Thousands of people are cheering. A woman in a red gown promises financial freedom. Her name: Dr. Ruja Ignatova. They believed her. What they didn’t know yet was that they were walking into one of the most devastating financial traps of the century. By the time the lights faded, OneCoin had defrauded investors of over $4 billion worldwide [1].

The Terrible Machinery Revealed

On paper, OneCoin appeared to be a cryptocurrency. However, in reality, it was smoke and mirrors. First of all, there was no public blockchain, no decentralized ledger anyone could audit.

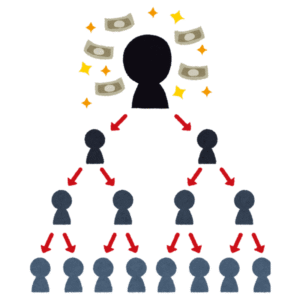

Instead, prosecutors described the operation as a classic multi-level marketing pyramid. New investor money paid earlier investors, while the ‘coin’ itself existed only in private databases controlled by insiders [1].

Accelerating Dread: The Global Spread

OneCoin didn’t just fool a few people. On the contrary, it spread like wildfire.

- Millions were recruited across continents.

- Furthermore, in many regions, recruiters targeted working families and the unbanked with promises of life-changing gains.

- For example, Europol later highlighted OneCoin as an example of how crypto fraud and pyramid marketing combine to devastate entire communities.

The pyramid grew until the music stopped. Finally, the losses were total [2].

Human Cost: The Victims Speak

Court filings contain chilling testimony.

A farmer sold livestock; a dutiful daughter convinced her parents to invest. U.S. prosecutors confirmed that victims spanned the globe and collectively lost billions.

One heartbreaking fact: when investigations closed in, co-conspirators faced U.S. charges and pleas, but Ruja Ignatova disappeared, leaving millions of victims behind [3].

Villain’s Excesses vs. Victim Suffering

Prosecutors outlined where some of the stolen funds were spent: on luxury purchases, real estate, private jets, and lavish events. As the DOJ noted, OneCoin was “a well-organized and highly profitable pyramid scheme”.

The contrast is brutal. Victims wound up with debt and ruined lives. Leaders walked away with luxury.

Justice Delivered, But the Queen Escapes

Some perpetrators were arrested and prosecuted. Konstantin Ignatov, Ruja’s brother, was arrested in 2019 and pleaded guilty.

Other insiders, including co-founder Karl Greenwood, were sentenced to lengthy prison terms [4].

But the alleged mastermind, Ruja Ignatova, vanished in 2017. In 2022, she was added to the FBI’s Ten Most Wanted list. She remains at large.

Educational Horror: How to Avoid the Next “Cryptoqueen”

The official cases reveal clear red flags:

-

No blockchain: if you can’t verify a ledger, you can’t trust it.

-

Aggressive recruiting: MLM style “sign up your friends” is classic pyramid behavior.

-

Hype over audits: concerts and ball gowns aren’t financial statements [1].

-

Outrageous guarantees: anyone promising “guaranteed profits” is selling a nightmare.

Horror Epilogue: Lasting Consequences

OneCoin wasn’t just fraud. It was betrayal. It took the hopes of working families and twisted them into broken finances and shattered trust.

Although some organizers are in prison, billions remain missing, and the “Cryptoqueen” herself is still gone. That lingering absence is the truest horror of all.

Conclusion

The OneCoin saga is a cautionary tale: flashy marketing, big promises, and no transparency.

Trust proof, not promises. Remember the victims who sold land, livestock, and futures because someone in a red gown told them to.

Disclaimer: All information verified through U.S. Department of Justice indictments, FBI filings, and Europol press releases.

-

NFT Scams: Celebrity Endorsement Frauds That Cost Fans Millions

-

Nikola Motors Fraud: The $34 Billion Fake Hydrogen Truck Company