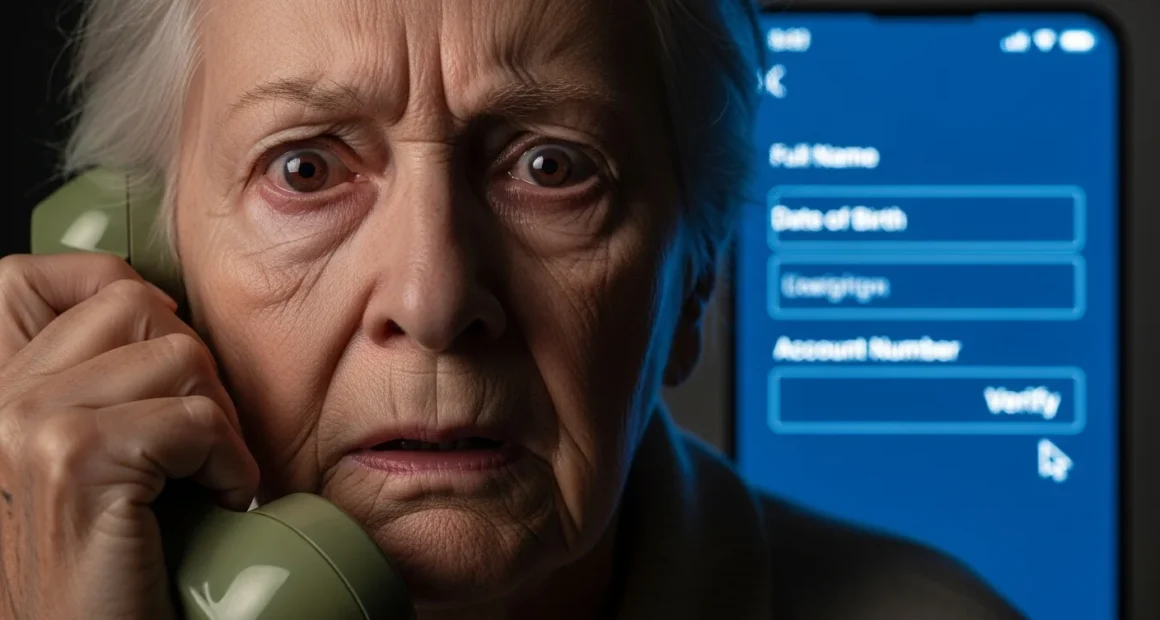

Margaret Anderson, 73, answered the phone at 10:23 AM. The caller ID showed “Social Security Administration.” The voice sounded official and urgent. “Your Social Security number has been suspended due to suspicious activity.”

Margaret’s heart stopped. She’d worked 47 years. Her monthly benefit was her only income. The thought of losing it terrified her.

The Social Security scam caller knew exactly what to say next. They’d rehearsed the script hundreds of times. Within 35 minutes, Margaret had withdrawn $28,400 from her bank and transferred it to “secure” her benefits.

The Social Security Administration never called her. They never suspend numbers. They never demand immediate payment. But the script was perfect. The fear was real. The money is gone forever.

The Anatomy of the Script

Social Security scams follow precise scripts designed by psychological experts. These aren’t random criminals improvising. They’re reading word-for-word instructions tested on thousands of victims.

The scripts use specific phrases that trigger compliance. “Your Social Security number has been compromised.” “There’s a warrant for your arrest.” “Your benefits will be terminated today.”

Each sentence serves a purpose. Create fear. Establish authority. Demand immediate action. Block rational thinking.

Moreover, the scripts include responses to common objections. When victims express doubt, callers have pre-written rebuttals. “I understand your concern, but this is a federal emergency.” “If you hang up, we’ll have to send officers to your location.”

The Federal Trade Commission documented that Social Security scams stole $1.6 billion in 2023. The average victim lost $23,700. But some lost everything they had. The scripts work with terrifying efficiency.

The Opening Hook

Criminals start with caller ID spoofing. Your phone displays “Social Security Administration” or “SSA Official.” The technology costs them $15 monthly. It creates instant credibility.

Then comes the script’s opening line. It’s always urgent. Always threatening. Always designed to spike your adrenaline.

