The predator in your inbox

You look at your email. You see a “URGENT NOTICE” from “Federal Student Aid.” They claim you qualify for a new forgiveness program—pay a small fee to enroll now.

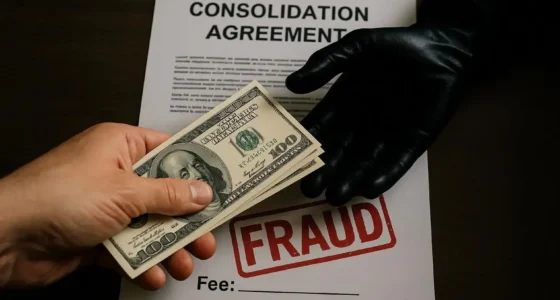

That line was where student loan forgiveness scams often begin. Scammers impersonate government agencies. They prey on fear, confusion, and desperation. Their whisper sounds convincing—and that’s how the trap closes.

Scammers know you want relief. They use that longing against you.

The anatomy of the scam

First, they contact you—by email, phone, or text. They use official logos, fake seals, and real data you’ve revealed before. They call you by name. They quote your loan balance.

Then they instruct you to pay via wire, gift card, or cryptocurrency. They claim it’s a nonrefundable “processing fee.”

Once you pay, they disappear. They never enroll you. They don’t contact your servicer. Your loan stays intact—often higher.

They may also demand your FSA ID or StudentAid.gov credentials, promising to “verify eligibility.” With that, they take control of your account.

Victim Story — The young teacher

Marisol, 32, works as a sixth-grade teacher. She owed $38,500 in student debt. She got a call one afternoon. The voice claimed to be from the Department of Education. They said Marisol qualified for a new forgiveness plan.

They told her to pay $249 as a “processing fee” within 24 hours. Desperate and hopeful, she did.

Weeks passed. Nothing changed. Her loan servicer didn’t acknowledge the program. She called the number. It was disconnected.

Marisol says she felt hollow—betrayed. She missed rent payments to send them money. She’s still stuck in debt.

Victim Story — The immigrant student

Ravi, 28, immigrated here to study. He carries $52,000 in federal and private loans. One evening, he got a text claiming he’d been approved for forgiveness under a new federal directive.

He clicked their website link. It asked for his Social Security, FSA ID, and $399. He gave it.

Within a day, someone had redirected his student loan payments. Months later, his loan balance grew. He says he felt “like handing my dreams to a ghost.”

Real cases the FTC exposed

In 2025, the FTC barred Eric Caldwell and David Hernandez for running a scam that pretended to be the Department of Education. They charged illegal upfront fees and pocketed money instead of helping borrowers. [1]

Another case: Start Connecting LLC, also known as USA Student Debt Relief, and affiliates, collected more than $7.3 million in bogus fees. They pretended to administer forgiveness and manipulated Spanish-speaking communities. [2]

In a different case, Panda Benefit Services and associates defrauded borrowers of $16.7 million, promising fake forgiveness programs. [3]

And the FTC shut down a scheme that stole over $20.3 million from consumers by impersonating the U.S. Department of Education. [4]

In yet another action, Express Enrollment LLC and Intercontinental Solutions LLC collected $8.8 million in junk fees by posing as federal agents, promising debt relief. [5]

Why this horror still thrives

Because fear and hope mix dangerously.

People are drowning under student debt. When someone offers a lifeline—even a false one—many grab it.

Also, impersonation scams are tricky to police. They shift names. They hide offshore. They use burner phones.

Finally, victims feel shame. Many don’t report. The predator advances in silence.

Warning signs — don’t fall

• They ask you to pay first, before doing anything

• They demand your FSA ID, Social Security, or login credentials

• They claim they work with the Department of Education or “federal forgiveness program”

• They pressure you with deadlines (“Act now!”)

• They use government seals or .gov-style email addresses

• They ask you to stop talking to your loan servicer

The Department of Education and StudentAid.gov will never charge you upfront. The U.S. government never demands private payments for you to apply. [6]

What victims can do now

• Report to the FTC at ReportFraud.ftc.gov

• File complaints with your state Attorney General

• Contact your loan servicer and explain you were scammed

• Freeze your credit or monitor for identity theft

• Demand refunds through your bank or payment platform

Final warning — stay haunted by this truth

These scams do not target dollars. They target dreams.

They rip hopes, futures, and trust.

Don’t let a convincing voice steal your future.

Don’t hand over your credentials to a phantom.

Because in this horror, the real crime is stealing your hope—and they might still chase you.

Resources

[6] Federal Trade Commission. “Scammers follow the news about student loan forgiveness.” April 2024.

Related reading(suggested)

Credit Repair Scams: Why ‘Fix Your Credit in 30 Days’ Is Always Fake