The IPO That Killed a Unicorn

August 14, 2019. WeWork filed for its initial public offering. The document was 300 pages. It revealed everything. Additionally, investors could finally see inside the “tech company.”

What they found was horrifying:

The Numbers:

- $1.9 billion loss in 2018

- $47 billion valuation claimed

- $690 million loss in the first half of 2019

- No profit in sight

- Burning $2 billion annually

The Red Flags:

- CEO Adam Neumann sold $700 million in stock before IPO

- The company paid Neumann $5.9 million for trademarking “We”

- Neumann borrowed $380 million from the company

- The board had minimal oversight

- Corporate governance was nonexistent

Wall Street was stunned. Analysts were baffled. Additionally, investors started asking questions. And the more they looked, the worse it got.

Six weeks later:

- IPO withdrawn

- Adam Neumann fired

- Valuation crashed from $47B to $8B

- SoftBank is forced to rescue the company

- Employees lost jobs

This is the WeWork collapse. The fastest destruction of a “unicorn” startup in Silicon Valley history. Consequently, it exposed how easily hype trumps fundamentals. Meanwhile, it revealed that one man’s ego nearly destroyed a company. And it proved that walking barefoot doesn’t make you Steve Jobs.

Let’s investigate how Adam Neumann convinced the world that renting desks was worth $47 billion.

The Beginning: “Physical Social Network”

Adam Neumann: The Salesman

Adam Neumann was born in Israel in 1979. He moved to New York in 2001. He was charismatic and ambitious. He had no business background. Furthermore, he’d failed at previous ventures.

In 2008, he started Green Desk with Miguel McKelvey—a shared office space for eco-conscious companies. The business was modest. However, it introduced Adam to the concept of co-working.

In 2010, Adam sold his Green Desk stake. Then, he founded WeWork with McKelvey. The pitch was simple: Modern, community-focused shared offices for startups and freelancers.

Initially, WeWork was just an office rental. However, Adam had bigger visions. He called WeWork a “physical social network.” Moreover, he claimed it was a tech company. Additionally, he said it would change how people work.

Investors didn’t understand the distinction between “office rentals” and “tech companies.” But Adam’s charisma made them believe.

The Early Success

WeWork’s first location opened in SoHo, Manhattan, in 2010. It had:

Open floor plans, Modern design, Free beer and coffee, Community events, Startup vibe.

It was successful immediately. Moreover, demand exceeded supply. Additionally, they opened more locations. By 2014, WeWork had 30+ locations globally.

The model seemed to work:

- Sign long-term leases (10-15 years)

- Build out fancy offices

- Rent desks short-term (month-to-month)

- Charge a premium over market rates

- Profit from margin

However, there was a fatal flaw in this model. During downturns, companies would cancel short-term rentals. Meanwhile, WeWork was locked into long-term leases. This mismatch would eventually destroy them.

The SoftBank Bet

In 2017, Masayoshi Son of SoftBank met Adam Neumann. Son was investing billions through his Vision Fund. He loved bold founders. Additionally, he made quick decisions.

After a 12-minute meeting, Son invested $4.4 billion in WeWork. Moreover, he valued the company at $20 billion. Additionally, he promised more funding. Son saw WeWork as the future of work.

This investment changed everything. Suddenly, WeWork had unlimited money. Moreover, their valuation skyrocketed. Additionally, Adam’s ego exploded. Furthermore, fiscal discipline disappeared.

The Private Jet and Lifestyle

As WeWork’s valuation grew, so did Adam’s lifestyle:

Personal Excess:

- $60 million private jet (Gulfstream G650)

- Multiple homes worth $80+ million total

- Surfing trips during work hours

- Smoking marijuana on a private jet before international flights

- Walking barefoot around offices

- Tequila shots with employees at 9 AM

Additionally, Adam cultivated a guru image:

- Talking about “elevating consciousness”

- Comparing himself to Gandhi and Steve Jobs

- Claiming WeWork would solve world peace

- Saying he’d be “president of the world”

The behavior was increasingly erratic. Employees were concerned. Additionally, board members were uncomfortable. But the money kept flowing, so nobody stopped him.