“This is Officer Williams from the Social Security Administration Inspector General’s office. Your Social Security number has been linked to criminal activity in Texas. We need to verify your identity immediately to prevent arrest.”

The words tumble out quickly. No time to think. No pause to question. Just immediate fear and confusion.

Furthermore, they use official-sounding titles. “Special Agent.” “Senior Investigator.” “Federal Compliance Officer.” The titles don’t exist in the real SSA. But victims don’t know that. The authority feels real.

The Inspector General’s office reports receiving 450,000 complaints about Social Security scams in 2023. That’s 1,232 reports every single day. The predators are calling constantly. Your number is probably on their list.

The Fear Escalation

Robert Chen, 68, got nervous when the caller mentioned “suspended benefits.” He got scared when they said “federal warrant.” He panicked when they threatened “immediate arrest.”

The script escalates methodically. First, they threaten your benefits. Then your legal status. Finally, your freedom. Each level increases pressure. Each statement feels more dangerous.

“Sir, I can see here that your Social Security number was used to rent a car in Texas. That car was found abandoned at the scene of a drug trafficking operation. There are 23 kilograms of cocaine linked to your SSN.”

Robert had never been to Texas. He’d never committed a crime. None of it was true. But the specific details made it feel real. The fear shut down his critical thinking.

Moreover, the scripts include time pressure. “We need to resolve this in the next 30 minutes.” “The warrant will be executed today.” “Your window to cooperate is closing.”

Time pressure prevents research. It stops victims from calling relatives. It blocks the reality checks that would expose the scam. That’s exactly what Social Security scams need to succeed.

The Verification Trap

The script then demands “verification” of your identity. This is where they steal your information. They already know some details about you. They use that knowledge to seem legitimate.

“For security purposes, I need to verify your Social Security number. What are the last four digits?”

You provide them. They confirm: “Yes, that matches our system.” Of course it matches. You just told them what it is. But the confirmation feels like proof they’re real.

Then they ask for the full number. Your date of birth. Your address. Your bank information. Each answer makes the scam more effective.

The Social Security Administration never calls asking for your SSN[3]. They already have it. Real government agencies don’t verify information by asking you to provide it. But the script makes it seem necessary and urgent.

Additionally, some Social Security scams use “verification codes.” They claim they’re sending a code to your phone. They need you to read it back for security. That code is actually from a real site where they’re trying to access your accounts. You’re giving them the two-factor authentication they need to steal everything.

The Payment Demand

Once they have your information, the script pivots to money. This is where the real damage begins. The demands are always urgent. Always specific. Always designed to bypass banking safeguards.

“To secure your Social Security account and prevent arrest, you need to transfer your funds to a protected federal account. This is for your safety while we investigate.”

They provide detailed instructions. Wire transfers to specific accounts. Gift cards from particular stores. Bitcoin transfers to “government wallets.” Cryptocurrency ATMs for “federal deposits.”

Martha Rodriguez, 71, withdrew $47,300 from three different banks in one afternoon. The scammer stayed on the phone during every transaction. They coached her on what to tell bank employees. “Just say it’s for home repairs. Don’t mention our call.”

The banks asked questions. Martha followed the script she’d been given. The transactions cleared. Her life savings vanished.

Currently, victims of Social Security scams rarely recover their money. Wire transfers are untraceable. Gift cards get drained immediately. Cryptocurrency transactions are irreversible. Once you send payment, it’s gone forever.

The Multiple Call Strategy

Sophisticated Social Security scams use multiple callers. The first person explains the “problem.” Then they transfer you to a “supervisor” who confirms everything. Finally, a “federal marshal” provides the payment instructions.

Each voice sounds different. Each person references what previous callers said. The coordination makes it feel legitimate. How could multiple government officials all be lying?

They’re not government officials. They’re criminals in a call center reading from scripts. The coordination is easy when everyone’s in the same room following the same playbook.

Moreover, they use background noise. Police radios. Office sounds. Ringing phones. The audio reinforces the illusion that they’re calling from a real government office.

The Continuation Scam

After stealing your money, many Social Security scams continue the relationship. They call again with new “problems.” More threats. More payment demands. More fear.

