The Meeting That Changed Nothing

September 20, 2016. Washington D.C. Senate Banking Committee hearing. John Stumpf, CEO of Wells Fargo, sat before angry senators. He’d been called to explain the fake accounts scandal.

Senator Elizabeth Warren grilled him: “You squeezed employees to the breaking point. When they opened fake accounts, you fired them. But you kept your job. You kept your bonus. You kept your $200 million.”

Stumpf deflected. He claimed he didn’t know about the fraud. He blamed “rogue employees.” Furthermore, he said Wells Fargo had “the best team in banking.”

Warren was furious: “This is about accountability. You should resign. You should give back the money you took while this was going on. And you should be criminally investigated.”

The room erupted in applause. Stumpf looked rattled. His career was effectively over.

Two weeks later, he resigned. However, he kept $130 million. No criminal charges were filed. Wells Fargo paid $3 billion in fines but admitted no wrongdoing.

This is the Wells Fargo fake accounts scandal. A fraud perpetrated by America’s third-largest bank against its own customers. Consequently, it destroyed trust in banking. Meanwhile, it exposed how sales pressure corrupts organizations. And it proved that even “legitimate” institutions commit fraud systematically.

Let’s investigate how Wells Fargo created 3.5 million fake accounts and got away with it.

The Culture: “Eight Is Great”

The Cross-Selling Obsession

Wells Fargo was obsessed with “cross-selling”—selling multiple products to each customer. The magic number: Eight. “Eight is great!” was the internal slogan.

The Logic: Customers with eight products are:

- More profitable

- Less likely to leave

- More engaged with the bank

The Pressure: Branches had daily quotas. Managers tracked every interaction. Additionally, employees who didn’t hit targets faced consequences. Furthermore, the culture was toxic.

The Metrics:

- Solutions per day

- Solutions per banker

- Solutions per branch

- Rankings posted publicly

- Constant competition

The Impossible Goals

Retail banking employees faced brutal quotas:

Daily Expectations:

- Personal bankers: 8-10 new accounts daily

- Tellers: Refer 5+ customers to bankers daily

- Branch managers: 20+ accounts daily for their branch

The Reality: Most customers need 1-2 bank accounts. Maybe a credit card. Perhaps a savings account. That’s it. Moreover, customers don’t open accounts daily. Additionally, organic growth couldn’t meet quotas.

Therefore, employees had two choices: Miss quotas and get fired, or fake accounts to survive.

The Consequences of Failure

Employees who missed quotas faced:

Immediate Consequences:

- Public shaming in branch meetings

- Demotions

- Hour cuts

- Bad reviews

- Termination

The Pressure:

- Managers calling at home demanding explanations

- Weekend calls about Monday quotas

- Threats to job security

- Constant stress and anxiety

Example: One employee described a manager saying, “You can go work at McDonald’s if you can’t meet your goals.” Another: “I don’t care how you get the accounts. Just get them.”

The message was clear: Hit targets or else. How do you hit them? Not their concern.

The Fraud Mechanics

How Fake Accounts Were Created

Employees developed systematic fraud methods:

The Process:

- Customer comes in for a legitimate account

- While processing, the employee opens 3-4 additional accounts

- Customer signs one signature pad

- Employee uses that signature for multiple accounts

- Fake email addresses created (employee’s personal email + numbers)

- Fake PINs assigned

- Accounts activated without customer knowledge

- Employee hits quota

Variations:

- Open accounts for family members without asking

- Create accounts using homeless people’s information

- Use deceased relatives’ identities

- Open accounts for non-English speakers who couldn’t read paperwork

The Secret Credit Cards

This was particularly insidious:

The Method:

- Employee opens a credit card in the customer’s name

- The customer never requested it

- Card sent to the branch, not the customer’s address

- Employee intercepts the card

- Employee activates the card

- The card sits unused in the drawer

- Annual fee charged to the customer

- The customer’s credit score is affected

Thousands of customers discovered unauthorized credit cards. They’d been charged fees. Their credit was damaged. All without their knowledge.