The Business Model Problem

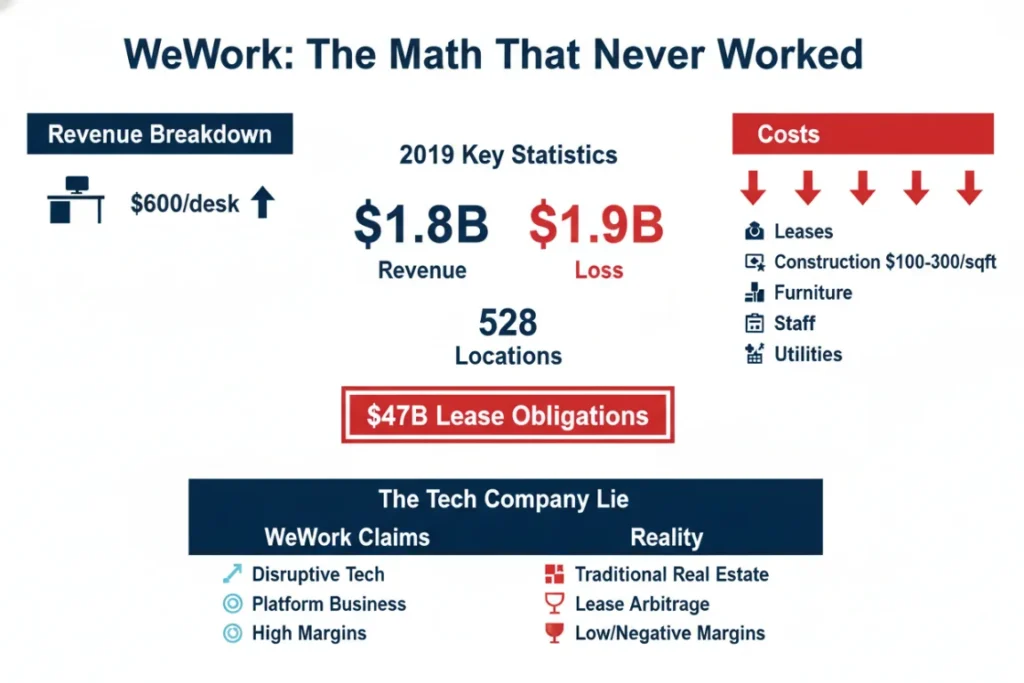

The Math That Never Worked

WeWork’s model had fundamental flaws:

Revenue:

- Rent desks at $500/month per person

- Average revenue: $600 per desk per month

Costs:

- Long-term lease commitments

- Building construction ($100-300 per square foot)

- Furniture and equipment

- Staff salaries

- Utilities and maintenance

- Marketing

- Corporate overhead

The Problem: They spent more building offices than they earned renting desks. Long-term lease obligations exceeded short-term rental income. Additionally, they were expanding too fast to reach profitability.

The Growth-at-All-Costs Strategy

Adam’s strategy: Grow fast, worry about profits later. Therefore:

- Open 100+ locations annually

- Sign massive lease commitments

- Build lavish offices

- Spend heavily on marketing

- Ignore profitability

By 2019:

- 528 locations in 111 cities

- 527,000 members

- $1.8 billion revenue

- $1.9 billion loss

- $47 billion lease obligations

The company was trapped. Moreover, they couldn’t slow growth—investors expected it. They couldn’t reach profitability—the model didn’t work. Furthermore, they couldn’t exit—long-term leases locked them in.

The “Tech Company” Lie

Adam insisted WeWork was a tech company. Why? Tech companies get higher valuations. Therefore:

The Claims:

- “We’re a tech platform.”

- “We use data and AI.”

- “We’re disrupting real estate.”

- “We’re creating a global community.”

The Reality:

- They rented office space

- Minimal technology beyond building management

- No proprietary tech

- No platform effects

- Just real estate with fancy marketing

Calling WeWork “tech” was like calling Starbucks “tech” because they use espresso machines. But investors believed it because they wanted to.

The Expansion Insanity

WeGrow: The School

In 2017, Adam and his wife, Rebekah (who had no educational experience), opened WeGrow—a private school. The concept: Education for “conscious entrepreneurship.”

The Details:

- $42,000 annual tuition

- Taught students to be “conscious leaders”

- Rebekah Neumann was CEO (paid $1 million+ salary)

- Part of WeWork’s “ecosystem”

The school closed in 2020. It had enrolled only 100 students. It lost millions. Furthermore, it was another vanity project.