“Mrs. Anderson, this is Agent Williams again. The investigation revealed additional complications. We need another payment to fully secure your account.”

Victims often pay multiple times. They’ve already lost so much. They’re desperate to resolve the situation. Each payment feels like it might be the last one needed.

The Federal Trade Commission found that 34% of Social Security scam victims paid criminals more than once. Some paid five or six times. The predators keep feeding until nothing remains.

The Recovery Scam

Weeks later, another call arrives. This one claims to be from a “Federal Recovery Division.” They say they can retrieve your stolen money. They just need $5,000 for “processing fees.”

This is the same criminals with a new script. They’re harvesting the same victims again. People are desperate enough to believe in recovery. People who haven’t learned that every promise was a lie.

The Office of Inspector General warns that recovery scams targeting Social Security scam victims stole an additional $347 million in 2023. The predators return to drain whatever’s left.

The Real SSA Never Does This

The actual Social Security Administration will never:

- Call you to threaten arrest or benefit suspension

- Ask for your Social Security number over the phone

- Demand immediate payment in gift cards or cryptocurrency

- Stay on the phone while you withdraw money

- Threatened to send the police to your home

- Request remote access to your computer

- Promise to “secure” your funds by transferring them

- Create urgency with countdown timers or deadlines

If any caller does these things, it’s a Social Security scam operation. Hang up immediately.

Furthermore, the real SSA communicates primarily by mail. If there’s a genuine problem with your account, you’ll receive official letters. You can call the SSA directly at their published number to verify any concerns.

The Demographic Targets

These scripts specifically target older Americans. People who trust authority. People who fear losing their benefits. People who remember when government agencies did call citizens.

The FBI reports that 87% of Social Security scam victims are over age 60. The median loss for victims over 70 is $32,400. For those over 80, it’s $41,700. The predators hunt the most vulnerable prey.

Additionally, they target people during vulnerable moments. Mid-morning, when seniors are home alone. Right after tax season, when people worry about government issues. During benefit payment weeks, when victims have cash available.

The timing is calculated. The targeting is deliberate. The cruelty is absolute.

Protecting Yourself and Others

Never engage with callers claiming to be from Social Security. Don’t press buttons to “speak with an agent.” Don’t call back the numbers they provide. Hang up immediately.

Then verify independently. Call the Social Security Administration at 1-800-772-1213. That’s the only official number. Visit SSA.gov to check your account status. Use only official government websites.

Furthermore, spread awareness. Tell your parents. Warn your grandparents. Share this information with every older person you know. The scripts work because victims don’t recognize them. Education is the only defense.

Also, report Social Security scams immediately. Contact the SSA Office of Inspector General at oig.ssa.gov. File a complaint with the Federal Trade Commission at ReportFraud.ftc.gov. Your report helps authorities track and potentially stop these operations.

The Dark Truth

The scripts keep evolving. Criminals test new phrases. They refine their approaches. They study which words generate the most fear and compliance.

Meanwhile, your loved ones answer their phones every day. They trust the caller ID. They respect authority. They fear government agencies. Everything that makes them good citizens makes them perfect victims.

The voice on the phone sounds official. The threats feel real. The urgency seems legitimate. But it’s all a script. Every word is designed to steal everything you have.

Social Security scams destroyed 67,000 victims’ lives in 2023. The number grows daily. The scripts get better. The predators get bolder.

Your phone will ring. The caller ID will look real. The voice will sound authoritative. The fear will feel overwhelming. And if you follow their instructions, your money will vanish forever.

Hang up. Verify independently. Trust nothing. The government voice that wants to help you is actually the predator that wants to destroy you.

Resources

[1] Federal Trade Commission. “Consumer Sentinel Network Data Book 2023.” February 2024.

[2] SSA: “Scam Alert – Office of the Inspector General – Social Security

[3]SSA: “Protect Yourself from Social Security Scams

[4] Federal Trade Commission. “How To Avoid a Government Impersonation Scam”

[5] Federal Bureau of Investigation. “Elder Fraud Report 2023.” June 2024.

Relate reading(suggested)

Romance Scam Psychology: The Love Hunters Who Weaponize Your Loneliness