The Account Shuffling

Another common tactic:

The Scheme:

- Transfer money between customers’ accounts

- Create an activity to justify new accounts

- Move $1 between accounts repeatedly

- This counted as “solutions”

- Customers charged transfer fees

- Employees hit targets

The Pin Number Games

Some employees got creative:

The Trick:

- Enroll customers in online banking without permission

- Create fake PINs

- Test PINs multiple times (each attempt counted as activity)

- Lock accounts after failed attempts

- “Help” the customer unlock the account (counted as another solution)

- Reopen locked accounts as new accounts

This created fake activity while appearing to help customers.

The Victims

Individual Customers

José Delgado, Small Business Owner: Discovered 6 unauthorized accounts in his name. Moreover, he was charged $1,500 in fees. Additionally, his credit score dropped 100 points. “I trusted Wells Fargo for 20 years. They violated that trust completely.”

Sandra Martinez, Retiree: Found 11 accounts she never opened. Secret credit cards. Moreover, $2,000 in fees was charged. Additionally, debt collectors were calling. “I’m on a fixed income. These fees hurt. I felt violated.”

The Homeless Victims: Employees used information from homeless individuals who came in for basic services. Moreover, they opened accounts without permission. Additionally, victims didn’t know for years. When discovered, their credit was ruined.

Small Businesses

Kevin’s Auto Shop: 8 business accounts opened without authorization. Moreover, monthly fees totaled $400. Additionally, accounting was a nightmare. “I spent months untangling this. Lost customers because I couldn’t focus on business.”

Credit Score Damage

Thousands of customers had their credit damaged:

The Impact:

- Unauthorized credit inquiries lowered scores

- Unpaid fees on fake accounts went to collections

- Credit card balances (even zero) affected credit utilization

- Customers denied mortgages or loans

- Some lost job opportunities due to credit checks

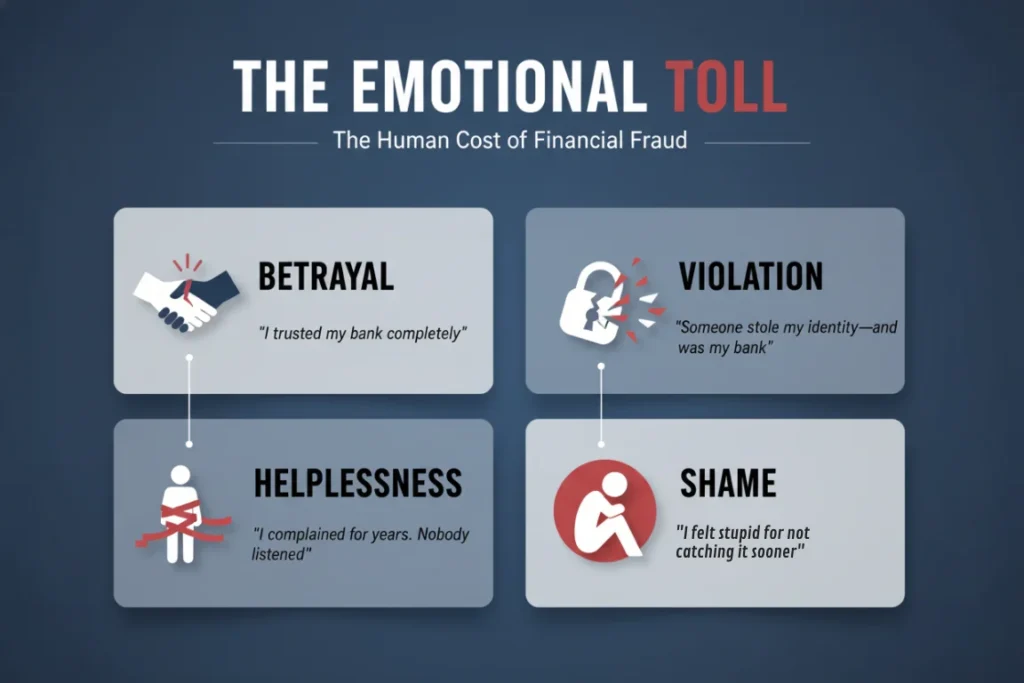

The Emotional Toll

Beyond financial harm, victims felt:

Betrayal: “I trusted my bank completely.”

Violation: “Someone stole my identity—and it was my bank.”

Helplessness: “I complained for years. Nobody listened.”

Shame: “I felt stupid for not catching it sooner.”