WeLive: The Apartments

WeWork launched WeLive—co-living apartments. The idea: Community living for young professionals.

The Problem:

High rent, Minimal privacy, Shared kitchens, A few locations opened, Unprofitable immediately.

WeLive never scaled. Demand was weak. Additionally, the economy was worse than that of the WeWork offices.

The Other “We” Companies

Adam announced more ventures:

- WeSleep: Hotels (never launched)

- WeBank: Financial services (never launched)

- WeCare: Healthcare (never launched)

Each announcement increased the valuation. However, none had working products. Instead, they were PowerPoint slides and press releases.

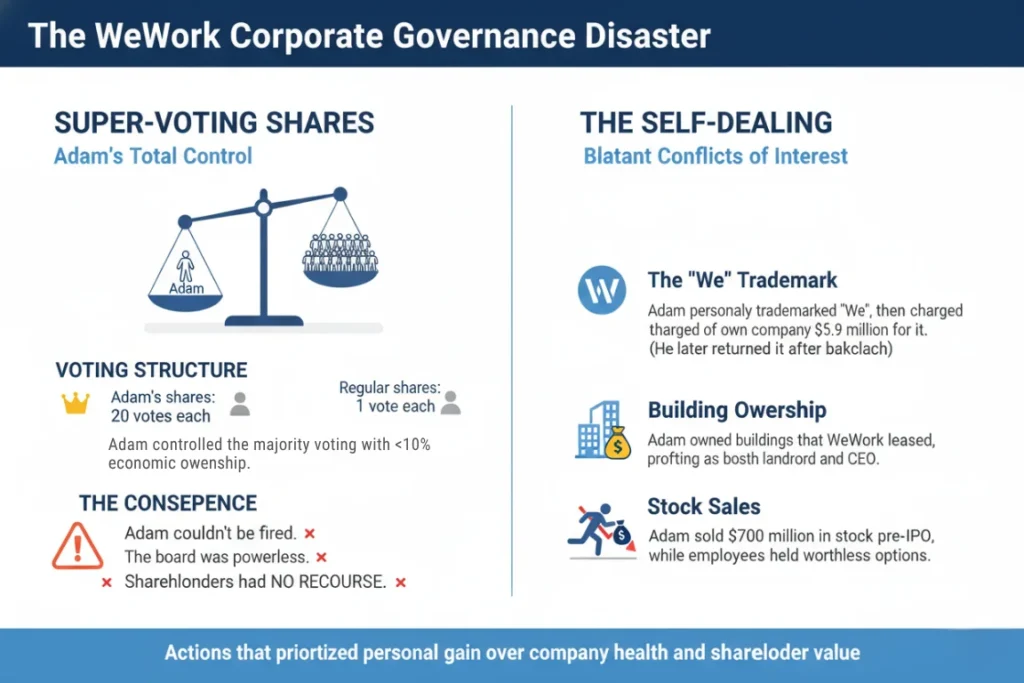

The Corporate Governance Disaster

Super-Voting Shares

Adam structured WeWork so he had total control:

Voting Structure:

- Adam’s shares: 20 votes each

- Regular shares: 1 vote each

- Result: Adam controlled the majority voting with <10% economic ownership

This meant Adam couldn’t be fired. He could make any decision. The board was powerless. Furthermore, shareholders had no recourse.

The Self-Dealing

Adam engaged in blatant conflicts of interest:

The “We” Trademark:

- Adam personally trademarked “We”

- WeWork wanted to use “We” for branding

- Adam charged the company $5.9 million for the trademark

- He profited from his own company’s name

After the backlash, he returned the money. However, the incident showed his mentality.

Building Ownership:

- Adam owned buildings WeWork leased

- He charged market rates to his own company

- He profited as both landlord and CEO

- Clear conflict of interest

Stock Sales:

- Adam sold $700 million in stock pre-IPO

- Meanwhile, employees held worthless options

- He extracted wealth while the company lost billions

- Insiders got rich, others got nothing

The Board’s Failure

WeWork’s board included impressive names. However, they exercised no oversight. They enabled Adam’s behavior. They ignored red flags. Furthermore, they prioritized growth over governance.