The Whistleblowers

The Retail Employees

Thousands of employees reported the fraud internally:

What They Reported:

- Fake accounts are being created

- Customers are being charged unauthorized fees

- Pressure from management to cheat

- Systematic fraud across branches

What Happened:

- Reports ignored

- Whistleblowers fired

- HR sided with management

- The ethics hotline was useless

- Retaliation was swift

Example: Yesenia Guitron worked at Wells Fargo for 4 years. She reported fake accounts multiple times and refused to create them herself. Additionally, she documented everything. She was fired in 2010 for “not being a team player.”

The Ethical Employees Who Refused

Some employees refused to create fake accounts:

The Consequences:

- Immediately targeted for termination

- Given impossible quotas

- Written up for minor infractions

- Eventually fired

- Blacklisted from the banking industry

Example: One employee said, “I was told ‘everyone does it.’ I refused. Within 3 months, I was fired for ‘performance issues.’ My real issue? I wouldn’t commit fraud.”

The Managers Who Spoke Up

Even managers who reported the fraud faced retaliation:

Case Study: The Branch manager in Los Angeles reported fraud to regional management. Moreover, she provided evidence of systematic cheating. Additionally, she refused to pressure her team. She was demoted, then fired within 6 months.

The message: Don’t rock the boat. Hit targets. Ask no questions.

The Cover-Up

The Internal Reports

Wells Fargo’s internal audit found the fraud years before it became public:

Timeline:

- 2011: Internal audit identifies fake accounts

- 2012: More widespread fraud discovered

- 2013: Escalating problem documented

- 2014: Senior management informed

- 2015: Continues unchecked

Yet nothing changed. Moreover, executives didn’t stop it. They increased quotas. The fraud wasn’t a bug—it was a feature.

The Los Angeles Times Investigation

In 2013, LA Times reporters began investigating. They interviewed former employees. They documented fraud patterns and published multiple articles.

The Findings:

- Systematic fraud across California

- Thousands of fake accounts

- Employee pressure tactics

- Management knowledge

Wells Fargo denied everything. Moreover, they attacked the reporters. Additionally, they claimed stories were isolated incidents. The fraud continued for three more years.

The Regulatory Failure

Regulators knew about problems but moved slowly:

Office of the Comptroller of the Currency (OCC):

- Received complaints since 2010

- Investigated but didn’t act decisively

- Issued warnings that Wells Fargo ignored

Consumer Financial Protection Bureau (CFPB):

- Started the investigation in 2013

- Took 3 years to act

- Finally fined Wells Fargo in 2016

The slow response allowed the fraud to continue harming customers.

The Reckoning (2016)

September 8: The Bombshell

CFPB announced Wells Fargo settlement:

The Numbers:

- 3.5 million fake accounts (later revised to 3.5 million+ affected accounts)

- 2 million fake credit/debit cards

- 565,000 fake credit card accounts

- 5,300 employees fired

- $185 million fine

The scale was staggering. Moreover, it was systematic. Additionally, it involved every level of the organization.

The Stock Collapse

Wells Fargo stock crashed:

- Lost $25 billion in market cap

- Share price fell 12%

- Credit rating downgraded

- Reputation destroyed

Investors were furious. Moreover, they sued for concealment. Additionally, they claimed executives knew and hid it.

John Stumpf Resigns

October 12, 2016. Stumpf resigned as CEO and chairman. However:

His Exit:

- Kept $130 million in compensation

- Retirement package intact

- No criminal charges

- Clawed back $41 million (retained $130M+)

The injustice was obvious. He presided over the fraud. He set the culture. Additionally, he profited immensely. Yet faced minimal consequences.

Carrie Tolstedt’s Fate

Carrie Tolstedt ran the retail banking division where fraud occurred. She was scheduled to retire in 2016.

Her Package:

- $125 million retirement package

- Left before the scandal broke publicly

- Knew about fraud for years

- Did nothing to stop it

Public outrage forced clawbacks:

- $67 million clawed back

- Kept $58 million

- Banned from the banking industry

- Criminal charges filed in 2020

The Criminal Consequences

The Employee Convictions

While 5,300 employees were fired, only a handful faced criminal charges. Most were low-level staff. They faced pressure from above. They had little power to resist.