The board was essentially decorative. Adam controlled everything. Therefore, their presence was theater, not oversight.

The IPO Disaster

August 2019: The S-1 Filing

When WeWork filed its IPO paperwork, investors finally saw the truth:

What the S-1 Revealed:

- $1.9 billion loss on $1.8 billion revenue

- No path to profitability

- $47 billion in lease obligations

- Adam’s stock sales and self-dealing

- The governance structure gives Adam total control

- Losses are accelerating, not shrinking

Additionally, the S-1 contained bizarre statements:

- “Elevating the world’s consciousness”

- Mission to “create a world where people work to make a life, not just a living”

- Adam’s title: “Chief Community Officer”

Wall Street was appalled. Moreover, analysts couldn’t value the company. Additionally, institutional investors declined to participate.

The Valuation Collapse

WeWork had planned to IPO at $47 billion valuation. However:

Week 1: Analysts suggest $25 billion

Week 2: Investment banks recommend $20 billion

Week 3: Price falls to $15 billion

Week 4: Might get $12 billion

Week 5: Maybe $10 billion

Week 6: IPO postponed indefinitely

The collapse was unprecedented. It happened in real-time. The media covered every decline. Furthermore, WeWork became a laughingstock.

September 2019: Adam Forced Out

By September, the IPO was dead. Moreover, SoftBank was furious. Additionally, employees were panicking. The company was weeks from running out of cash.

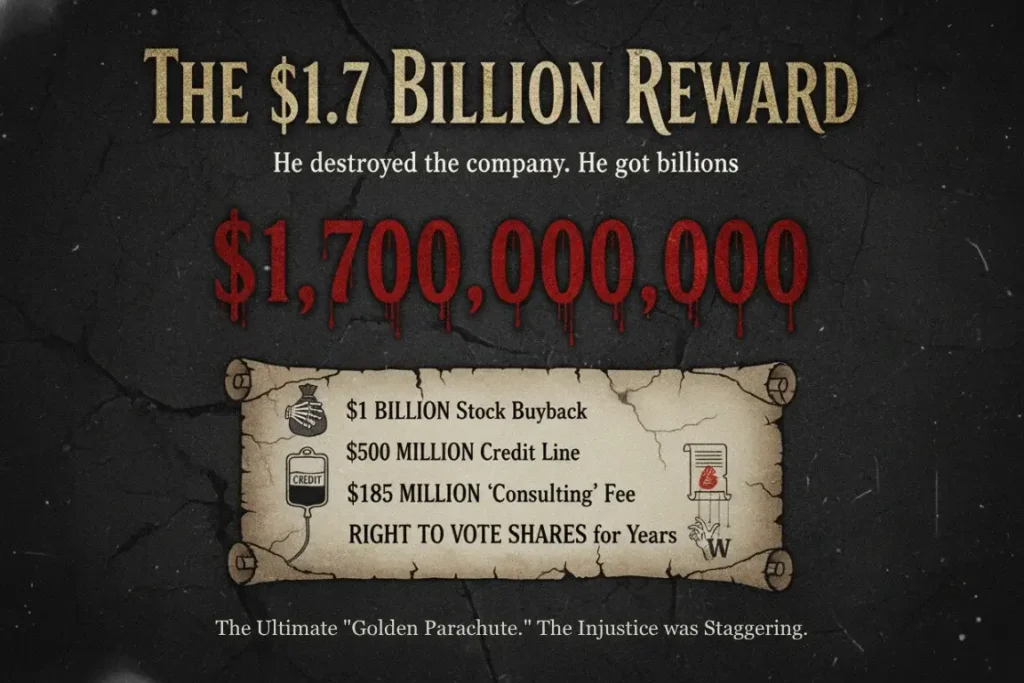

The board (finally) acted. They forced Adam to resign as CEO. However, the deal was generous:

He destroyed the company, he got billions, and the employees got nothing. The injustice was staggering.

The SoftBank Rescue

The Bailout

October 2019. WeWork was days from bankruptcy. SoftBank had no choice—let it die or save it.

They chose rescue:

- $5 billion emergency funding

- $3 billion tender offer for shares

- Valuation: $8 billion (down from $47B)

- SoftBank owned 80% of the company

The rescue saved WeWork from immediate collapse. However, it locked SoftBank into a disaster.

The Lawsuits

Legal actions flooded in:

Minority Shareholders: Sued SoftBank for backing out of the tender offer partially. Moreover, they claimed SoftBank had manipulated the valuation. They settled for $490 million in 2021.

Adam Neumann: Sued SoftBank for not completing the stock purchase. Settled confidentially.

Employees: Filed suit over worthless stock options. Many lost years of compensation.

The Bankruptcy (2023)

The COVID Blow

The pandemic destroyed WeWork’s model:

- Remote work became permanent

- Companies cancelled office leases

- Demand for co-working collapsed

- Revenue plummeted

- Lease obligations remained

WeWork tried to renegotiate leases. They closed unprofitable locations. Additionally, they cut staff. But the debt was too large.

November 2023: Chapter 11

WeWork filed for bankruptcy with:

- $18.7 billion in lease obligations

- $4.4 billion in debt

- Massive ongoing losses

- No path to profitability

The bankruptcy was inevitable. It ended the WeWork story. Additionally, it validated every critic who said the model never worked.

The Aftermath

For SoftBank: Lost $14+ billion on WeWork. Moreover, reputation was damaged. Additionally, the Vision Fund’s credibility was destroyed.

For Employees: 27,000+ lost jobs. Stock options are worthless. Years of work for nothing.

For Adam: Walked away with $1.7 billion. Started new ventures. Faced no criminal charges. Living in luxury.

For Real Estate: Landlords lost billions in unpaid rent. Buildings stood empty. Co-working model discredited.

The Victims

The Employees

Maria, 28, Community Manager: “I joined believing in the mission. I worked 70-hour weeks. My stock options were supposed to make me wealthy. Now they’re worth $0. I wasted three years.”

James, 35, Designer: “I turned down Google to join WeWork. The equity package was worth $500,000 on paper. Actually, zero. I lost years of career growth and money.”

Sarah, 31, Operations Manager: “Adam sold $700 million in stock. Meanwhile, we got options we couldn’t sell. Then the company collapsed. He got rich. We got nothing.”

The Small Landlords

Building Owners: WeWork signed leases, then stopped paying. They left buildings half-built. They abandoned locations mid-lease. Small landlords faced bankruptcy.

Example: New York landlord leased 5 floors to WeWork. WeWork built fancy offices. Moreover, they paid rent for 2 years. Then they stopped paying and abandoned the space. Landlord lost $8 million and couldn’t re-lease the gutted floors.

The Local Businesses

Vendors: WeWork owed millions to contractors, designers, and suppliers. When bankruptcy came, they got pennies. Moreover, many small businesses closed. Their “community” destroyed actual communities.

The Lessons

Red Flags Ignored

Charisma Over Substance: Adam was magnetic. However, charisma doesn’t create profits. Moreover, personality cults hide problems. Additionally, investors confused confidence with competence.

“Tech Company” Label: Real estate with WiFi isn’t tech. Moreover, calling yourself tech doesn’t make it true. Additionally, investors should verify claims. If revenue comes from rent, it’s real estate.

Growth Without Profitability: “Grow first, profit later” doesn’t work in capital-intensive businesses. WeWork needed billions just to operate. Additionally, scale made problems worse, not better.

Founder Control: Adam’s voting control meant no accountability. The boards couldn’t stop him. Shareholders had no power. Single-person control is dangerous.

Self-Dealing: Adam profited personally while the company lost billions. He sold stock while employees couldn’t. He charged the company for trademarks. Clear red flags.

Cult of Personality: “Elevating consciousness.” Comparisons to Steve Jobs. Messianic vision. These are warning signs, not selling points.

SoftBank’s Blank Check: Unlimited funding enabled bad behavior. Moreover, discipline disappeared. Adam faced no constraints. Too much money is dangerous.

How It Happened

Investor FOMO: Nobody wanted to miss “the next big thing.” SoftBank’s huge bet validated WeWork. Other investors followed without due diligence.

Valuation Insanity: Private markets assigned valuations based on story, not fundamentals. Each funding round increased the valuation. Reality was postponed until IPO.

Media Hype: The press celebrated Adam as a visionary. They rarely questioned the business model and promoted the narrative uncritically.