The Injustice:

- Frontline employees fired and prosecuted

- Managers who created pressure kept their jobs longer

- Executives who set the culture faced minimal consequences

The Executive Indictments (2020)

Four years after the scandal, DOJ finally charged executives:

Carrie Tolstedt (Former Retail Banking Head): Charged with obstruction and making false statements. Moreover, she allegedly hid fraud from regulators. Additionally, she lied about sales practices. Trial pending.

James Strother (Former Risk Officer): Charged with failing to report crimes. Moreover, he knew about fraud and didn’t act.

Sentences: Both face up to 30 years if convicted. However, trials have been delayed repeatedly. Justice crawls slowly for powerful defendants.

The Corporate Plea Deal

In February 2020, Wells Fargo admitted criminal wrongdoing:

The Deal:

- Plead guilty to misleading investors

- Pay $3 billion in fines and restitution

- Three-year deferred prosecution agreement

- Admit systematic fraud

This was historic. Moreover, major banks rarely admit to crimes. Additionally, it validated everything the victims said.

The Institutional Failures

The Board’s Negligence

Wells Fargo’s board failed completely:

What They Missed:

- 5,300 employees fired over 5 years (obvious pattern)

- Internal audit reports documenting fraud

- Public reports in the LA Times

- Customer complaints are flooding in

- Regulatory warnings

How did they miss systemic fraud? They didn’t. Instead, they ignored it. They prioritized profits over customers. Additionally, they enabled the culture.

The Auditor’s Failure

KPMG was Wells Fargo’s auditor. The certified financial statements were accurate. However:

Questions:

- How did they miss millions of fake accounts?

- Did they audit customer accounts?

- Were they incompetent or complicit?

KPMG faced no penalties. Moreover, they kept Wells Fargo as a client. The audit failure was never fully investigated.

The Regulatory Failure

Multiple regulators knew:

Timeline of Failures:

- 2010: First complaints to OCC

- 2011: Internal audit finds fraud

- 2013: LA Times publishes investigation

- 2016: CFPB finally acts

Six years of regulatory inaction. Moreover, millions more fake accounts were created during that time. Additionally, thousands more victims were harmed. The system failed to protect consumers.

The Fallout

The Ongoing Scandals

The fake accounts were just the beginning. Additional Wells Fargo frauds emerged:

2017: Improper Auto Insurance

- 800,000 customers charged for insurance they didn’t need

- Cost: $80 million in refunds

- Caused 20,000 improper car repossessions

2018: Mortgage Fraud

- Charged improper mortgage fees

- 625 homes were wrongly foreclosed

- $8 billion in fines and restitution

2019: Wealth Management Fraud

- Unauthorized account modifications

- Fake signatures on documents

- More fake accounts discovered

The fake accounts weren’t an isolated problem. Instead, they revealed deep cultural rot.

The Asset Cap

In 2018, the Federal Reserve took unprecedented action:

The Penalty:

- Wells Fargo cannot grow assets above $1.95 trillion

- Must remain at 2017 size until compliance improves

- Board members forced to resign

- Governance reforms required

This was the most severe penalty ever imposed on a major U.S. bank. It’s still in effect as of 2024. It costs Wells Fargo billions in lost business.

The Ongoing Lawsuits

Thousands of lawsuits were filed:

Class Actions:

- Customers for fees and fraud

- Shareholders for concealment

- Employees for wrongful termination

Settlements:

- Over $4 billion paid to customers and shareholders

- Ongoing litigation continues

- Some cases are still pending

The Lessons

The Toxic Incentive Structure

What Went Wrong:

- Impossible quotas created pressure to cheat

- Short-term metrics prioritized over long-term relationships

- Quantity rewarded over quality

- Results mattered more than methods

- Compensation tied to hitting targets at any cost

The Result: When you create impossible goals and tie compensation to them, people will cheat. They’ll rationalize the cheating. Additionally, the culture will celebrate cheaters as “top performers.”

The Ethical Breakdown

The Stages:

- Pressure: Impossible quotas create stress

- Rationalization: “Everyone does it”

- First Violation: Open one fake account

- Normalization: Becomes routine

- Escalation: More accounts, less guilt

- Culture: Fraud becomes standard practice

This pattern repeats in organizations with toxic cultures. Moreover, it explains how good people do bad things. Additionally, it shows how fraud becomes systematic.

The Warning Signs

Impossible Targets: When quotas can’t be met honestly, fraud follows. If targets require extraordinary circumstances daily, they’re wrong.