Governance Failure: Board members didn’t govern. They enabled rather than constrained. Additionally, prestige replaced oversight.

Protection Strategies

1. Understand the Business: Strip away buzzwords. Moreover, identify actual revenue sources. If it’s rent, it’s real estate. Technology is what you build, not what you call yourself.

2. Examine Unit Economics: Does the company make money on each transaction? Will scale improve or worsen economics? WeWork lost more with growth.

3. Check Founder Incentives: Are founders selling stock early? Do they profit from self-dealing? These suggest they don’t believe in long-term success.

4. Demand Governance: Super-voting shares without oversight is dangerous. Boards must actually govern. Additionally, founder control needs limits.

5. Verify “Tech” Claims: What proprietary technology exists? Moreover, where are the network effects? If neither exists, it’s not tech.

6. Follow the Cash: How much money is burned? When will profits arrive? If the answer is “eventually,” be skeptical.

Where They Are Now

Adam Neumann: Living in luxury. Started new ventures (including Flow, another real estate “tech” company funded by Andreessen Horowitz for $350 million). Faced no criminal charges. Net worth estimated $2+ billion.

Rebekah Neumann: Living with Adam. No longer involved in business. WeGrow school is closed.

WeWork: Emerged from bankruptcy in 2024 as a smaller company. 80% of locations closed. Business continues but has diminished. “Tech company” pretense abandoned.

SoftBank: Lost $14+ billion. Masayoshi Son’s reputation was damaged. Vision Fund strategy questioned. Still recovering from WeWork disaster.

Employees: Most stock options are worthless. Many sued. Some received small settlements. Career damage from association with a failed company.

Office Market: Co-working model discredited. Traditional landlords validated. Flexible office space exists, but without the hype.

The Final Truth

The $47 Billion Magic Trick

Adam Neumann convinced the world that office rentals were worth $47 billion. He did it through charisma, buzzwords, and unlimited funding from SoftBank. He lived lavishly while the company burned billions. Additionally, he extracted $700 million before the collapse.

The WeWork collapse wasn’t complex fraud like Theranos. Instead, it was simpler: A real estate company pretending to be tech. Moreover, a CEO who believed his own hype. Additionally, investors who have suspended critical thinking.

The business model never worked. Unit economics were negative. Growth made losses worse. Additionally, long-term leases created catastrophic risk. Anyone who analyzed the fundamentals could see it.

But nobody wanted to look. The narrative was too compelling. SoftBank’s money validated everything. Furthermore, Adam’s confidence was infectious.

The Great Disconnect

“We’re elevating the world’s consciousness,” Adam said while smoking weed on his private jet. What he actually did: Destroy billions in investor wealth, cost 27,000+ jobs, and prove that Silicon Valley’s emperor had no clothes.

He walked away with $1.7 billion, and he started new ventures immediately. Additionally, he faced zero criminal consequences. The system rewarded his failure spectacularly.

Meanwhile, employees who believed the mission got nothing. Landlords who trusted leases lost millions. Investors who bought the hype lost billions. The people who enabled Adam—SoftBank, the board, and early investors—all suffered.

The WeWork collapse was Silicon Valley’s Icarus moment. Flying too high on borrowed wings, believing hype over reality. Additionally, assuming rules don’t apply.

Then reality asserted itself. The IPO filing revealed the truth. Moreover, investors finally looked at the numbers. The emperor’s nakedness became undeniable.

Six weeks. That’s how long it took for $47 billion in value to evaporate. That’s how fast delusion meets reality. Additionally, that’s how quickly a “unicorn” becomes a cautionary tale.

Adam Neumann didn’t invent office space. He didn’t revolutionize work. He didn’t elevate consciousness.

He just convinced people he did.

Until he couldn’t anymore.

And that’s the WeWork story: The greatest magic trick in startup history.

Until everyone looked behind the curtain and found just an office rental company losing money on every desk.

While the magician flew away on a $60 million private jet, smoking weed and counting his billions.

Resources

[2] New York State Attorney General. “Investigation into WeWork Corporate Governance.”

Related reading(suggested)

The $9 Billion Theranos Fraud: How Elizabeth Holmes Fooled Everyone

The $65 Billion Bernie Madoff Ponzi: A Complete Victim Analysis