Punishment Culture: Fear-based management breeds cheating. Moreover, public shaming ensures silence. Additionally, termination threats prevent whistleblowing.

Ignored Whistleblowers: When employees report problems and face retaliation, fraud is systemic. It’s leadership-enabled. It won’t stop until forced.

High Turnover: 5,300 employees fired over 5 years. That’s 1,060 annually. Moreover, in a 265,000-employee company, that’s suspicious. High turnover in retail banking suggests systemic problems.

Customer Complaints: Thousands of complaints about unauthorized accounts. They were dismissed as customer confusion. Actually, they were evidence of fraud.

Regulatory Warnings: When regulators issue warnings and nothing changes, leadership has chosen fraud over compliance.

Protection Strategies

For Customers:

- Monitor accounts monthly

- Check credit reports quarterly

- Question all new accounts/cards

- Report unauthorized accounts immediately

- Don’t assume your bank is honest

For Employees:

- Document pressure to commit fraud

- Report through multiple channels

- Consult employment lawyers

- Refuse to participate regardless of consequences

- Understand whistleblower protections

For Investors:

- Watch for regulatory actions

- Read whistleblower reports

- Examine compensation structures

- Question impossible growth

- Verify customer satisfaction metrics

Where They Are Now

John Stumpf (Former CEO): Retired with $130+ million. Paid $17.5 million SEC fine. Lifetime ban from the banking industry. No criminal charges. Living in California.

Carrie Tolstedt (Former Retail Banking Head): Awaiting trial on criminal charges. Kept $58 million after clawbacks. If convicted, faces up to 30 years. Trial delayed multiple times.

Tim Sloan (Successor CEO): Resigned in 2019 after continued scandals. Replaced by outsider Charles Scharf.

Wells Fargo: Still operating under Federal Reserve asset cap. Paid over $7 billion in fines and settlements. Closed thousands of branches. Reputation permanently damaged.

Fired Employees: 5,300 lost jobs. Many couldn’t find banking work. Some sued for wrongful termination. Most received no compensation. Careers destroyed.

Victims: Received an average $25 in compensation per fake account. Credit damage took years to fix. Some never recovered. Trust in banking is shattered.

The Final Truth

Wells Fargo didn’t have a few rogue employees. Instead, they had a rogue culture. That culture came from the top. It was deliberate, not accidental.

John Stumpf and Carrie Tolstedt created “eight is great.” They set impossible quotas. They ignored fraud for years. When caught, they blamed frontline employees. They kept their bonuses while 5,300 workers were fired.

A System Designed for Fraud

The cruelty was systematic. Employees were pressured to cheat. Customers were exploited. Whistleblowers were fired. The organization punished honesty and rewarded fraud.

3.5 million fake accounts. Think about that number. Consider the scale. Realize the intention. This wasn’t accidental. Instead, it was the system working as designed.

Wells Fargo wanted growth at any cost. Employees are paid for their jobs. Customers paid with their credit scores. Whistleblowers paid with their careers. But executives? They paid nothing.

Zero Accountability, Millions in Rewards

Stumpf kept $130 million. Tolstedt kept $58 million. Neither faced jail time. Trials were delayed indefinitely. Justice for the powerful moves slowly. Justice for the powerless never arrives.

The saddest part? Wells Fargo wasn’t unique. Instead, they were just caught. Investigation revealed similar practices at other banks. The entire industry has toxic incentives.

“Eight is great” wasn’t just a Wells Fargo slogan. Instead, it was a philosophy: Growth at any cost. Profits over people. Bonuses over ethics. This philosophy dominates corporate America.

Wells Fargo’s fake accounts scandal proved that even “legitimate” institutions commit systematic fraud. They do it knowingly. They face minimal consequences. Victims get pennies while executives keep millions.

The lesson isn’t that Wells Fargo was evil. Instead, it’s that incentives matter more than ethics. Cultures can corrupt good people. And without accountability, fraud becomes policy.

5,300 employees were fired for following orders. Meanwhile, the executives who gave those orders kept their wealth.

That’s not justice. That’s just how the system works.

And Wells Fargo proved it.

Citations

[7]United States v. Tolstedt, 2:23-cr-00115 – CourtListener.com

Related reading(suggested)

[1]WeWork Collapse: Adam Neumann’s $47 Billion Valuation Scam